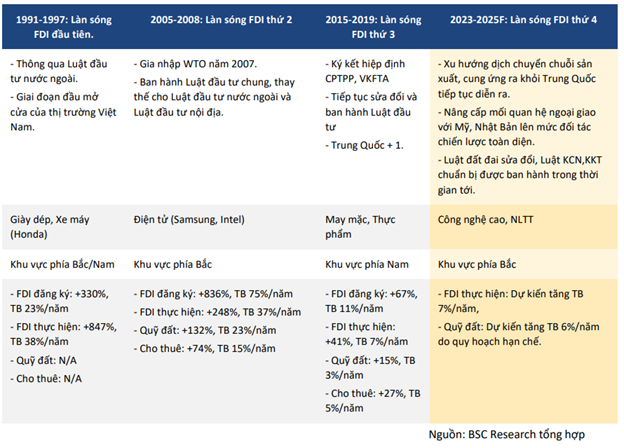

In its 2024 industry outlook report, BIDV Securities Company (BSC) predicts that the FDI trend will continue to thrive in 2024-2025, offering opportunities for industrial real estate businesses to unlock new land resources.

In 2023, the total registered FDI reached $28.1 billion, up more than 24% compared to the previous year. Of this, newly registered FDI reached $20.2 billion, an increase of 62%, and realized FDI reached $23.2 billion, a 3.5% increase, mainly contributed by China and Taiwan.

With manufacturing facilities still relocating from China, coupled with the Vietnamese government’s efforts to attract FDI by enhancing diplomatic relations with the United States and Japan to comprehensive strategic partners and continuously organizing seminars connecting FDI investors with provinces.

Furthermore, the amended Land Law has been passed and the draft Industrial Zone and Economic Zone Law is being issued. BSC expects a fourth wave of FDI to flow into Vietnam in 2024-2025, focusing on high-tech sectors and renewable energy.

|

Statistics of FDI waves into Vietnam from 1991 to the present

|

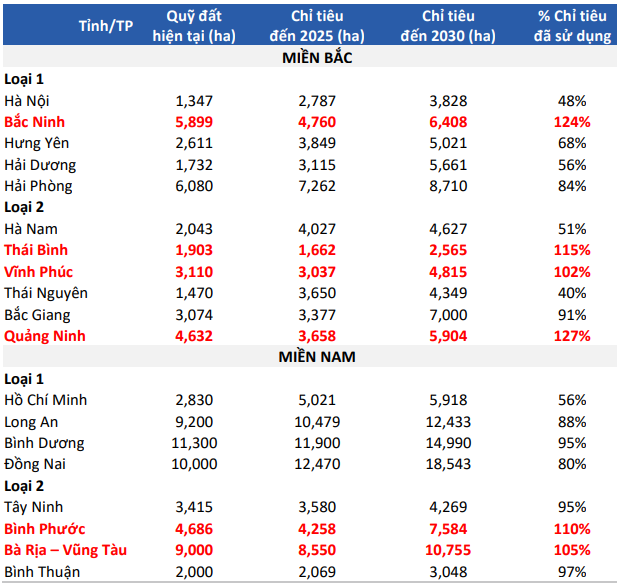

BSC’s analysis group compared the current land fund with the approved land fund until 2025 and found that many provinces have used up their quotas. Therefore, BSC believes that the supply of industrial real estate in industrial zones will still be scarce in the next 1-2 years.

This also creates pressure on the government to accelerate the legal progress to unlock the supply in provinces that still have approved quotas, as the supply from tier 1 areas is running low.

|

Statistics on land funds in some provinces

|

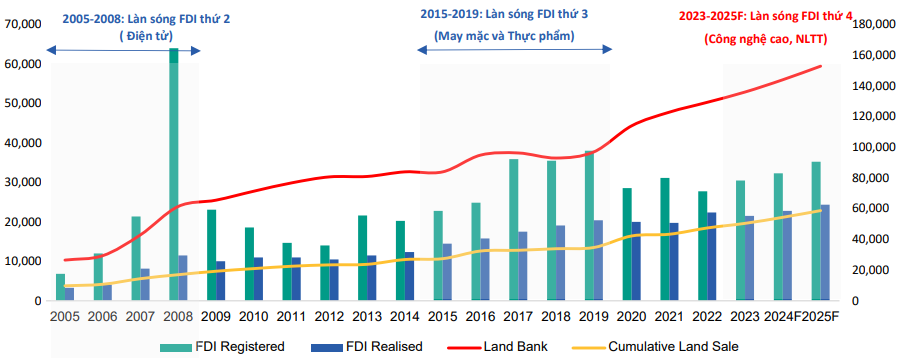

According to BSC, the new supply drop-off will occur in the second half of 2025 and beyond.

Earlier, the third wave of FDI into Vietnam with the supply of new unlocked land was delayed by 1-2 years from the influx of FDI. Specifically, the realized FDI growth averaged 7% per year in the 2015-2019 period. Meanwhile, during this period, the land fund supply only increased by 3% per year and was unlocked from 2020.

Similarly, for the fourth wave of FDI from China, BSC believes that the new supply drop-off will also be delayed by 1-2 years and will start from the second half of 2025. The new supply will tend to shift to tier 2 satellite provinces of Hanoi and Ho Chi Minh City.

This is due to improved transportation infrastructure, which reduces travel time between key economic regions and level 2 market areas, as well as affordable land rental and labor costs in level 2 markets, along with an abundant land fund that provides more choices for tenants. BSC believes that this trend will benefit businesses that are developing or have projects in level 2 markets.

|

The fourth wave of FDI is expected to accelerate the pace of unlocking industrial land from 2024 onwards

Source: BSC

|