Ending the weekend trading session, Vn-Index sharply declined to close at 1,174 points, a loss of 18 points.

The State Bank of Vietnam has officially started selling foreign exchange to intervene in the exchange rate, a move that had long been anticipated. Today it continued to put downward pressure on the market, along with increased margin calls by several securities companies. Initially, the index seemed to be driven by negative sentiments from the conflict in the Middle East, however, it later shifted its focus to domestic macroeconomic factors.

Market breadth was extremely negative with 405 stocks declining and only 90 rising. No single group of stocks maintained a positive growth trend. Securities dropped by 3.97%; Real Estate by 3.23%; Chemicals by 2.37%; Retail by 2.21%; and Construction Materials by 1.01%.

Large-cap stocks that had the most negative impact on the market were the usual suspects: VIC (-2.24 points); CTG (-1.44 points); FPT (-0.87 points); BCM, GVR, HDB and MBB also contributed to the decline. Total trading volume on the three exchanges today was close to 27,000 billion VND.

The exchange rate cooled down immediately after the State Bank of Vietnam announced the sale of foreign currency. Foreign investors returned to net buying with a net value of 652.2 billion VND. In terms of matched orders alone, they bought a net value of 647.7 billion VND, the highest net buying value in six months.

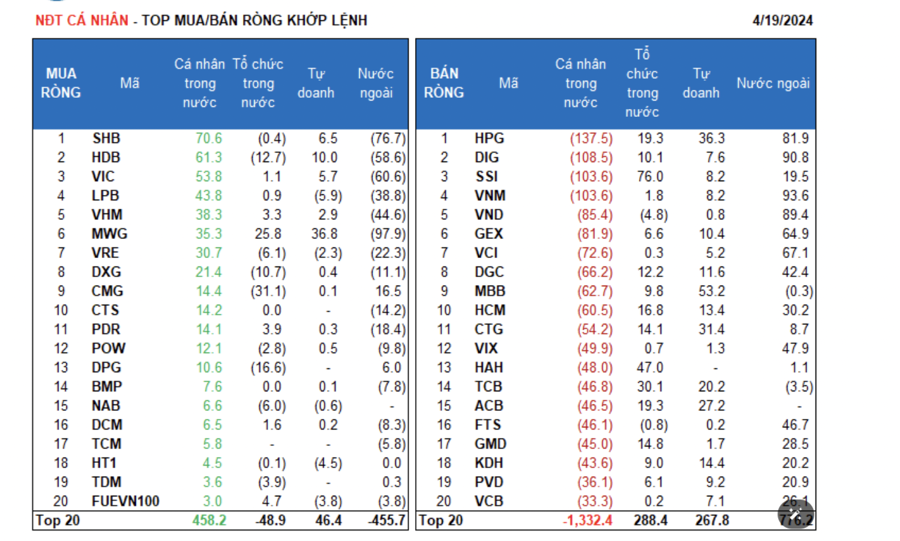

The main sectors purchased by foreign investors in matched orders were Financial Services, Food and Beverage. The top foreign net buy orders included VNM, DIG, VND, HPG, VCI, GEX, VIX, FTS, DGC and STB.

Foreign investors were net sellers in matched orders in the Banking sector. The top foreign net sales included MWG, SHB, VIC, HDB, VHM, VRE, PDR, CTS and DXG.

Domestic individual investors were net sellers by 1,617.6 billion VND, of which 1,502.1 billion VND was in matched orders. In terms of matched orders alone, they net bought in 3 out of 18 sectors, primarily in the Electricity, Water and Gas sector. The top net purchases by domestic individual investors were SHB, HDB, VIC, LPB, VHM, MWG, VRE, DXG, CMG and CTS.

In terms of matched orders, the top net sales were in 15 out of 18 sectors, primarily in Financial Services and Food and Beverage. The top net sales included HPG, DIG, SSI, VNM, VND, GEX, DGC, MBB and HCM.

Proprietary traders were net buyers by 533.4 billion VND, with a net buy of 537.9 billion VND in matched orders. In terms of matched orders alone, proprietary traders net bought in 16 out of 18 sectors. The strongest net buying was in Banking and Real Estate. The top net purchases in matched orders by proprietary traders today included FPT, MBB, BID, MWG, HPG, CTG, ACB, TCB, NLG and PNJ.

The top net sales were in the Automobile and Components sector. The top net sold stocks included STB, LPB, E1VFVN30, HT1, FUEVN100, FUESSVFL, VRE, REE, FUEDCMID and NAB.

Domestic institutional investors were net buyers by 403.9 billion VND, with a net buy of 316.6 billion VND in matched orders. In terms of matched orders alone, domestic institutions net sold in 5 out of 18 sectors, with the largest value in the Information Technology sector. The top net sales included CMG, FPT, DPG, HDB, DXG, DBC, VRE, NAB, VND and NKG.

The largest net buy value was in the Financial Services sector. The top net purchases included SSI, HAH, TCB, MWG, ACB, HPG, VJC, HCM, GMD and CTG.

Negotiated transactions today reached 1,337.6 billion VND, a decrease of 41.5% from the previous session and contributing 5.0% to the total transaction value.

FPT was the stock with the most notable negotiated transaction, with 2.49 million units traded between foreign institutions.

The proportion of capital flows increased in Real Estate, Securities, Steel, Construction, Chemicals, Information Technology and Construction Materials, while it decreased in Banking, Food, Agriculture and Fisheries, and Aviation.

In terms of matched orders alone, the proportion of trading value increased in the mid-cap VNMID and small-cap VNSML groups, while it decreased in the large-cap VN30 group.