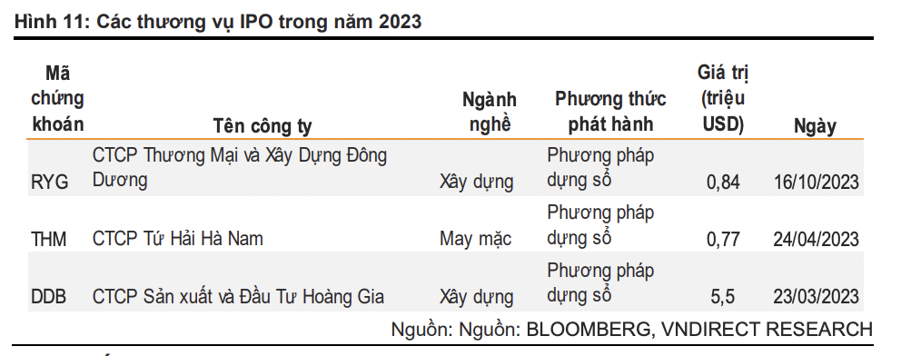

The IPO market was lackluster throughout 2023, with only three companies successfully completing IPOs, raising a total of 173 billion dong (~7 million USD), a 90% decrease compared to the same period.

In 2024, DNSE became the first successful IPO company, raising about 900 billion dong (36 million USD). Other successful listings included Hua Na Hydropower JSC (HNA), Quy Nhon Port Corporation (QNP), and Taseco Real Estate Investment Corporation (TAL).

VnDirect believes that the prospects for the IPO market will remain poor in the near future, not only due to the illiquidity of the market but also due to stricter regulations from the State Securities Commission (SSC).

Specific regulations include: IPO companies must have been profitable for 2 consecutive years prior to the IPO (previously only required 1 year) and must not have accumulated losses.

While this helps select companies with stable growth rates and strong financial capabilities to participate in the stock market, thereby improving the quality of the market, it also inadvertently hinders the development of startup businesses, especially in the technology sector, making venture capital funds hesitant to invest in Vietnamese startups unless they have plans to list abroad.

IPO companies must disclose the use of funds from inception to IPO application, which poses a challenge for companies that have been established for decades. The lengthy IPO processing time makes foreign investors hesitate.

However, according to VnDirect, 2024 will see a resurgence in IPO activity as market liquidity improves.

Regarding state divestment, due to the overall liquidity situation in the market, the state divestment speed of the State Capital Investment and Trading Corporation (SCIC) is significantly slower than the regulations stated in Decision No. 1479/QD-TTg dated November 29, 2022. The number of SCIC divested companies only reached 12% of the set plan for the 2022-2025 period.

VnDirect believes that the state divestment speed will increase rapidly starting this year as market liquidity improves and the urgency of divestment to have financial resources to support fiscal policy objectives.

Regarding the promotion of IPOs, representatives of the State Securities Commission said that to support capital mobilization activities, the commission is currently reviewing Decree 155, which includes regulations on IPO offering, listing, and trading registration.

According to Pham Thi Thuy Linh, Deputy Head of the Market Development Department of the State Securities Commission, in the past period, some businesses closely associated with initial public offerings (IPOs) but not eligible for listing have brought shares to the UPCoM trading registration. In practice, there is a certain amount of time between IPOs and listings/trading registrations in terms of procedures.

Therefore, the State Securities Commission is currently working with the trading exchange to find solutions to shorten this time, ensuring that businesses can list/trade as soon as possible.

In particular, in March, the State Securities Commission plans to hold a conference for relevant parties to share and discuss difficulties, in order to provide the fastest support to units in need of capital mobilization in 2024-2025.

At the Conference on implementing the mission of developing the securities market in 2024, chaired by the Prime Minister at the end of February, Vu Thi Chan Phuong, Chairman of the State Securities Commission, stated that in 2024, the securities industry will continue to diversify commodity products on the market, promote public offerings, initial public offerings with listings, trading registrations on the stock exchange; enhance the capacity and financial safety of the securities business organization system through continued restructuring of securities companies, fund management companies, and promote management, supervision, and correction of activities of securities business organizations to ensure compliance with legal regulations.