The story of an 8.5 million VND credit card debt that turned into 8.8 billion VND after 11 years has made many stock investors think about buying a stock in 2013 and “putting it away” until now, could they make a profit of more than 1,000 times?

In reality, it’s impossible. No stock on the Vietnamese stock market in 2013 is still trading now for a “huge” profit of a thousand times. This number is equivalent to a consistent 84% profit per year over a decade.

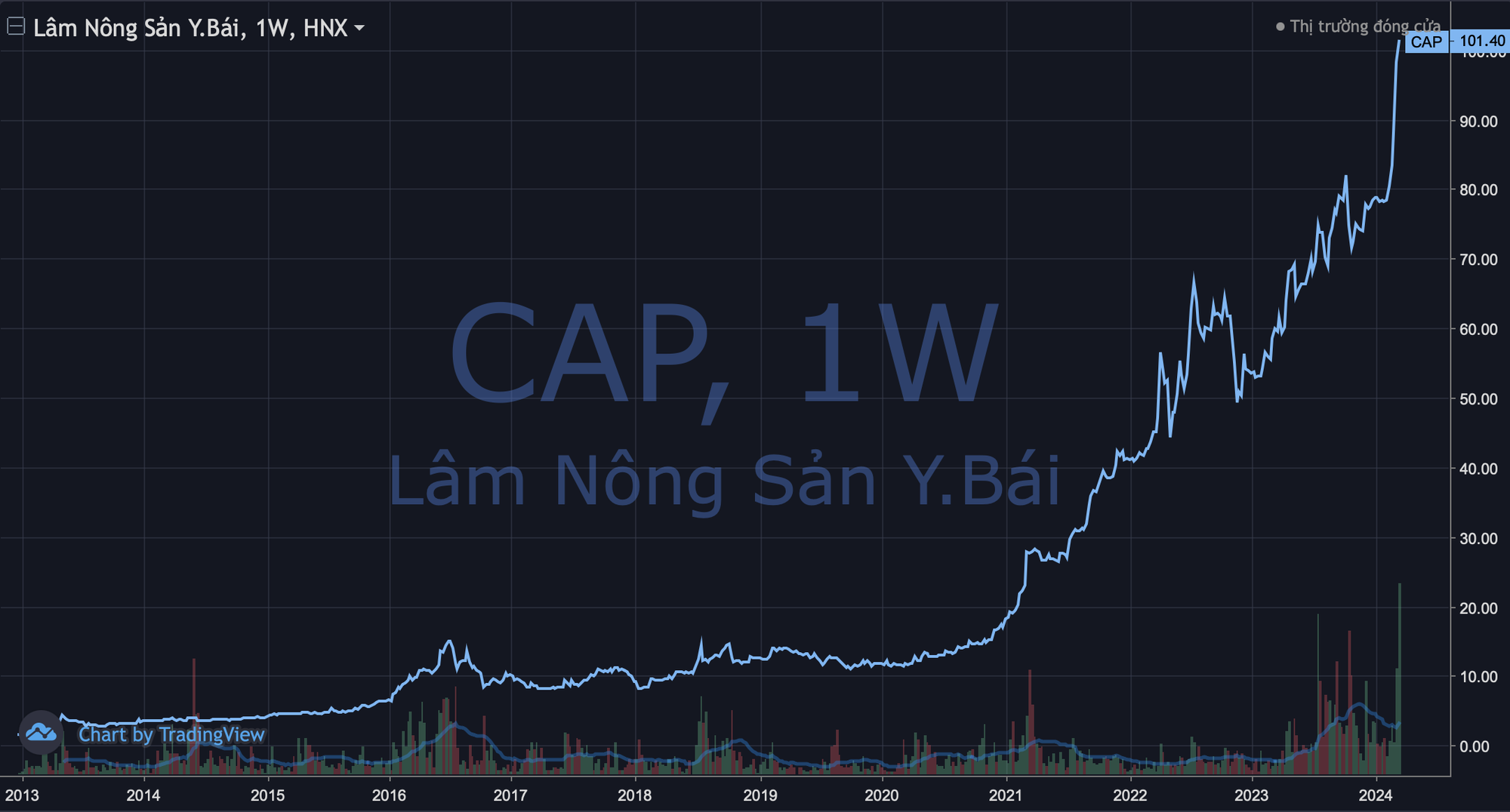

Even the most resilient growth stocks like FPT, CAP, DP3, SLS, etc. can’t provide investors with a profit of a hundred times, let alone a thousand times. In fact, a 20% annual average return over a decade is already very rare in the Vietnamese stock market.

CAP is one of the fastest-growing stocks in Vietnam’s stock market over the past 11 years, but its profit is still below 100 times.

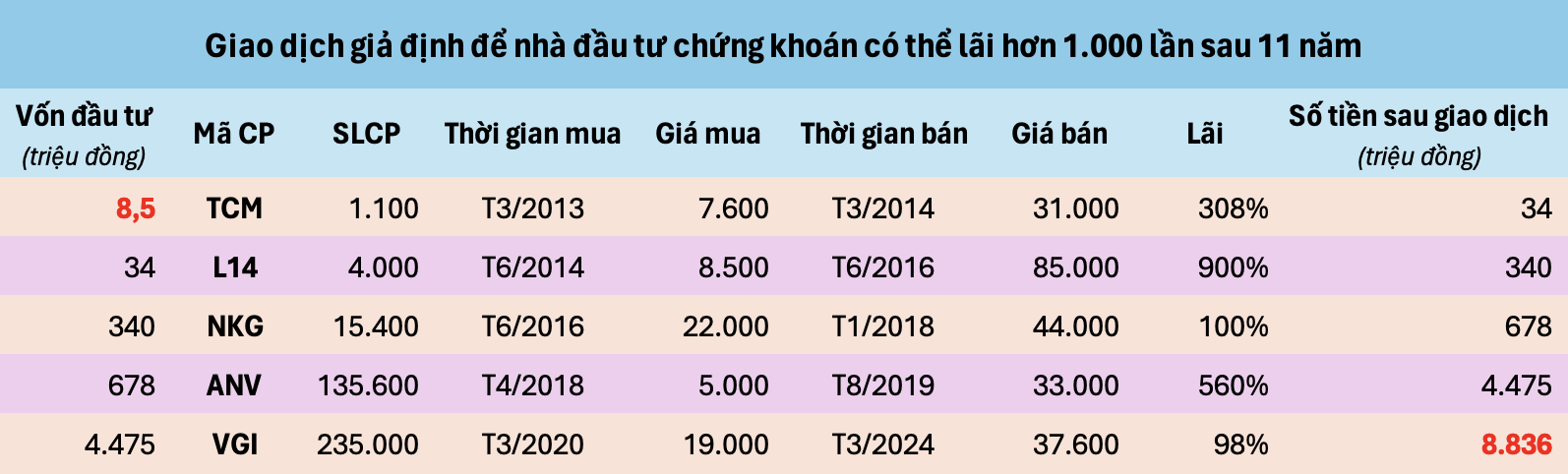

However, in theory, there is still a way for investors to put 8.5 million into the stock market in 2013 and make 8.8 billion after 11 years.

First, investors buy 1,100 TCM stocks at a price of 7,600 VND/share in mid-March 2013. After holding for one year, by the end of March 2014, they sell at a price of 31,000 VND/share, and their account has 34 million VND.

After a 3-month break, they continue to use 34 million VND to buy 4,000 L14 stocks at a price of 8,500 VND/share at the end of June 2014. After holding for 2 years, they sell at a price of 85,000 VND/share at the end of June 2016, and the investor has 340 million VND.

Immediately after taking profits, they continue to use the entire amount in the account to buy 15,400 NKG stocks at a price of 22,000 VND/share. After one and a half years, they sell at a price of 44,000 VND/share at the beginning of January 2018 and “pocket” 678 million VND.

After more than half a year of “resting”, they use the entire amount to buy 135,600 ANV stocks at a price of 5,000 VND/share in April 2018. By the end of August 2019, they sell at a price of 33,000 VND/share, and the investor has nearly 4.5 billion VND.

After that, they use the entire amount to buy 235,000 VGI stocks at the bottom of Covid-19 at a price of 19,000 VND/share at the end of March 2020. By holding until now, the investor will have more than 8.8 billion VND in their account.

The hypothetical transaction is based on the current perspective on the past, so everything seems easy, but the actual stock market is not as simple as that. To achieve the above, investors must have a “golden touch” as well as a lot of luck to continuously buy at the bottom and sell at the top over many years.

It is important to emphasize that with the speculative approach of going “all in”, just one mistake can cause investors to lose all of their previous achievements.

In reality, winning consistently in the stock market is almost impossible, especially in a “tough” environment like the Vietnamese stock market. “90% of transactions in the market are losses“, said Pham Minh Huong, Chairman of the Board of Directors of VNDirect, at the annual general meeting in 2023.

Similarly, Trinh Thanh Can, CEO of Kafi, even believes that the probability of keeping money from short-term speculation is almost less than 1%. “The majority of profits made from short-term trading will be returned in the next trade. Therefore, according to general market statistics, individual investors often suffer losses“, the expert emphasized.

In general, all traders have the right to choose their investment approach. For those who prefer “safe and steady” gains, stocks with sustainable growth, high dividends every year with profits equal to or even tens of times over a long period are a worthy choice to consider.

For risk-loving investors, a trading strategy of short-term speculation may provide more excitement. Profitability may be higher, but it comes with significant risks and is difficult to sustain over the long term.

Overall, calculating over an 11-year period, a 1,000 times profit is almost “unimaginable” for any mainstream investment channel in Vietnam. However, with a longer time frame, it is not impossible for a Vietnamese stock to achieve a dreamy level of profitability in the future.