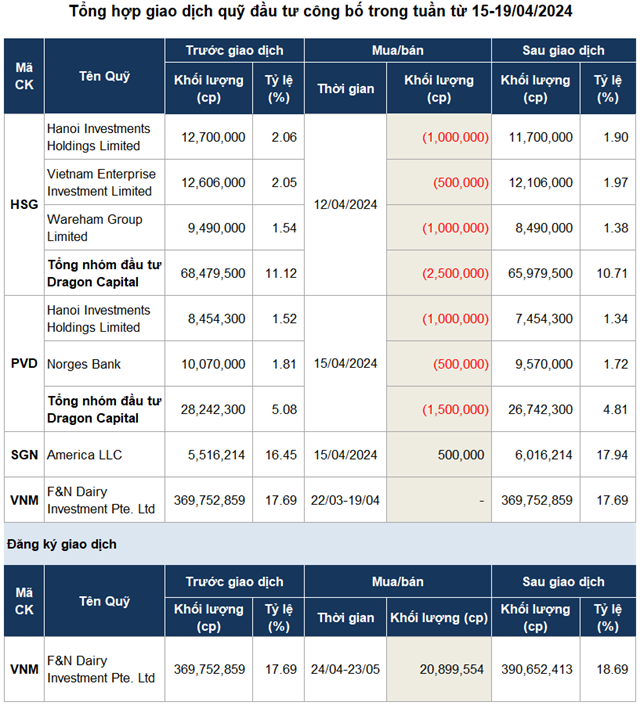

Accordingly, the sale of 1.5 million PVD (PetroVietnam Drilling and Drilling Services Corporation) shares by foreign fund Dragon Capital on April 15th helped the selling force prevail.

Specifically, 2 member funds of Dragon Capital, Hanoi Investments Holdings Limited and Norges Bank, sold 1 million and 500,000 units, respectively.

After the transaction, Dragon Capital is no longer a major shareholder of PVD with an ownership rate reduced to 4.81%, corresponding to nearly 27 million shares.

| Price movements of PVD shares from the beginning of 2023 to the session of April 19, 2024 |

Closing the session of April 15, 2024, PVD price hit the floor to VND30,550/share. According to this price, it is estimated that Dragon Capital earned nearly VND46 billion after divesting capital from PVD.

The foreign fund’s divestment occurred in the context of a sharp 7.97% market decline compared to the previous week with increased liquidity. This is the sharpest one-week decline since October 2022 due to the negative impact of escalating geopolitical tensions in the Middle East when Iran decided to retaliate against Israel.

In contrast to the transaction, foreign fund America LLC continued to increase its ownership rate at SGN (Saigon Ground Services Corporation) to 17.94% (more than 6 million shares) after buying 500,000 SGN shares in the session of April 15th.

| Price movements of SGN shares from the beginning of 2023 to the session of April 19, 2024 |

According to the SGN price at the close of the trading session, it is estimated that the foreign fund spent nearly VND36 billion to increase its ownership.

Source: VietstockFinance

|