Vietnam’s Airport Ground Services Firm SAGS Eyes Long Thanh Airport Expansion

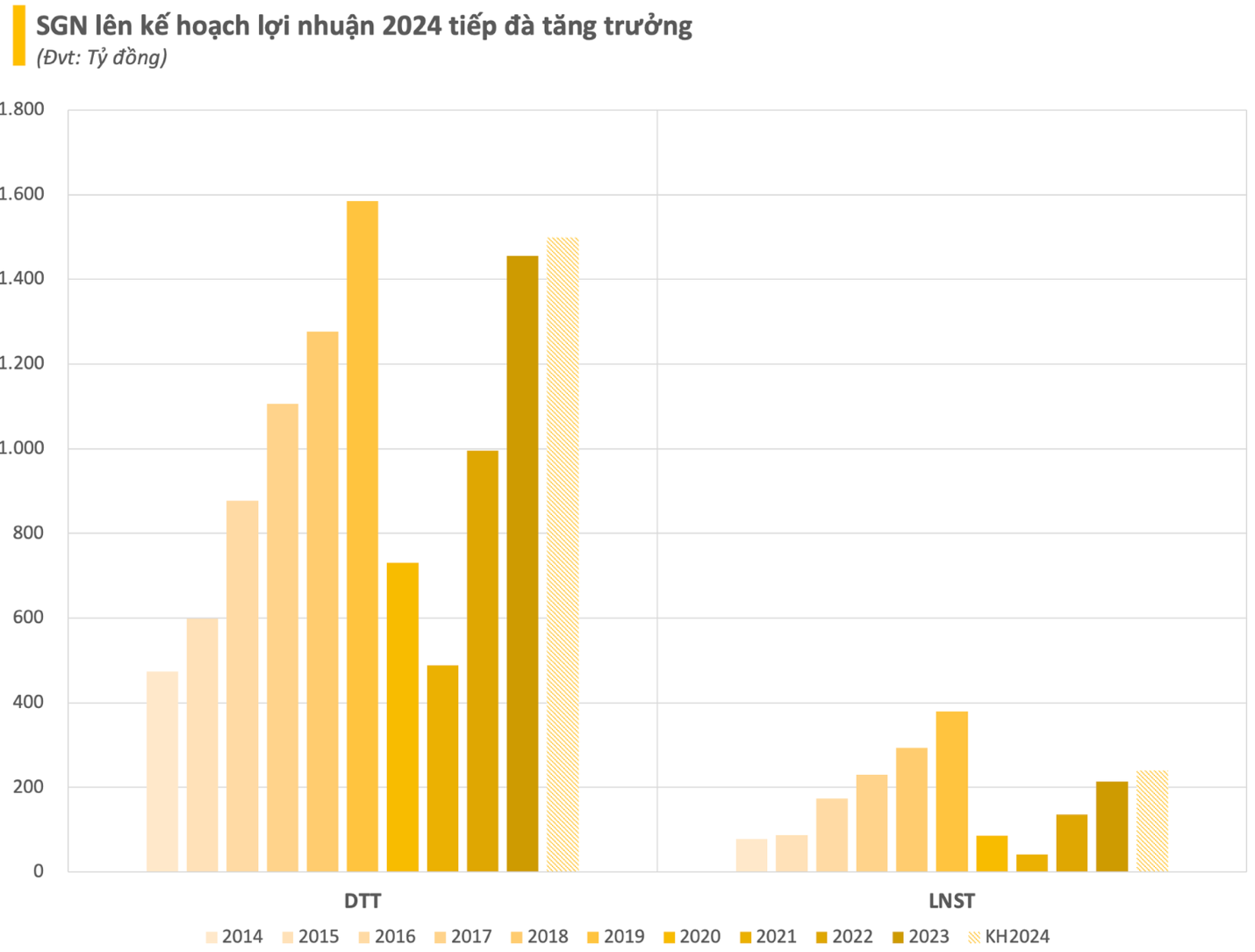

On April 25, 2024, Saigon Ground Services Corporation (SAGS, stock code SGN) held its annual general meeting to approve a consolidated revenue plan of VND1.499 trillion, matching the previous year’s figure. SGN expects its after-tax profit to reach VND240 billion, up nearly 6%.

This year, the company will focus on enhancing service quality, customer orientation, and brand building while retaining existing customers and acquiring new ones.

SGN also emphasized that it will dedicate all its resources to bidding for the Long Thanh Airport project – a mega-project pivotal to the aviation industry, with phase 1 slated to commence in 2026. Accordingly, SGN will participate in the bidding process for the investment project to construct and operate ground equipment maintenance facilities and handle aircraft cleaning services at Terminals 01 and 02 of Long Thanh International Airport.

Long Thanh Airport Crucial for Company’s Survival

Regarding the significance of Long Thanh Airport, Mr. Dang Tuan Tu, Chairman of SGN’s Board of Directors, stressed, “Long Thanh Airport will determine the company’s future existence and growth. According to the feasibility study, 80% of international flights will be transferred to Long Thanh in phase 1. Therefore, if we fail to win the bid for Long Thanh Airport, we will incur significant losses as international flights at Tan Son Nhat will be transferred to Long Thanh. Long Thanh Airport will decide the company’s survival in the coming years.”

At Long Thanh Airport, SGN intends to expand its service offerings beyond ground handling for airlines. Notably, SGN will collaborate on services within the ACV ecosystem, such as terminal operations and cargo handling. These initiatives align with the company’s strategic directions for the future.

According to the plan, if SGN wins the bid for Long Thanh, it will invest approximately VND174 billion, including VND51 billion for Tan Son Nhat International Airport (apron equipment, information technology, and preparation for Long Thanh International Airport) and VND123 billion for equipment investments at Long Thanh International Airport.

Grounded Aircraft Account for 20-30% of Vietnam Airlines and Vietjet’s Fleets

Assessing the 2024 business landscape, SGN’s management believes that the aviation industry will face numerous challenges, potentially exceeding those of 2023. The slow recovery of the international market due to factors such as war, conflict, political tensions, inflation, and a global economic slowdown will hinder industry growth. Consequently, people’s disposable income will decline, affecting global travel demand.

Currently, Vietnam’s two major tourism markets, China and Russia, are facing challenges. China’s economy is recovering slowly, and its government is prioritizing domestic tourism over international travel. Meanwhile, in Russia, the ongoing war and sanctions have crippled its tourism industry.

Regarding domestic aviation, SGN noted that the pandemic has significantly reduced airline resources. For example, Bamboo Airways’ fleet has decreased from 30 to 7-8 aircraft.

The two major airlines, Vietnam Airlines (stock code HVN) and Vietjet Airs (stock code VJC), have also been impacted by technical issues with NEO 320-321 engines, forcing them to ground aircraft for repairs. According to SGN, the number of grounded aircraft accounts for 20-30% of these airlines’ fleets.

“This demonstrates the airlines’ reduced transport capacity, while their financial situations have also weakened considerably. The aviation industry continues to be affected and has not yet recovered; airlines are unable to increase their operating capacity and are still delaying payments to service providers like SGN,” emphasized the Chairman of SGN.

In 2023, SGN set aside a 70% provision for doubtful accounts receivable from Bamboo Airways (amounting to VND53.6 billion) and a VND6.6 billion provision for accounts receivable from Vietravel Airlines.

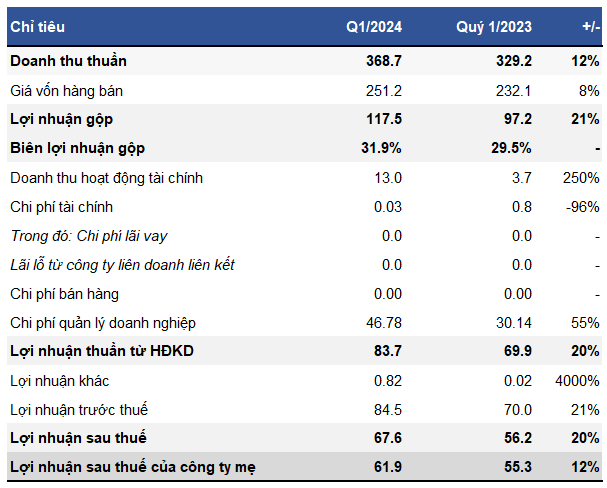

Reflecting on 2023, SGN recorded revenue of VND1.455 trillion and net profit of VND227.4 billion, representing a 46% and 65% increase respectively compared to the fourth quarter of 2022, exceeding its planned targets. This was a remarkable result considering the significant profit decline in the fourth quarter of 2023 due to provisions for uncollectible accounts receivable from airlines.

Based on these results, SGN proposed to shareholders a cash dividend payment for 2023 at a rate of 25%, amounting to approximately VND84 billion.