On April 20th, Nhat Viet Securities Corporation (code: VFS) organized its annual General Meeting of Shareholders (GMS) 2024.

The meeting approved the business plan for 2024, with the target of 282 billion VND in revenue, up 15% compared to that of 2023; total expenses of 126 billion VND, down 8%; after-tax profit of 124 billion VND, up 45%.

Looking back at 2023, Nhat Viet Securities recorded total revenue of 245 billion VND, up 43% compared to 2022; after-tax profit of 86 billion VND, up 36%. In 2023, the company also completed the transfer of shares from UPCoM to HNX, changing its corporate identity.

At the meeting, the Board of Directors of VFS proposed to shareholders to continue implementing the plan to issue additional shares to existing shareholders, which was approved at the 2023 Annual General Meeting of Shareholders.

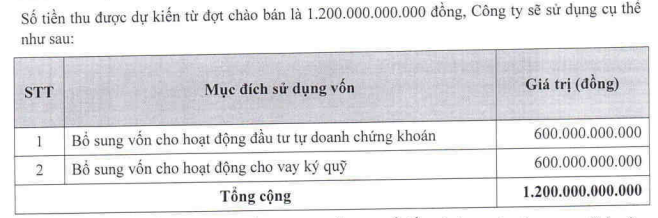

Specifically, the company plans to offer 120 million shares to existing shareholders (proportion of 1:1) at the price of 10,000 VND/share. If the issuance is successful, Nhat Viet Securities will raise up to 1,200 billion VND; at the same time, the charter capital will be doubled to 2,400 billion VND.

The entire amount will be used to supplement capital for securities trading (600 billion VND) and for margin lending (600 billion VND).

The offering is expected to take place in 2024, immediately after the State Securities Commission approves the offering method.

In addition, VFS also plans to issue shares to pay stock dividends to shareholders with a ratio of 8% (100:8), meaning that each shareholder owning 100 shares will receive 8 new shares, equivalent to a total of 9.6 million shares issued. The distribution period will be in 2024, before or at the same time as the record date for the rights offering to existing shareholders as per the above method.

In 2023, Nhat Viet Securities issued nearly 40 million shares in a private placement, raising capital from over 802 billion VND to 1,200 billion VND as it stands. With nearly 400 billion VND mobilized, VFS allocated 200 billion VND to supplement capital for proprietary trading and nearly 200 billion VND for margin lending.

In terms of personnel, the meeting elected a new Board of Directors for the 2024-2029 term, including Ms. Nghiem Phuong Nhi, Mr. Tran Anh Thang, Ms. Nguyen Thi Lan, Mr. Hoang The Hung, and Mr. Nguyen Xuan Diep.

The new Board of Directors for the 2024-2029 term of Nhat Viet Securities, with Ms. Nghiem Phuong Nhi (center) elected as Chairwoman

The Board of Directors also decided to elect Ms. Nghiem Phuong Nhi as Chairwoman of VFS’s Board of Directors. Ms. Nhi holds a Bachelor’s degree from the National Economics University, a degree from Saxion University in Deventer, the Netherlands, and completed a Master’s program at Radboud University in Nijmegen, the Netherlands, specializing in Business Administration.

From 2008 to 2023, Ms. Nhi served as Head of Financial Investment of the Viettel Group, and held senior positions in large organizations such as a member of the Board of Directors of Viettel Posts and Telecommunications Corporation, a member of the Board of Directors of Viet Nam Import-Export and Construction Corporation, and a member of the Board of Directors of Viettel Construction Corporation.

Ms. Nhi is currently the Chairwoman of Hoan An Finance Investment Corporation and Chairwoman of Amber Fund Management Corporation.