The VN-Index closed the month of April 2024 at 1,209.52 points, a decrease of 74.57 points or 5.81% compared to the end of March 2024, with a significant decline in liquidity.

The average daily transaction value on all three exchanges in April reached VND 24,405 billion. In terms of matching orders alone, the average daily transaction value was VND 24,405 billion, down 18% compared to the previous month but still up 11.3% compared to the average of the first three months of the year.

In terms of the monthly timeframe, the allocation of cash flow continued to recover from the bottom in Real Estate; reached a peak in Oil & Gas, Retail, Information Technology, Aviation, and Telecommunications; and declined to the bottom in Steel, Construction, and Construction Materials. In terms of matching orders alone, Individuals continued to be the only net buyers, continuing to net buy Banking, Real Estate, and Food.

The VN30 large-cap group increased in cash flow attractiveness while the allocation of cash flow decreased in the VNMID mid-cap and VNSML small-cap groups.

Foreign investors sold a net VND 5,990.7 billion, while in terms of matching orders alone, they sold a net VND 4,979.8 billion.

Foreign net matching buy stocks were in the Retail, Construction, and Materials groups. The top foreign net matching buy stocks included MWG, HPG, KDH, NLG, DPG, VND, DXG, TCB, GMD, and VPB.

Foreign net matching sell stocks were in the Real Estate group. The top foreign net matching sell stocks included VHM, MSN, FUEVFVND, VNM, VRE, VCI, SHB, STB, and HDB.

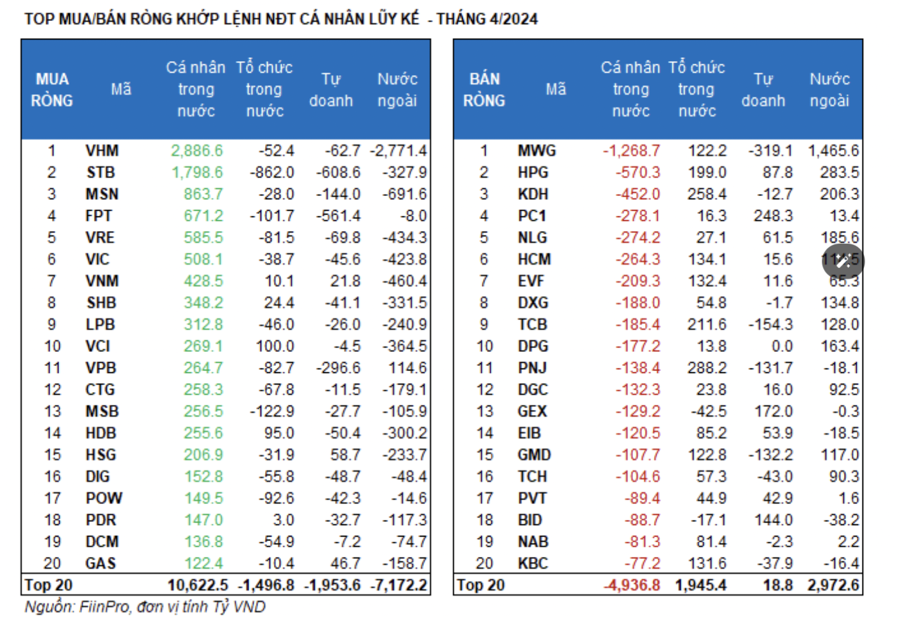

Individual investors bought a net VND 4,134.8 billion, of which they bought a net VND 6,500.9 billion. In terms of matching orders alone, they net bought in 9/18 sectors, mainly in the Real Estate sector. Top net purchases by individual investors were concentrated in VHM, STB, MSN, FPT, VRE, VIC, VNM, SHB, LPB, and VCI.

Matching sell side: They net sold in 9/18 sectors, mainly in the Retail and Basic Resources sectors. Top net sales included MWG, HPG, KDH, PC1, NLG, HCM, DXG, TCB, and DPG.

Domestic institutional investors sold a net VND 22.6 billion, while in terms of matching orders alone, they sold a net VND 316.2 billion.

In terms of matching orders alone, Domestic institutions sold a net in 8/18 sectors, with the largest value in the Banking group. Top net sales included STB, FUEVFVND, E1VFVN30, CMG, GVR, MSB, HPX, FPT, POW, and VIB.

The largest net buy value was in the Personal & Household Goods group. Top net buys included PNJ, KDH, TCB, HPG, HCM, EVF, KBC, GMD, MWG, and HAH.

Self-trading bought a net VND 1,878.4 billion, while in terms of matching orders alone, they sold a net VND 1,204.9 billion.

In terms of matching orders alone, Self-trading net bought in 9/18 sectors. The strongest buying group was Financial Services, Construction, and Materials. Top net matching buy stocks for self-traders today include FUEVFVND, PC1, E1VFVN30, GEX, BID, SSI, HPG, NLG, PVD, and HSG.

Top net sell stocks were in the Banking group. Top stocks sold net included STB, FPT, MWG, VPB, VIX, TCB, ACB, MSN, GMD, and PNJ.

In terms of the monthly timeframe, the allocation of cash flow continued to recover from the bottom in Real Estate; reached the peak in Oil & Gas, Retail, Information Technology, Aviation, and Telecommunications; and decreased to the bottom in Steel, Construction, and Construction Materials.

In terms of capitalization scale, the allocation of cash flow increased in the large-cap group, reaching 42.5% in April (vs. 38.9% in March). On the contrary, the allocation of cash flow decreased to 42.6% in the VNMID mid-cap group and 8.5% in the VNSML small-cap group.

In terms of cash flow scale, the average daily transaction value decreased by VND 1,186 billion (-11.4%) in the large-cap group, -VND 3,462 billion (-27.3%) in the VNMID group, and -VND 603 billion (-24.7%) in the VNSML group.

In terms of price movement, the VNSML and VNMID indices were under strong correction pressure, decreasing by -8.61% and -6.72% respectively, while the index of the large-cap VN30 group decreased by -4.35%, less than the general decrease (-5.81%).