HAI An Declares Q1 Revenue with Marginal Increase Amidst Cost Pressures

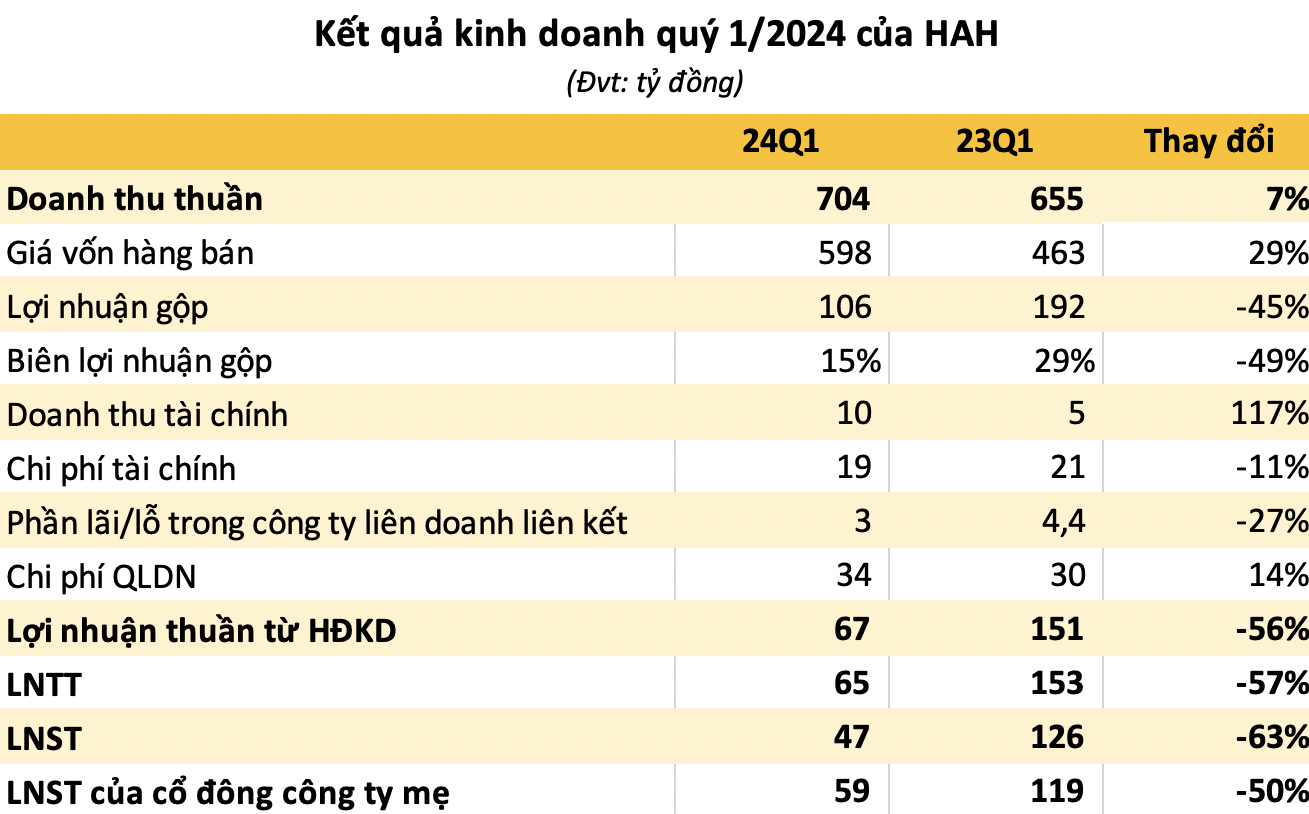

HAI An Transportation and Stevedoring Joint Stock Company (HAI An, stock code: HAH) announced its Q1/2024 financial statement, showing a revenue increase of 7% year-over-year to VND 704 billion (USD 30.3 million). However, the rise in cost of goods sold by 29% led to a 45% decrease in gross profit to VND 106 billion (USD 4.6 million), with profit margin narrowing from 29% to 15%.

Financial revenue doubled to VND 10 billion (USD 430,000), while financial expenses fell 11% to VND 19 billion compared to the same period last year. Combined with management expenses of VND 34 billion (USD 1.5 million), HAI An reported a 63% decline in after-tax profit to VND 47 billion (USD 2 million), with net income dropping by 50% to VND 59 billion.

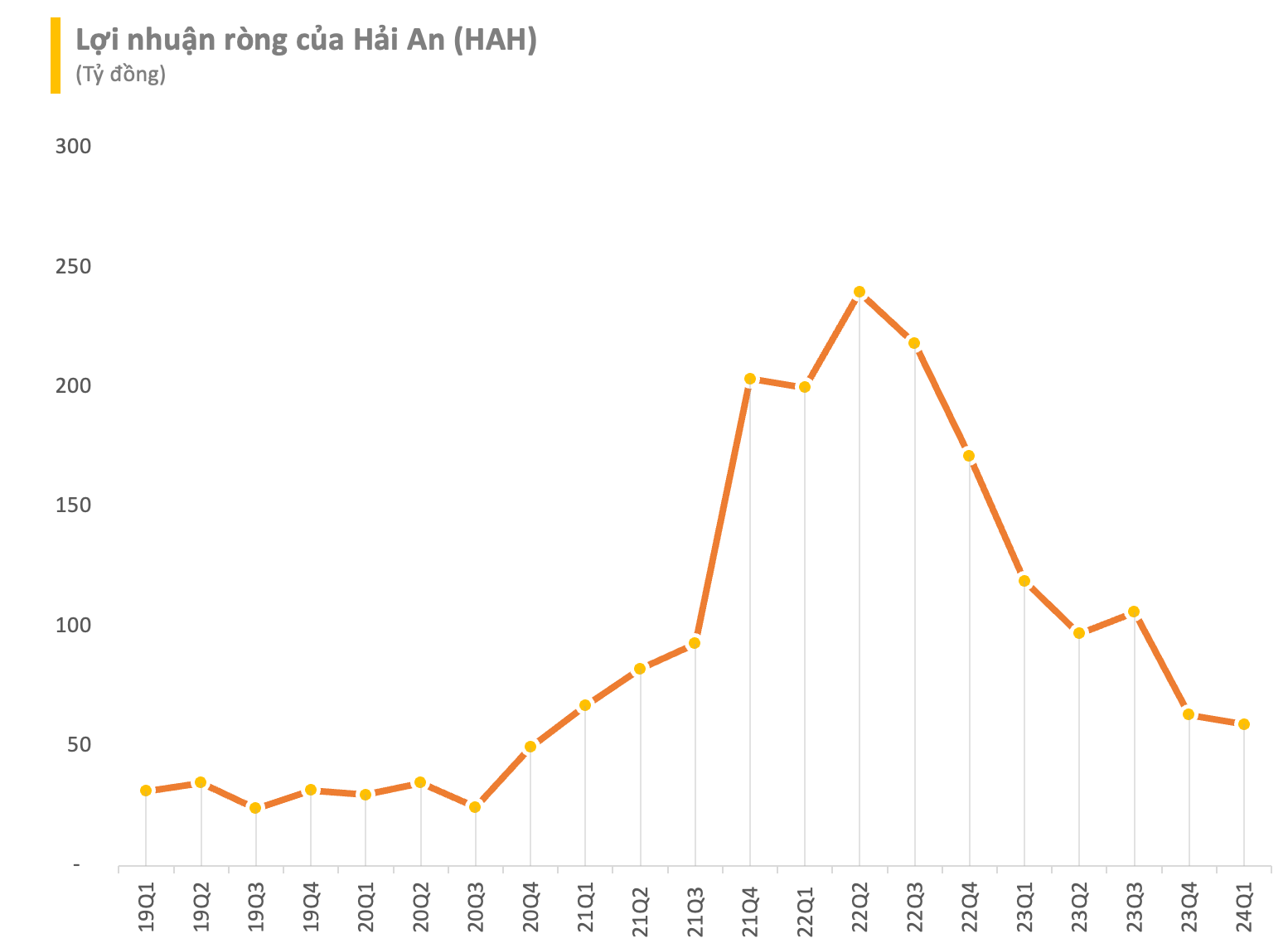

According to the company’s explanation, the decrease in net income was driven by reduced transportation activities. While transportation volume grew due to an additional route, falling sea freight rates and lease rates resulted in a sharp decline in vessel operating profits. The performance of subsidiaries and associates also negatively impacted earnings.

In 2024, HAI An aims for consolidated revenue of VND 3,502 billion (USD 151.3 million) and after-tax profit for the controlling shareholders of VND 340 billion (USD 14.7 million), representing increases of 34% and a decrease of 11% respectively compared to last year. Thus, with 3 months completed, the company has achieved 20% of its revenue target and 16% of its annual net income goal.

HAI An currently owns and operates one of the largest and youngest container fleets in Vietnam, comprising 12 vessels with capacities ranging from 787 to 1,800 TEU, and a total capacity of approximately 18,000 TEU. The average age of the fleet is 15 years.

As of March 31, 2024, HAH’s total assets amounted to VND 5,780 billion (USD 249 million), an 8% increase since the beginning of the year. Of this amount, VND 632 billion (USD 27.3 million) was held in cash and cash equivalents, with an additional VND 64 billion (USD 2.8 million) in bank deposits under 12 months. HAI An has also invested in two associates: Hai An Logistics (original cost of VND 1.5 billion, current value of VND 34 billion) and An Bien Marine Transportation (original cost of VND 85 billion, current value of VND 104 billion).

Total liabilities at the end of the first quarter increased by VND 328 billion (USD 14.2 million) to VND 2,516 billion (USD 108.9 million), including total borrowings of nearly VND 1,270 billion (USD 54.8 million), of which more than VND 353 billion (USD 15.2 million) is short-term debt and VND 917 billion (USD 39.6 million) is long-term debt. Equity reached VND 3,264 billion (USD 140.9 million), with over VND 812 billion (USD 35 million) in retained earnings.