TPC Annual General Meeting TPC on April 26

|

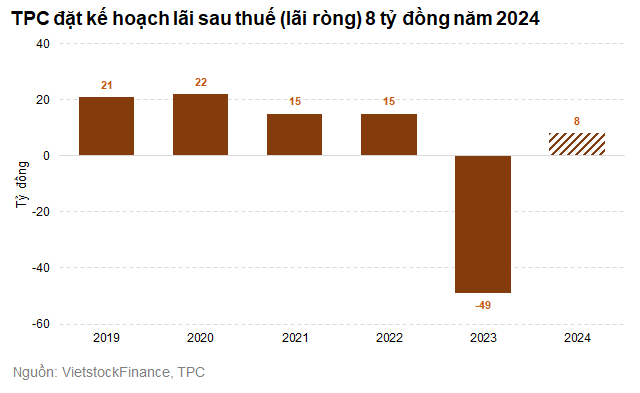

Management talks about the heaviest loss in 45 years

Looking back at the results of 2023, the company’s packaging output was 12.363 tons, a 37% decrease compared to the previous year. Net revenue was 567 billion VND, down 45%. The net loss was nearly 49 billion VND. Due to the loss, TPC will not pay dividends for 2023, as approved by the AGM.

“This is the first time in 45 years since our company was established that we’ve experienced severe losses that we can’t turn around quickly,” said Pham Trung Cang, Vice Chairman of the Board.

He cited the impact of post-COVID-19 global economic slowdown, declining purchasing demand, and the Russo-Ukrainian war as the reasons. The world was in turmoil, from the recession crisis to the surge inflation, and all prices were rising frantically, including PP and PE resin, the raw materials used to make packaging. The company had purchased and stored these materials when the prices were extremely high.

“The Company’s policy has always been to maintain a reserve, and we always keep a 1 to 3 months’ supply of raw materials, so that when a contract is signed, we have the materials immediately available. Our raw materials have to be imported, and with the global economy experiencing extreme fluctuations and prices rising that sharply, if we didn’t maintain the inventory, we would face significant challenges in our production and business operations. Therefore, the Board of Directors and the Executive Board decided to stockpile the resin in the fourth quarter of 2022, when the global price was very high,”he said.

He went on to say that after 2022, the global economy changed suddenly from rampant price increases to a recession, with no trade, and prices falling in a straight line. By the first quarter of 2023, packaging prices had fallen by about 30% compared to the stored prices. Export orders also saw a sudden drop, including orders from supermarket customers (shopping bags). They either postponed or even canceled the orders. Meanwhile, domestic demand was weak, and competitors were cutting prices to survive. Under these circumstances, TPC had no choice but to accept a small loss to keep its employees on the payroll.

In addition, interest rates increased, export orders fell sharply, and foreign currency revenues were not coming in quickly enough. Previously, the Board of Directors’ policy was for TPC to borrow entirely in USD for lower interest rates. However, due to our confidence in the balance of our USD exports and loans, the company only borrowed USD, not VND; when the exchange rate skyrocketed, we incurred an exchange loss of 7-8 billion VND. With exports at a standstill and no orders, TPC still had to repay maturing debts, so we borrowed more VND to buy USD at a high price to repay the maturing USD loans.

Setting a modest target of 8 billion VND for 2024, the company has already cut its workforce by more than half

For 2024, the company has set a target of 8.323 tons of total packaging output, a total packaging revenue of 303.7 billion VND, and an after-tax profit of 8 billion VND

In addition, TPC also presented to the shareholders a proposal to reduce the depreciation expense in 2024 by 50-70% of total depreciation expenses, if the results of production and business operations are unprofitable; and a proposal to increase the capital contribution to its subsidiary, TDH Investment Company Limited, from 45 billion VND to 100 billion VND, to meet the subsidiary’s production and business operations needs. These proposals were approved by the AGM.

“We are setting a profit target of 8 billion VND for 2024 only, which will not offset the net loss of 2023. The loss will be offset by the proceeds from the real estate sale,” the Vice Chairman said in response to shareholders’ concerns about whether the plan for 2024 was overly optimistic.

He explained that the sale of real estate also aims to add to working capital, reduce bank loans, and limit the amount of USD used since our exports are low. In the past, 65% of its output was exported and 35% was sold domestically, but now only 10-15% is exported and the domestic market has also declined. Therefore, the leaders learned a lesson and will no longer borrow USD, but it will borrow VND for domestic production and business operations, even though the interest rates are higher.

In addition, the company is also restructuring low-demand, inefficient products with very slow turnover rates. For example, it has reduced its production of 6-7 million shopping bags and has at times reduced it to zero. Now, it is producing about 1 million bags per month. After the Board of Directors and the Executive Board’s restructuring, eliminating non-essential departments, and discontinuing inefficient products, the number of employees has decreased from 700 to 300.

“When we decided to reduce our staff, we were devastated to part with workers who had been with us for so long. The workers who remain now are paid on a per-product basis, earning 10-12 million VND per month. They can’t survive on less.

The situation is a bit better for the staff. Recently, our management team has taken several voluntary pay cuts to set an example. The leaders will have to endure the hardship. We will not lower the workers’ pay, and if things get really tough, we’ll reduce our staff again, but we will not cut the remaining workers’ pay. The Board of Directors will not receive any bonuses if the company does not make a profit,” said Cang.

Therefore, the AGM approved the Board of Directors and the Supervisory Board’s proposal to not receive any bonuses for 2024, due to the net loss in 2023 and the economic challenges in 2024, in order to reduce the company’s expenses. In 2023, the total bonus for the Board of Directors and the Supervisory Board was 700 million VND.

Finally, Cang said that the Board of Directors and the Executive Board have been actively marketing and working with individual customers to assess their needs and negotiate the best possible prices to make sales. With the economy likely to face further challenges in 2024, the company has set the aforementioned targets.

In terms of the Q1 results, the company made a profit of about 1.7 billion VND. Due to the Lunar New Year holiday, our expenses were high, but we expect Q2 to be better. In April, the company signed a number of new domestic contracts, which are higher than in the first quarter months, resulting in an increase in contracts in the second quarter. In addition, an American customer has placed an order for approximately 14 containers of geotextile products (which are used in levee construction to protect against flooding), which will provide the company with production work for 2-3 months. This is a high-quality product with a relatively good profit margin.

Real estate liquidation for loss compensation

One of the important motions approved was to authorize the Board of Directors to liquidate real estate assets at C11-C15 Duc Hoa Ha Plastic Industrial Park, Duc Hoa District, Long An Province, to offset losses. At the same time, the party acquiring the real estate assets shall guarantee the selling party the right to lease back the assets in order to continue production and business operations.