The market recovered to the surprise of investors, despite the absence of any overly positive supporting information. The VN-Index surpassed the 1,200-point mark for the ninth time. Inflow of capital was enthusiastic, and liquidity also increased, with the transaction value on HoSE reaching over VND 19,800 billion, an increase of over 13% compared to the previous session.

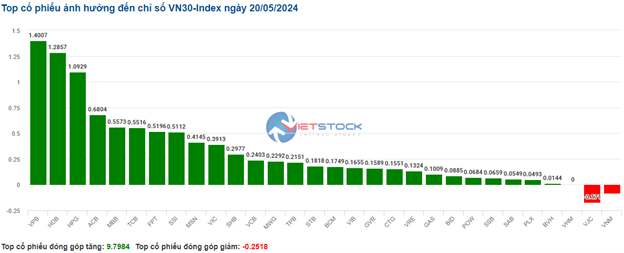

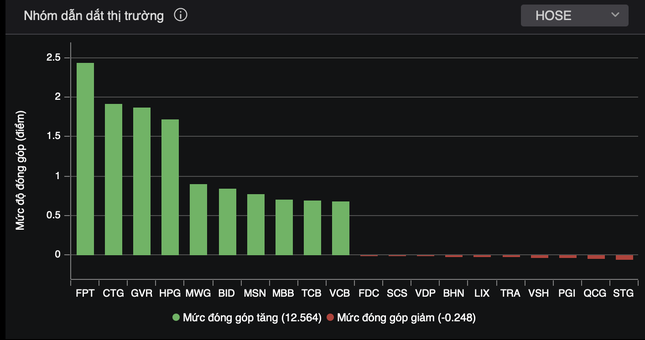

The green color covered 435 stocks , and most industry groups contributed to the VN-Index’s growth. In the VN30 basket, FPT, GVR increased to the ceiling . FPT became the most positive driver, contributing nearly 2.5 points after the news of “joining hands” with NVIDIA to build a $200 million AI factory. FPT’s stock price reached VND 120,100 per unit, the highest in history. Trading volume also reached over 10 million shares, leading liquidity on the entire floor with a value of VND 1,204 billion.

Meanwhile, despite also reaching the ceiling price, GVR was still over 16% away from its 2-year peak price (set in early April).

FPT leads the group driving the market.

Large-cap stocks were supportive of the market’s upward trend. All stocks in the VN30 basket increased in price. The increase in the VN30-Index was higher than the main index. 22 stocks in this basket increased by more than 1%.

The VN-Index’s explosive session also witnessed the return of the real estate group. PDR, NBB, TCH, DXG hit the ceiling. DIG recorded the third-highest liquidity on the entire floor, with a value of VND 713 billion.

The securities , construction , materials, oil and gas… groups also had positive trading.

At the end of the trading session, the VN-Index increased by 28.21 points (2.4%) to 1,205.61 points. HNX -Index increased by 5.24 points (2.35%) to 227.87 points. UPCoM-Index increased by 0.86 points (0.98%) to 88.37 points. Foreign investors net sold VND 213 billion; however, if excluding transactions in FUEVFVND fund certificates (nearly VND 1,000 billion), foreign capital was not overly negative. Some stocks such as HPG, MWG, VND, PVS, SSI… were bought net.

Liquidity improved compared to the previous session, but was still lower than the average of the past 20 sessions. In the international context, the market received positive news when the US PMI data was much lower than experts had predicted. This signal suggests that investors are expecting the Fed to cut interest rates soon.

The State Securities Commission (SSC) said that it had just had an online meeting with the World Bank and the Asian Securities and Financial Markets Association (ASIFMA) on the contents of the draft Circular amending and supplementing several regulations on securities transactions on the securities trading system; clearing and settlement of securities transactions; operations of securities companies; and information disclosure on the securities market to resolve several bottlenecks related to the criteria for upgrading the Vietnamese stock market.

The issues that the attendees were particularly interested in were pre-transaction margin deposits, the settlement procedures of the Vietnam Securities Depository (VSD), securities companies, and custodian members for foreign investor transactions, and the ability to settle transactions.