Oil skims three-week low as markets weigh mixed US data, US sanctions on Venezuela, Iran and easing Mideast tensions

Oil prices held near three-week lows as investors weighed mixed US economic data, US sanctions on Venezuela and Iran and easing Middle East tensions.

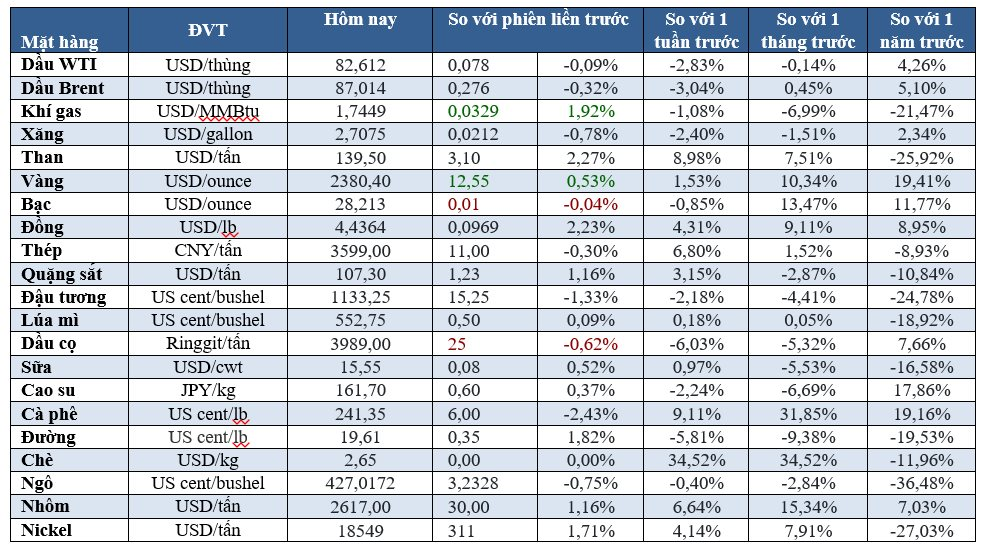

Brent crude futures fell 18 cents, or 0.2%, to $87.11 a barrel, while US West Texas Intermediate (WTI) crude gained 4 cents, or 0.1%, to settle at $82.73.

That was Brent’s lowest close since March 27, for a second consecutive day.

A resilient US labor market, a key pillar of its economy, along with stubbornly high inflation, has led financial markets and some economists to push back expectations for when the US Federal Reserve might start cutting interest rates until perhaps September.

Lower rates reduce the cost of borrowing and can boost economic growth and demand for oil.

Venezuela has lost a key US license allowing it to export oil to global markets, a move that is set to hit the volume and quality of the OPEC nation’s crude and fuel exports.

Gold gains as rising Middle East tensions boost haven demand

Gold held onto safe-haven gains as lingering tensions in the Middle East overshadowed strong US economic data that tempered expectations of interest rate cuts.

Spot gold rose 1% to $2,384.83 per ounce by 17:47 GMT. It had hit its highest since last Friday at $2,431.29. US gold futures settled up 0.4% at $2,398.

Bullion’s advance came even as data showed that the number of Americans filing new claims for unemployment benefits held near a historically low level last week. The upbeat US economic data and hawkish rhetoric from Fed officials have forced investors to sharply reconsider how soon the US central bank might cut interest rates.

“With the Fed rate cut expectations priced in and with some natural profit-taking after the swift rally, there could be some consolidation in gold, but a sharp drop is less likely,” said Xiao Fu, head of commodity market strategy at Bank of China International (BOCI).

Silver rose 0.3% to $28.30 per ounce. Platinum climbed 0.7% to $944.25 and palladium gained 0.1% to $1,027.34.

Copper at 22-month high as inventories tighten

Copper prices advanced to their highest in 22 months as funds extended buying amid tightening inventories. Three-month copper on the London Metal Exchange climbed 1.9% to $9,764 a tonne, its highest since June 2022.

“The market is still very much driven by the real impact of Russian material sanctions and, in the near term, exchange LME cancellations are tightening nearby stocks,” said Amelia Xiao Fu, head of commodity market strategy at Bank of China International.

On-warrant inventories available in LME warehouses fell by 15,200 tonnes to their lowest in a month at 90,400 tonnes after investors issued instructions to the exchange that they plan to withdraw metal, data showed on Thursday.

Also on the LME, aluminum gained 1% to $2,612 a tonne after LME available stocks fell by 20,600 tonnes to 214,275 tonnes.

LME tin rose 4.6% to $34,285, its highest since June 2022, amid fund buying and supply concerns. Nickel climbed 1.8% to $18,560 while lead added 1.2% to $2,181 but zinc fell 1% to $2,812.

Iron ore extends gains on expectations of rising Chinese demand

Iron ore futures in China extended gains for a second session on expectations of improved steel demand in China and improved steel margins.

The most-traded September iron ore contract on China’s Dalian Commodity Exchange ended daytime trading up 3.07% at 874 yuan ($120.75) a tonne.

On the Singapore Exchange, the most-active May iron ore contract was up 0.52% at $116.45 a tonne by 0718 GMT, its highest since March 8, after a more than 5% gain in the previous session.

Coke and coking coal futures both rose, climbing 2.17% and 2.02%, respectively.

On the Shanghai Futures Exchange, steel rebar rose 1.18%, hot-rolled coil increased 1.16%, wire rod grew 1.42%, and stainless steel climbed 1.59%.

Soybeans ease on ample South American supplies, dry weather supports wheat

US soybean and corn futures closed lower after hitting six-week lows, with both markets pressured by plentiful supplies from South America.

Corn futures were pressured by spreading concerns over a fungus disease in Argentina, the world’s No. 3 exporter of the animal feed grain. Wheat futures, meanwhile, turned higher as drought concerns escalated in parts of the US Plains winter wheat belt.

Chicago Board of Trade July soybean futures settled down 15-1/4 cents at $11.49 a bushel. CBOT July corn ended down 4-3/4 cents at $4.36-1/4 a bushel, while CBOT July wheat rose 3/4 cent to $5.53 a bushel.

Soybean futures were pressured in part by a wave of farmer selling in Brazil as the Brazilian real weakened this week to its lowest since March 2023, making their dollar-priced soybeans more competitive.

Wheat futures rose sharply, defying losses in soybeans and corn.

Cocoa jumps nearly 10% after better-than-expected grind data

London and New York cocoa futures hit multi-year highs on concerns over tightening supplies compounded by better-than-expected demand, while robusta coffee futures fell back after hitting a fresh contract high for the sixth consecutive session.

London July cocoa climbed by 833 pounds, or 9.7%, to 9,418 pounds a tonne, after hitting a peak of 9,535 pounds.

Dealers said data showing cocoa grindings in Europe and Asia, a measure of demand, were much stronger than expected, adding to the strong rally in cocoa prices.

Cocoa prices have rallied by more than 150% so far this year and with the supply outlook still seen as tight due to erratic weather and disease, demand needs to contract to reduce the deficit.

Cocoa grindings in Europe in the first quarter fell by 2.2% year-on-year, while Asian grinds declined by 0.2% compared with the same period last year, industry data showed.

New York July cocoa futures rose by 9.6% to $