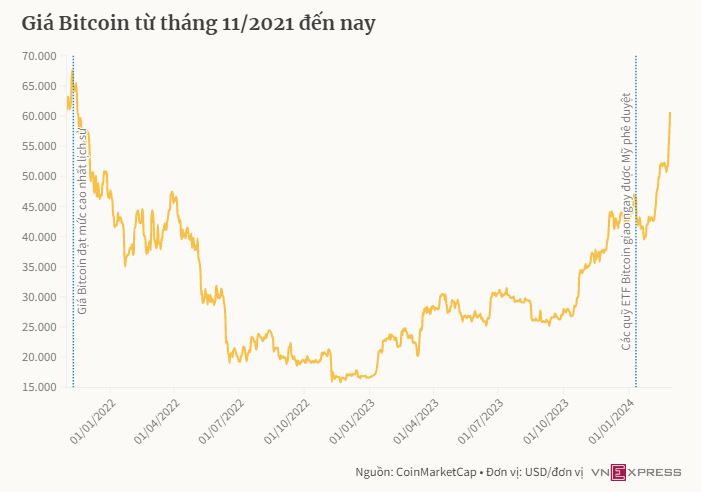

* Bitcoin surpasses $68,500 and is close to setting a new record

Since mid-2021, Tung has invested over 20 million VND “just for fun” in cryptocurrencies, but lost over half of it when the market crashed two years later. In the middle of last year, as the market gradually warmed up, Tung returned. This time, all of his 250 million savings and stock investments were transferred to the cryptocurrency market.

Participating in various groups, Tung found that buying and holding – the initial investment strategy – became “dull”. The volatility of 10-15% after a few days or weeks was much higher compared to other investment channels, but it was not enough for Tung. Seeing people bragging about making hundreds or even thousands of percentage points in just a few days or even hours, Tung was attracted. From buying and holding, this 28-year-old investor switched to trading futures contracts with high leverage.

But in a market described as “wild” like cryptocurrencies, with high and unpredictable volatility, using leverage is like “a double-edged sword”.

Initially, Tung made a considerable profit by following the general trend with moderate leverage. Feeling that there were good opportunities, he gradually increased the leverage to 10 or even 20 times with other cryptocurrencies (altcoins). As for Bitcoin, sometimes Tung used maximum leverage (125 times the capital).

When Bitcoin was trading around the $51,000-52,000 range, Tung switched to opening a short position. “Everyone thought Bitcoin would correct sharply because it had been continuously rising. Many people even claimed that this trade was a sure thing and there’s no need for a stop loss,” Tung said. But Bitcoin went against his prediction, and Tung had to cut his losses due to using excessively high leverage. All the profits from December 2023 to the beginning of 2024, together with 30% of the capital, disappeared with the short BTC order.

The more he lost, the more motivated Tung became to recover. Unstable psychology caused him to make repeated mistakes, and 70% of his remaining capital evaporated in just over an hour of continuous trading. In one day, Tung lost all of his accumulated capital.

Unlike Thanh Tung, Anh Duy chose the right trend but still “burned” his account because of using excessive leverage.

Duy opened long positions with a series of medium-cap altcoins, using leverage of 10-20 times after Bitcoin surged, with the expectation that the market would soon explode. He believed that he had taken a beautiful enough position without having to cut losses. However, on the night of February 28th, Anh Duy’s account of over 70 million VND “disintegrated” within minutes when Bitcoin rose to $60,000 but a series of altcoins plummeted. All positions with leverage of 10-20 times were liquidated as the coins fell over 10% within a few seconds.

Liquidation occurs when a trading platform closes leveraged positions because the trader has lost part or all of the initial margin, causing them to fail to meet the requirements to hold their position. According to Coinglass, nearly $700 million of long-short positions in the cryptocurrency market were liquidated on the night of February 28th. While short Bitcoin positions were closed en masse, long positions with altcoins suffered the same fate.

The altcoin futures contracts that rose and fell the most on March 4th on the Binance exchange. Screenshot |

“Everyone thinks that if Bitcoin keeps rising, everyone will be profitable. But the issue is not how much profit you make, but how much you keep and how stable it is,” said Ha Le, a seasoned trader with years of experience in the market.

Buying and holding also carries risks. Many cryptocurrencies never return to their peak or are affected by unexpected events, such as the “FTX crash”. However, compared to this approach, using leverage in the cryptocurrency market is much riskier, especially when investors expect to “change their lives in a few minutes”.

“If a stock market fluctuates 3-5%, it is considered a lot, but in the cryptocurrency market, fluctuations of 15-20% within a few minutes are not rare. With volatility above 10% as it was on December 28th, investors only need to use 8 times leverage to burn their accounts, not to mention higher levels of leverage,” Ha said.

Thanh Tung’s story is not uncommon among cryptocurrency investors in the past few days. That’s because not many investors maintain discipline or choose to control their greed in this market.

Having used high leverage in trading and also lost most of his capital, but unlike Thanh Tung or Anh Duy, Duy Minh has become more cautious in the face of market surges. He has a principle to limit trading when the market is highly volatile, only increasing his positions when the market stabilizes and always taking profit or cutting losses according to the predetermined strategy.

“Fomo is the enemy of investors. It doesn’t matter how much profit you make, the issue is how much you keep and how stable it is,” Minh said.

Statistics from Coin98 Insights show that 64% of cryptocurrency investors in Vietnam have not made any profits, with nearly 44% in losses over the past year, based on a survey of 1,200 respondents conducted in December 2023.

The biggest reason that caused people to lose money in the past year was the FOMO mentality (fear of missing out) at 29.7%, followed by not having a careful trading plan (35.7%). Other reasons include not reacting in time to unexpected market events (14.8%), using inappropriate leverage (13.5%), being scammed or hacked (5.7%). A common trait among Vietnamese investors is that they often combine multiple factors and consider different aspects before making a decision.

Minh Son