Located at 4 Lang Ha Street (Ba Dinh District, Hanoi) is the Harec office building with a scale of 15 floors and 2 basements, with a rental area of nearly 8,000m2 managed and operated by Harec Investment and Trading Company Limited (stock code HRB, UpCom). Although it has been in operation for 16 years, the equipment and infrastructure quality are not high, the parking basement is small, and there are more limitations than modern office buildings for rent today, but this Grade B office building is located in a prime location of the capital, so the occupancy rate is very high.

This is a small-scale enterprise with a chartered capital of less than 64 billion VND. With a simple model and locational advantages, Harec operates smoothly, with stable revenue and profits, which can be distributed high cash dividends as well as accumulate large idle cash. Total assets of over 160 billion VND are mainly idle cash.

Currently, Harec is owned by Hanoi Beer Alcohol and Beverage Corporation (Habeco) holding 40%, Mr. Hoang Quang Thanh – Chairman of the Board of Directors holding 7%, Mr. Hoang Quang Tuan – son of the Chairman of the Board of Directors holding 20%, and Mr. Phan Huy Ty – Member of the Board of Directors cum Director holding 23.33%.

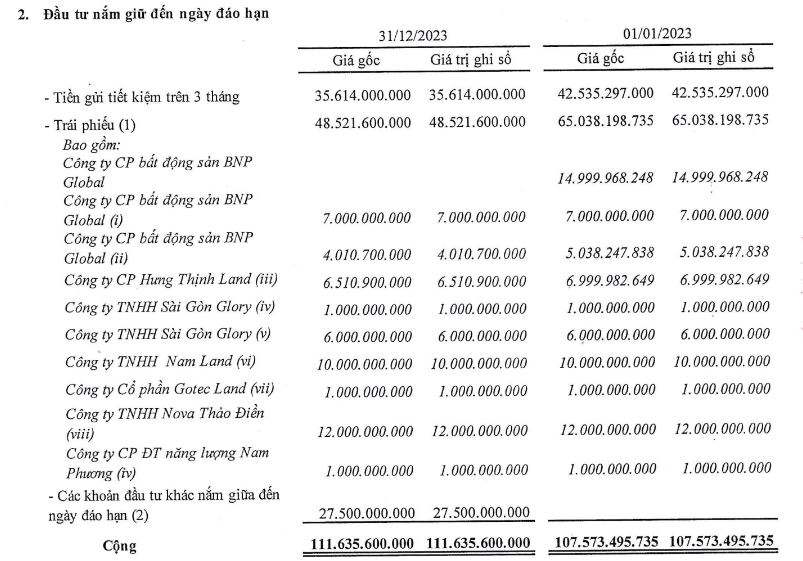

The audited financial statements for 2023 show that at the end of the year, the company had nearly 112 billion VND (equivalent to 68% of total assets) for short-term financial investments. Among them, 48.5 billion VND (equivalent to 30% of total assets) invested in corporate bonds purchased from Tan Viet Securities Joint Stock Company. Specifically, 11 billion VND to buy bonds of BNP Global Real Estate Joint Stock Company; 6.5 billion VND to buy bonds of Hung Thinh Land Joint Stock Company, 17 billion VND for Sai Gon Glory Limited Liability Company; 10 billion VND for Gotec Land Joint Stock Company; 12 billion VND for Nova Thao Dien Limited Liability Company…

Some bonds have expired but Harec only recovered part of the principal, and the remaining part is expected to be recovered in the future when the issuing companies have sent letters requesting bondholders to extend the bonds and make payment in 2024. The total value of overdue bond payment is 17.5 billion VND, and the Audit Unit has expressed an opinion except for not collecting enough evidence to assess the recovery ability of these bonds.

In addition, Harec also allocated 27.5 billion VND to VPS Securities Joint Stock Company for loans to invest in financial assets and financial asset cooperation, with interest rates ranging from 5.5% – 9% per year.

The company’s main revenue comes from office rental services and some other services such as parking, building technical services, and the total revenue in 2023 reached 42.5 billion VND, an increase of 18.3%. With such operations, Harec’s gross profit margin reached nearly 90%. The most notable expense of Harec is the business management cost. In 2023, the company achieved over 23 billion VND in after-tax profit, an increase of 32% compared to 2022, equivalent to a profit per share (EPS) of 3,240 VND.

With these results, Harec’s revenue exceeded the plan by 15% and after-tax profit exceeded the plan by 64%. The company plans to distribute dividends at a rate of 17% for 2023.

Harec’s director, Mr. Phan Huy Ty, enjoys an annual income of over 1.2 billion VND, equivalent to over 100 million VND per month.