The Vn-Index has officially broken through the 1,200-point mark once again after more than a dozen attempts to surpass this threshold. Today’s decline was primarily due to the derivatives expiry, with the market lacking any significant news other than the exchange rate and the State Bank’s USD selling pressure.

The index saw a slight recovery in the morning, but it was heavily sold off towards the end of the session, closing down over 22 points at 1,193 points, surpassing all expert forecasts. The market breadth was extremely negative, with 348 stocks gaining and only 137 declining. Almost all large-cap groups were heavily sold off, with banks falling by more than 2%; Securities by the most at 3.98%; Oil & Gas by 2.35%; Real Estate by 2.26%; Construction Materials by 1.39%; and Chemicals by 3.51%.

The top stocks that contributed the most to the market’s decline today were BID (-3.09 points), CTG (-1.79 points), GVR (-1.67 points), and VIC (-1.32 points), along with VPB, MBB, VHM, and VCB. On the other hand, the only group that saw a slight increase was Seafood, up by a mere 0.20%.

On the negative side, stocks fell across the board despite low liquidity, indicating that bottom-fishing demand remains cautious. Trading volume on all three exchanges today amounted to only VND21,300 billion, which is only 60-70% of the volume seen during the session when the index plunged 60 points. Foreign investors were net sellers with a net selling value of VND996.6 billion, of which VND845.6 billion was through matching orders.

Foreign investors were net buyers of Utilities, Food & Beverage, and Consumer Goods through matching orders. The top foreign net buys through matching orders included VNM, GMD, MWG, SSI, EVF, E1VFVN30, VGC, VIX, TV2, and CNG.

Foreign investors were net sellers of Real Estate through matching orders. The top foreign net sells through matching orders included FUEVFVND, VHM, SHB, MSN, VIC, MSB, CTG, HDB, and VCI.

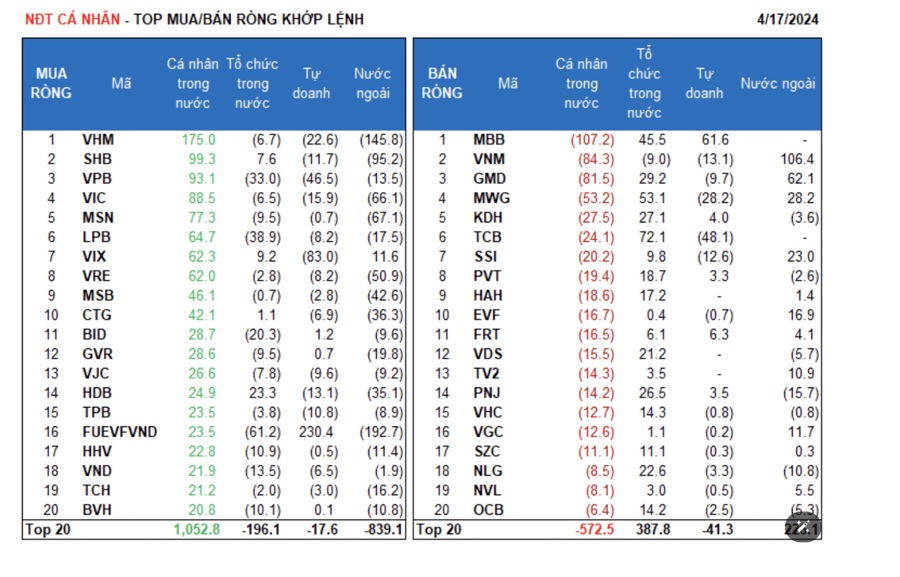

Domestic individual investors were net buyers with a value of VND722.1 billion, of which VND746.4 billion was through matching orders. In terms of matching orders alone, they were net buyers in 11 out of 18 sectors, primarily in the Banking sector. The top buys by domestic individual investors included VHM, SHB, VPB, VIC, MSN, LPB, VIX, VRE, MSB, and CTG.

They were net sellers in 7 out of 18 sectors through matching orders, mainly in the Utilities and Retail sectors. The top sells included MBB, VNM, GMD, MWG, KDH, TCB, PVT, HAH, and EVF.

Proprietary traders were net sellers with a value of VND29.1 billion, of which they were net sellers of VND153.1 billion through matching orders. In terms of matching orders alone, proprietary traders were net buyers in 8 out of 18 sectors. The sectors with the highest net buys were Financial Services, Construction, and Materials. The top proprietary trader net buys through matching orders today included FUEVFVND, MBB, STB, VTP, DGC, CTR, GEX, PC1, HCM, and FRT.

The top proprietary trader net sells were in the Banking sector. The top stocks that were sold included VIX, FPT, TCB, VPB, ACB, MWG, VHM, HPG, VCB, and VIC. Domestic institutional investors were net buyers with a value of VND299.8 billion, of which they were net buyers of VND252.3 billion through matching orders.

In terms of matching orders alone, domestic institutions were net sellers in 7 out of 18 sectors, with the largest value in the Financial Services sector. The top sells included FUEVFVND, STB, LPB, VPB, BID, VND, E1VFVN30, HHV, BVH, and GVR. The largest net buys were in the Utilities sector. The top buys included TCB, MWG, FPT, MBB, GMD, KDH, PNJ, VCI, ACB, and HDB.

Negotiated transactions today reached VND2,287.5 billion, down -28.2% from the previous session and contributing 10.7% to the total trading value.

The Banking sector continued to be the most actively traded through negotiated transactions, with a focus on EIB, MBB, HDB, MSB, and TCB.

In addition, some mid- and small-cap stocks with notable negotiated transactions were TMT, DBC, PET, and EVF.

The proportion of cash flow increased in Banking, Food, Agriculture & Fishery, Warehousing, Logistics & Maintenance, Investment Funds, and Gas & Petroleum Distribution, while it decreased in Real Estate, Securities, Steel, Construction, Retail, Oil & Gas Equipment & Services, Chemicals, and Electric Equipment.

In terms of matching orders alone, the proportion of trading value increased again in the large-cap VN30 group, while it decreased in the mid-cap VNMID group and the small-cap VNSML group.