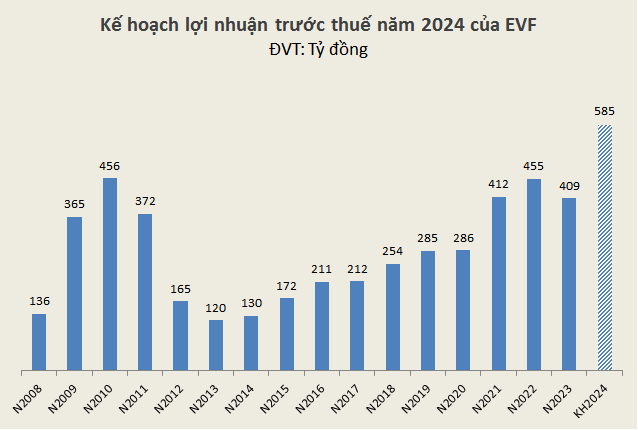

Pre-tax profit target for 2024 increased by 43%

According to EVF, global economic growth is expected to continue facing challenges in 2024. This is the second year since the outbreak of the war in Ukraine, which has led to high prices of commodities such as wheat and oil. Domestically, the Government sets a target for GDP growth in 2024 at 6-6.5%; inflation control at 4-4.5%, stable foreign exchange market, currency, and banking system. The banking industry targets a credit growth of about 15% in 2024 and will vigorously and efficiently implement the Project for Restructuring Credit Institutions associated with Bad Debt Resolution for the period of 2021-2025.

In this context, EVF aims to achieve total assets of VND 54,500 billion and pre-tax profit of VND 585 billion in 2024, increasing by 10% and 43% respectively compared to 2023.

Source: VietstockFinance

|

Looking back at 2023, EVF achieved over VND 409 billion in pre-tax profit, a decrease of 10% compared to 2022 and only achieved 73% of the annual profit plan in the context of the consumer lending market being negatively affected, many consumer finance companies suffering heavy losses; EVF’s fundraising activities were affected by difficulties due to negative information about consumer credit.

A positive point is that EVF’s non-performing loan ratio as of December 31, 2023 decreased compared to 2022, from 1.64% to 1.08%.

In addition, total assets at the end of 2023 reached VND 49,221 billion, an increase of 17% compared to the beginning of the year, thanks to outstanding customer loans reaching over VND 33,553 billion, an increase of 38%. Total mobilized capital also increased by 7%, reaching VND 39,351 billion, mainly due to the issuance of valuable papers with an increase of 70% to VND 17,421 billion.

Dividends for 2023 will be distributed in the form of 8% stock dividends

According to the Shareholders’ Meeting documents, EVF’s Board of Directors plans to propose to shareholders the plan to distribute 2023 dividends in the form of stock dividends from the 2023 profit and the remaining years’ undistributed profits, totaling nearly VND 571 billion.

With the current charter capital of nearly VND 7,042 billion and the value of stock dividends of nearly VND 571 billion, the estimated implementation rate of the stock dividend distribution rights is 8% of the charter capital, equivalent to the issuance of more than 56 million shares as dividends (shareholders owning 100 shares will receive 8 additional shares).

Additional charter capital of more than VND 638 billion

The Board of Directors of EVF will propose to shareholders a plan to increase the charter capital by more than VND 638.4 billion in 2024 to enhance overall financial capacity and capital capacity in order to meet the requirements for business development.

Source: VietstockFinance

|

Specifically, the financial company will increase its capital by more than VND 563 billion by issuing more than 56 million shares as 2023 stock dividends (8% of charter capital) and increase capital by an additional VND 75 billion through selling 7.5 million shares to employees under the Employee Stock Ownership Plan (ESOP) at the face value of VND 10,000 per share.

The VND 75 billion proceeds from the ESOP share sale will be used by EVF to supplement working capital for business operations. The sale is expected to take place in the third quarter of 2024, immediately after the completion of capital increase by issuing stock dividends and approved by the State Bank of Vietnam and the State Securities Commission.

Foreign room reduced to 15%

In the upcoming Shareholders’ Meeting, the Board of Directors of EVF will also propose to shareholders a plan to reduce the maximum ownership ratio of foreign investors (foreign room) to create favorable conditions for potential domestic investors who wish to become EVF shareholders.

According to EVF, the current maximum ownership ratio of foreign investors is 50% of EVF’s charter capital, as prescribed by law. The company will propose to shareholders to reduce the maximum ownership ratio of foreign investors to 15% of the charter capital.