Mai Vien Real Estate Posts Robust Financial Performance in 2023

The Hanoi Stock Exchange (HNX) recently published a document released by Mai Vien Real Estate Joint Stock Company, disclosing the company’s periodic financial report for the year 2023.

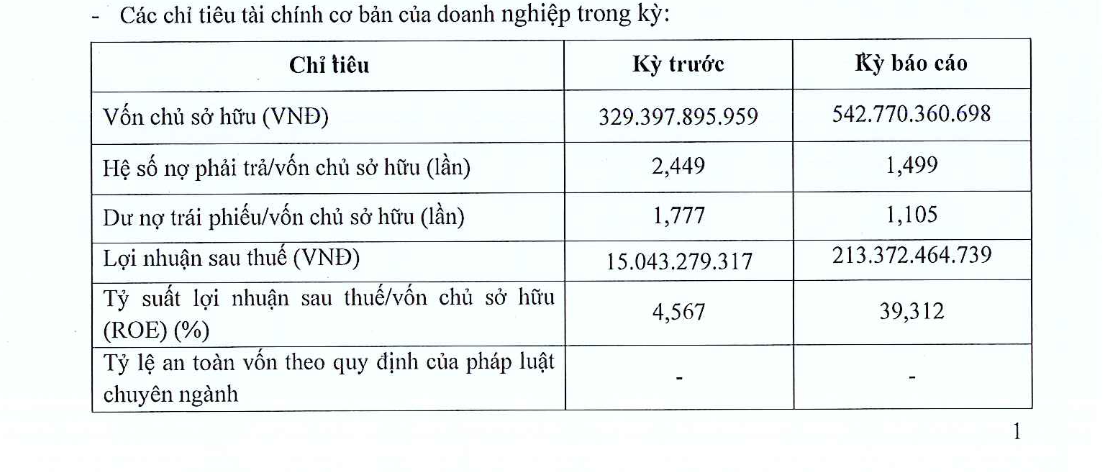

According to the report, the company’s equity reached nearly VND 542.8 billion by the end of 2023, representing an impressive 64.8% increase from the previous year’s corresponding period.

Source: HNX

Remarkably, Mai Vien Real Estate’s after-tax profit for 2023 soared to over VND 213 billion, a staggering 14.2-fold increase compared to the same period in 2022.

The company’s debt-to-equity ratio improved significantly, decreasing from 2.449 times to 1.499 times. Its total debt as of December 31, 2023, amounted to approximately VND 813.7 billion, out of which nearly VND 600 billion represents outstanding bond debt.

The bond debt originates from the MVJCH2124001 bond series issued on October 26, 2021, with a maturity of 36 months. The issuance value was VND 600 billion, with Everest Securities Joint Stock Company and National Commercial Bank as the lead underwriters. The bondholders comprise 250 domestic professional investors.

The collateral for the bond issuance includes land use rights, ownership rights of residential properties, and other assets attached to the land at 3-3A-3B-5 Suong Nguyet Anh Street, Ben Thanh Ward, District 1, Ho Chi Minh City (Fusion Suites Saigon Hotel), owned by Fusion Suites Saigon Hotel JSC.

The proceeds from the bond issuance were intended to contribute to a joint investment with Dai Lam Joint Stock Company for the development of the Thac Bac Long Cung Ecotourism Resort Project (Tu Son Commune, Kim Boi District, Hoa Binh Province) under a business cooperation agreement between Mai Vien Real Estate and Dai Lam Company.

In 2023, Mai Vien Real Estate made interest payments of VND 69 billion on the MVJCH2124001 bond series.

Mai Vien Real Estate was established in February 2014 and is headquartered in the Ruby Tower building at 81-83-83B-85 Ham Nghi Street, Nguyen Thai Binh Ward, District 1, Ho Chi Minh City.

Mai Vien Real Estate is known as the investor behind the Cantavil Premier commercial center (Xa Lo Ha Noi Road, Thu Duc City, Ho Chi Minh City).

Currently, the Director and legal representative of Mai Vien Real Estate is Ms. Nguyen Thao Phuong (born in 1989).

In January 2021, Ms. Nguyen Thao Phuong replaced Mr. Pham Thanh Tung (born in 1980) as the Director and legal representative of Fusion Suites Saigon Hotel JSC (Fusion Suites Saigon). This entity owns the Fusion Suites Saigon Hotel, the asset used as collateral for Mai Vien Real Estate’s VND 600 billion bond issuance.

As of October 2023, the position of Director and legal representative of Fusion Suites Saigon is held by Mr. Tran Quang Chung (born in 1983).