The State Capital Investment Corporation (SCIC) has announced that it will exercise the right to buy 30 million shares in the offering of 73 million shares that was approved by the Board of Directors of the Military Commercial Joint Stock Bank (MB – code MBB) on January 27, 2024. The transaction is expected to be carried out from March 8 to April 6.

According to the approved plan, MB will privately place 73 million shares with 2 investors: the Military Industry-Telecoms Group (Viettel) and SCIC. Specifically, Viettel is entitled to purchase 43 million MBB shares and SCIC is entitled to purchase 30 million MBB shares. The transfer restriction period is 5 years from the completion of the offering.

SCIC currently holds over 491.4 million MB shares, equivalent to 9.42% of the Bank’s charter capital. After completing the transaction, SCIC will increase its ownership to over 521 million shares (9.86% of the charter capital). Meanwhile, if Viettel exercises its right to purchase, its ownership will increase to 1.01 billion shares (19.072% of the charter capital) and it will still be the largest shareholder of MB.

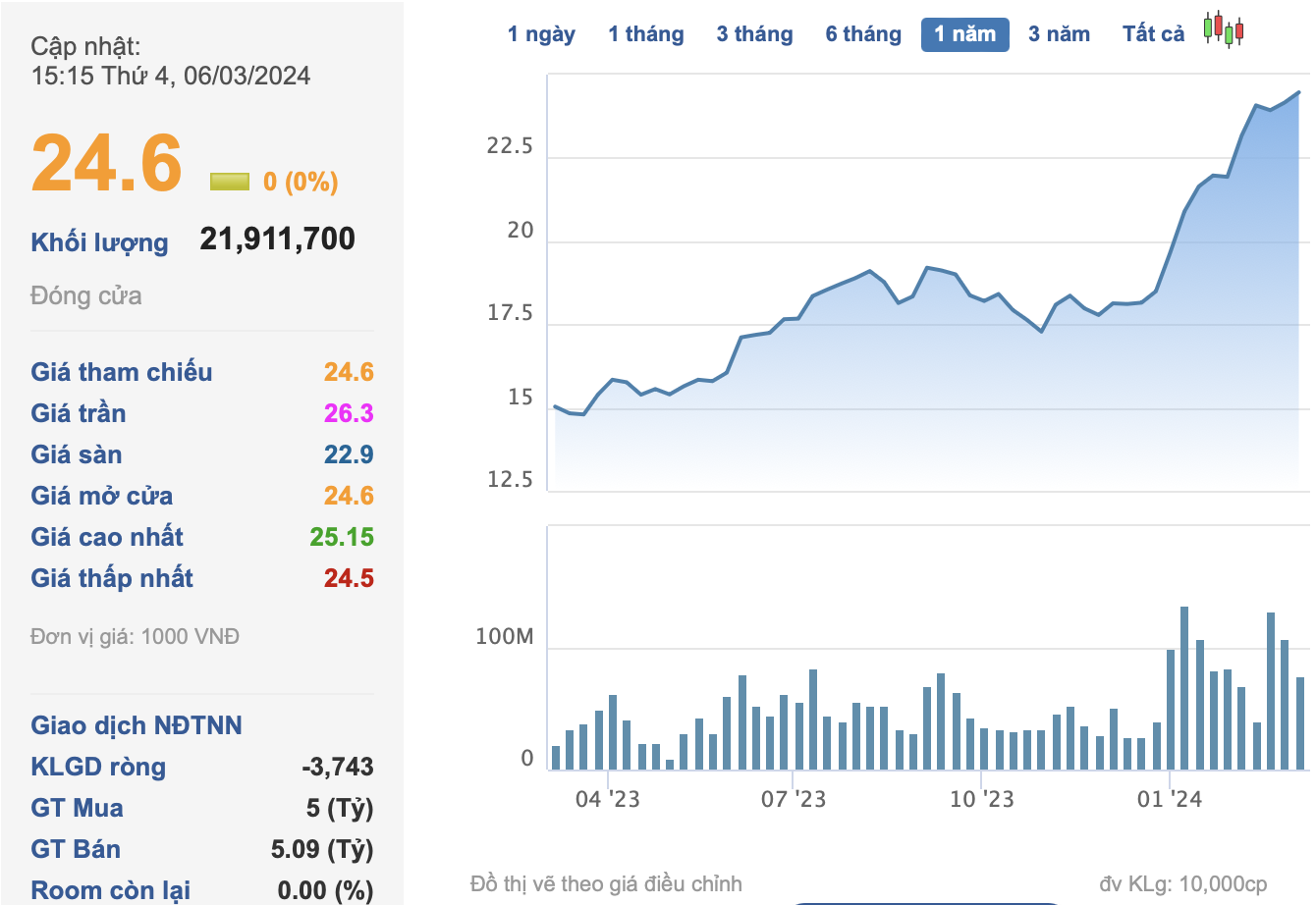

The expected offering price is VND 15,959/share, corresponding to an estimated amount of VND 480 billion that SCIC has to spend to buy the above-mentioned shares. On the market, MBB shares have increased by 32% since the beginning of the year to the historical peak of VND 24,600/share. Therefore, the private offering price is nearly 35% lower than the current market price of MBB.

The proceeds of VND 730 billion from the offering will be added to MBB’s investment capital and business capital on the principle of safety, efficiency, and benefits for shareholders. The private offering plan will be implemented from the first quarter of 2024, and registration and reporting procedures will be carried out from January 2024.

The private offering to domestic investors does not affect the maximum foreign ownership ratio of MB, which remains at 23.2351% of the charter capital. After completing the private offering, MB’s charter capital will increase to VND 52,871 billion, ranking fifth in the banking industry, behind VPBank, BIDV, Vietcombank, and VietinBank.