DIC Corp Reports Q1 Loss as Real Estate Sales Drop

Hanoi, Vietnam – April 28, 2024 – According to its consolidated financial report for the first quarter of 2024, DIC Corporation (DIC Corp – code DIG) recorded a revenue of VND 186.4 billion (USD 8.03 million), a decline of nearly 6% compared to the same period in 2023. Real estate revenue contributed VND 111.8 billion (USD 4.82 million), accounting for 60% and marking a significant increase of close to 55% from Q1 2023.

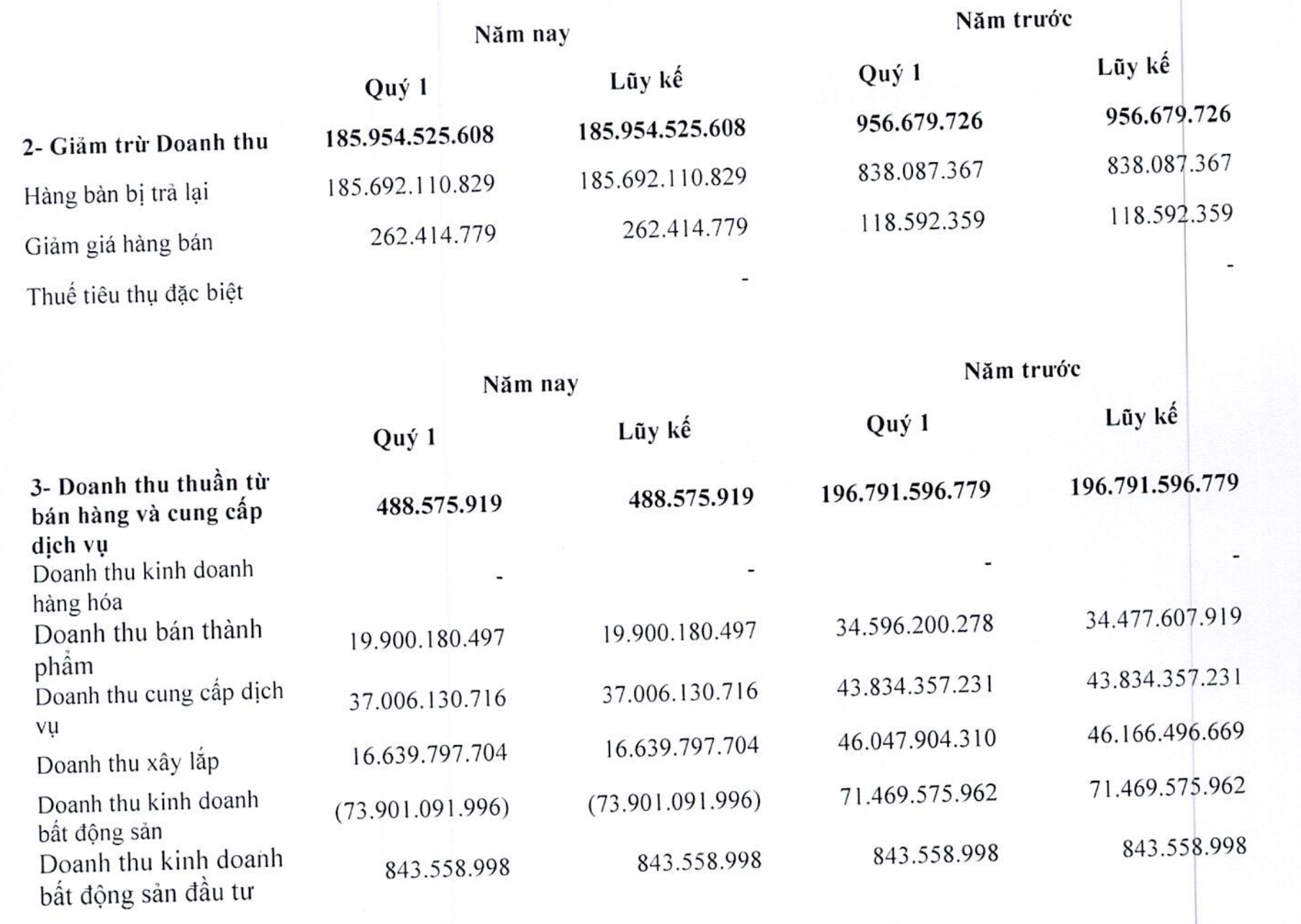

However, DIC Corp also reported a substantial returned goods provision of nearly VND 186 billion (USD 8.03 million) in the first quarter of this year, a significant surge compared to less than VND 1 billion (USD 43,056) in Q1 2023. This resulted in a net revenue of only under VND 490 million (USD 21,214), with a negative net revenue from real estate sales of VND 73.9 billion (USD 3.19 million). Therefore, the majority of DIC Corp’s returned goods were related to real estate.

Source: DIC Corp’s Q1 2024 Consolidated Financial Statements

Selling below cost led to a gross loss of VND 50.8 billion (USD 2.20 million) for DIC Corp, compared to a positive result of VND 42.4 billion (USD 1.83 million) in the same period last year. In the first quarter, financial revenue dropped by 93% to VND 12 billion (USD 518,745), while financial expenses also decreased by approximately 82% to just over VND 12 billion (USD 518,745). Conversely, selling and administration expenses showed an increase compared to Q1 2023.

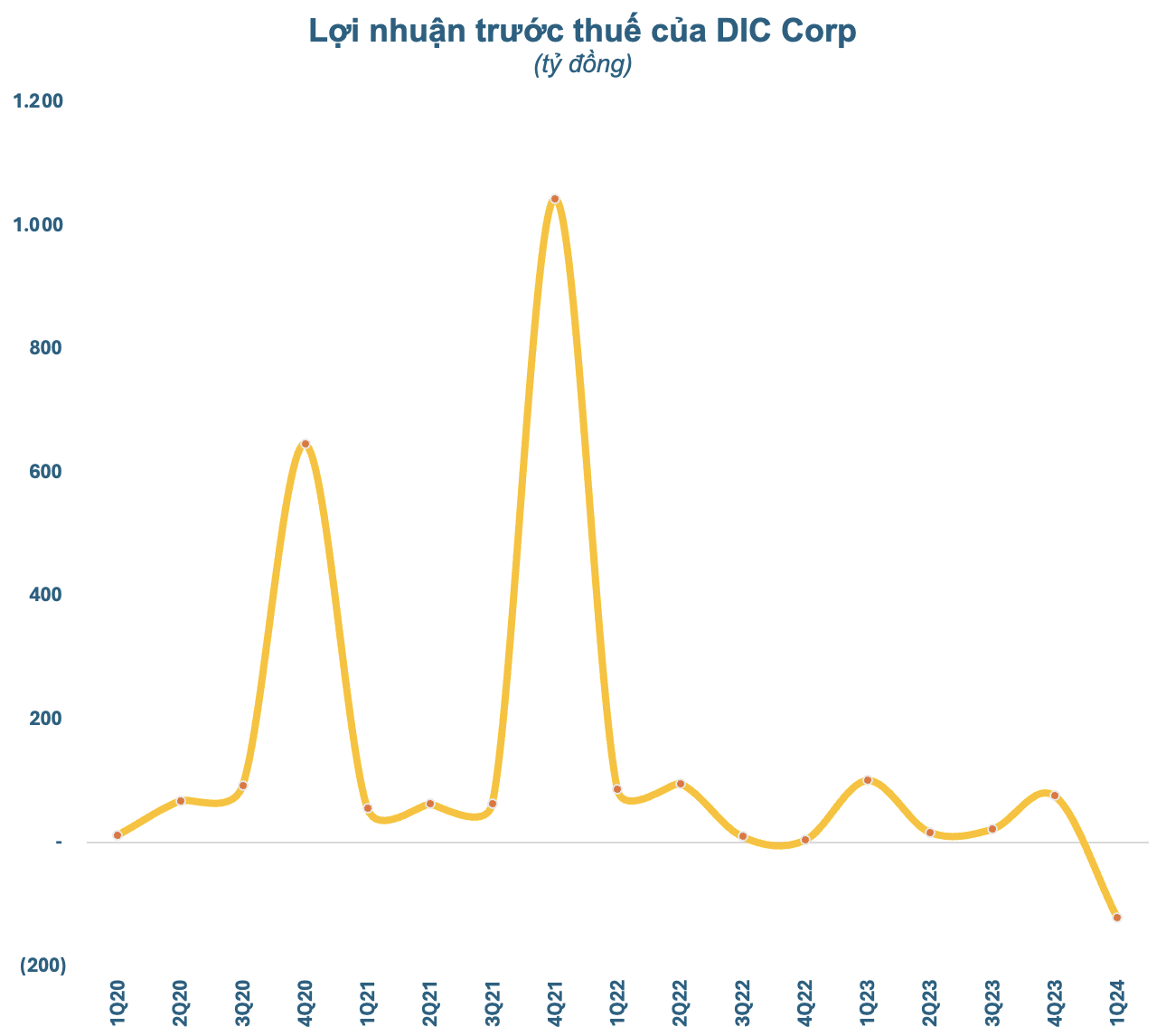

As a result, DIC Corp reported a pre-tax loss of nearly VND 121 billion (USD 5.22 million), while in Q1 2023, it had posted a profit of over VND 101 billion (USD 4.36 million). This is the largest quarterly loss for the real estate company since its listing in August 2009. The last time DIC Corp reported a pre-tax loss was in the first quarter of 2017, but the loss at that time amounted to only approximately VND 14 billion (USD 607,581).

On April 26, DIC Corp successfully held its 2024 Annual General Meeting of Shareholders (AGM) at the last minute, with 2,101 shareholders (including in-person and online) representing 306 million voting shares, or 50.24%.

Prior to the meeting, the company had launched an incentive program to encourage shareholder attendance. Specifically, shareholders holding 1,000,000 DIG shares or more received VND 10,000,000 (USD 431) per shareholder. Shareholders holding less than 1,000,000 shares received VND 10 (USD 0.004) per share. It is estimated that DIC Corp may have spent up to several billion VND (USD 863,058) to organize the AGM.

At the meeting, DIC Corp shareholders approved several important resolutions, including the 2024 business plan. This year, the real estate company has set ambitious targets, aiming for revenue of VND 2,300 billion (USD 99.13 million) and pre-tax profit of VND 1,010 billion (USD 43.62 million), an increase of 72% and 509%, respectively, compared to the 2023 results.

However, the record first-quarter loss has raised questions among shareholders about DIC Corp’s ability to achieve its 2024 plan. Last year, the company also set a high pre-tax profit target of VND 1,400 billion (USD 607,581), but only achieved around 1/8 of the set goal.

Capital Raising Plans

During the 2024 AGM, DIC Corp shareholders also approved capital raising plans, which are expected to be implemented in the near future.

First, DIC Corp plans to borrow an additional VND 220 billion (USD 9.52 million) from banks. Of this, VND 160 billion (USD 6.89 million) will be used to develop the Cap Saint Jacques Complex Project – Phase 2 & 3 in Vung Tau; and VND 60 billion (USD 2.60 million) will be invested in the DIC Star Vi Thanh hotel and conference center in Vi Thanh Commercial and Residential Area in Hau Giang.

Second, DIC Corp plans to conduct a rights offering to existing shareholders at a ratio of 32.794%, issuing an additional 200 million shares at a price of VND 15,000 (USD 0.65) per share, raising VND 3,000 billion (USD 129.73 million), which is expected to be completed in 2024.

DIC Corp will use VND 1,135 billion (USD 49.04 million) of the raised funds to supplement the investment capital for the Cap Saint Jacques Complex Project Phases 2 & 3 at 169 Thuy Van, Ward 8, Vung Tau City; VND 965 billion (USD 41.81 million) for the Vi Thanh Commercial and Residential Area Project in Ward 4, Vi Thanh City, Hau Giang Province; and the remaining VND 900 billion (USD 38.84 million) to pay off a portion or all of the principal and interest of bonds issued in 2021.

Third, the company plans to conduct a private placement of up to 150 million shares to professional securities investors, with an offering price not lower than VND 20,000 (USD 0.86) per share (37.9% lower than the closing price on March 29 of VND 32,200 (USD 1.39) per share), which will be subject to a one-year transfer restriction and is expected to be implemented between 2024 and 2025.

If the private placement is successfully issued, DIC Corp will raise VND 3,000 billion (USD 129.73 million), of which it plans to use VND 2,000 billion (USD 86.31 million) to supplement the capital for the Nam Vinh Yen New Urban Area Project in Vinh Yen City, Vinh Phuc Province; and VND 1,000 billion (USD 43.16 million) to supplement the investment capital for the Lam Ha Centre Point Housing Project in Lam Ha Ward, Phu Ly City, Ha Nam Province.

Fourth, DIC Corp plans to issue an additional 30 million shares under the employee stock option plan (ESOP), representing 4.919% of the total outstanding shares, to be implemented in 2024, and the ESOP shares will be subject to a one-year transfer restriction from the closing date of the offering. The expected issue price is VND 15,000 (USD 0.65) per share, 53.4% lower than the closing price on March 29, 2024 of VND 32,200 (USD 1.39) per share.

Fifth, DIC Corp plans to declare a cash dividend for 2023 in the form of shares at a ratio of 2.5% and issue bonus shares at a ratio of 2.5%, for a total of 5%, to be sourced from share capital and is expected to be implemented in 2024. As such, it is estimated that DIC Corp will issue 30.5 million additional shares for its 2023 cash dividend and bonus share distribution.

The order of issuance will be rights offering to existing shareholders, declaration of cash dividend for 2023 and issuance of bonus shares, issuance of ESOP shares, and finally, private placement of shares. If all four issuances are completed (totaling over 410 million shares), DIC Corp’