Market Liquidity Declines from Previous Session, with VN-Index and HNX-Index Trading Volumes Down

Market liquidity declined significantly compared to the previous trading session, with the VN-Index recording a trading volume of nearly 616 million shares, equivalent to a value of nearly 14 trillion VND; the HNX-Index traded over 75 million shares, equivalent to a value of nearly 1.4 trillion VND.

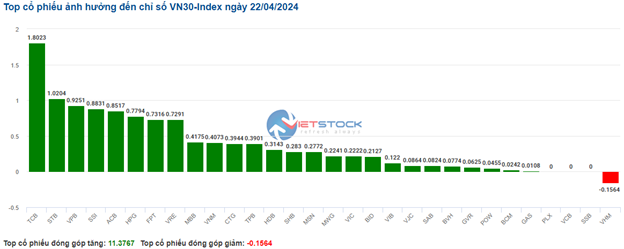

Top 10 Stocks Impacting the VN-Index on April 22, 2024

Image:

Afternoon Session: VN-Index Rebounds on Buying Momentum

The VN-Index opened the afternoon session on an optimistic note, with buyers driving the index higher throughout the session, closing near its intraday high. The stocks contributing most positively to the VN-Index were BID, CTG, SSI, and TCB, adding over 4.8 points. Conversely, VIC, MBB, and PGV had the most negative impact, reducing the index by nearly 0.8 points.

HNX-Index Follows Suit

The HNX-Index also exhibited similar behavior, with positive contributions from BVS (9.88%), DDG (9.37%), MBS (6.64%), and SHS (5.75%).

Image:

Strongest Market Recovery: Securities Sector

The securities sector recorded the strongest recovery, with a gain of 5.83%, primarily driven by SSI (+5.72%), VND (+6.88%), VCI (+5%), and HCM (+6.64%). Other performing sectors were financial services and consumer durables, with gains of 4.7% and 2.22%, respectively. Conversely, the healthcare sector experienced the sharpest decline, losing 0.7%, largely due to DHG (-0.09%), IMP (-5.34%), and DBD (-0.37%).

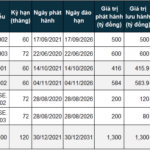

Foreign Investment Flows

Foreign investors returned to net selling, offloading more than 200 billion VND on the HOSE exchange, primarily in MWG (88.02 billion), VIC (53.77 billion), HDB (52.93 billion), and VHM (51.18 billion). On the HNX exchange, foreign investors bought a net of nearly 72 billion VND, focusing on BVS (31.1 billion), PVS (31.02 billion), and MBS (18.6 billion).

Image:

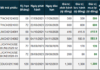

Morning Session: VN-Index Gains but Liquidity Remains Subdued

During the morning session, all three exchanges gained ground, with the VN-Index rising by 7.92 points. Advancing stocks outnumbered declining stocks by a ratio of more than 3 to 1. However, only over 6.3 trillion VND flowed into the HOSE exchange at the close of the morning session, indicating investor caution after a period of negative market performance.

Large-cap stocks, including BVH, VRE, SSI, STB, BID, TPB, and CTG, pushed the market higher. Conversely, real estate stocks exerted downward pressure, with VHM and VIC leading the decline.

Image:

Securities Sector Continues to Lead Gains

As of the end of the morning session on April 22, the securities group remained the primary driver of the index’s growth, contributing a 3.1% gain. Most stocks in this sector posted positive returns, including VND (+3.34%), VCI (+3.22%), HCM (+3.42%), SHS (+2.87%), MBS (+2.73%), FTS (+5%), VIX (+2.76%), BSI (+4.62%), and CTS (+2.3%). Notably, SSI gained 2.56% and led the sector in trading value, reaching 265.54 billion VND during the morning session.

Food and Beverage Sector Rebounds

The food and beverage sector recovered from last week’s sharp decline, with VNM, MSN, and SAB posting gains. In the banking sector, several stocks also performed well, including BID, CTG, TCB, VPB, ACB, HDB, SSB, VIB, STB, and TPB.

Conclusion

Despite the positive gains, liquidity remained subdued during the morning session, with total market trading value reaching only over 7 trillion VND, significantly below recent averages.