Vn-Index ended the 5-day holiday period with significant differentiation beginning to take place between industry groups. The index has been struggling all morning, with real estate currently the group with the most negative impact on the market.

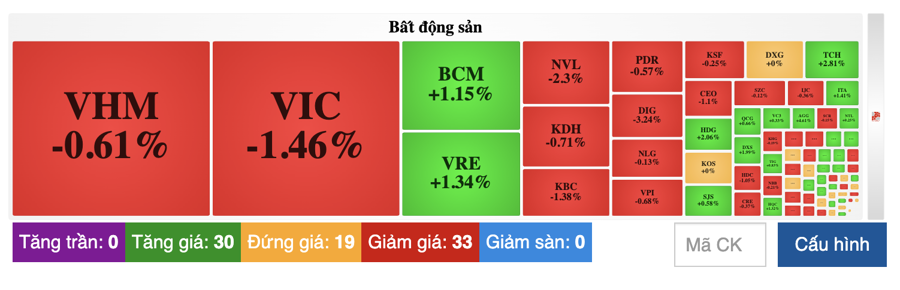

This group’s stocks fell by 0.51%, with at least 33 stocks falling sharply, such as VIC and VHM, which fell by 1.46% and 0.61%, respectively; NVL fell by 2.3%; DIG fell by 3.24%. KDH, KBC, NLG, PDR… also made adjustments right from the beginning of the session.

The selling pressure of this group reflects the disappointing business results in the first quarter. Accordingly, according to Fiintrade’s update, as of April 28, 2024, 787/1641 listed companies representing 83.8% of the capitalization on the three exchanges had published their financial reports for the first quarter of 2024, including many leading enterprises.

With Real estate, the after-tax profit of 60/130 enterprises representing 74.4% of the total industry capitalization) decreased sharply by 82% due to Vinhomes (VHM) no longer recording wholesale project sales revenue as in the same period. Excluding VHM, the profit of the remaining 59 real estate enterprises decreased by 15.1% due to the impact of the residential real estate group (NVL, KDH, DIG, NLG).

Vinhomes (VHM) recorded revenue of VND 8,211.2 billion and profit before tax of VND 884.7 billion, down 72% and 91%, respectively, compared to the first quarter of 2023. Some major corporations such as Novaland (NVL), DIC Corp (DIG), LDG (LDG), Nam Long (NLG) or Kinh Bac (KBC)… all reported significant losses in the first quarter of 2024.

According to VDSC’s assessment, previously, the market paid a higher price for the potential recovery of businesses. The fact that enterprises lack products for sale in the period 2022-2023 will make it difficult for enterprises to record strong profit growth in 2024.

VDSC expects that from 2025, when the Law on Real Estate Business and the Law on Housing are amended, along with the decree on the development and management of Social Housing being issued, it will solve the bottlenecks related to Social Housing projects. Accordingly, it is expected that Tier II provinces and cities, where large industrial clusters are concentrated, will be the areas witnessing the excitement in this segment.

Real estate stocks are currently trading at P/B of 1.5-2, which is relatively reasonable in terms of current assets. However, some medium-sized real estate companies with large land funds in Tier II cities are currently trading at P/B of 0.9 – 1.2x, lower than the industry average (1.5x), which are also potential businesses that can be considered for the long term.

The supply and absorption of the market in 2024 are expected to improve compared to 2023, when investors and developers are more confident about the market recovery; interest rates remain low and infrastructure projects are under construction and completion stages.

The apartment product continued to recover in terms of sales in 2024, but there will be differentiation between segments: With the mid-end segment, the projects are mostly from reputable domestic investors and located in suburban areas; With the high-end segment, the projects are mostly from foreign investors and located in the central business district (CBD).

For low-rise projects/urban areas, the system of ring roads/highways connecting to the CBD is a factor that investors are interested in. It is expected that the period after the second half of 2024 will be the right time for companies to boost sales, when the infrastructure system (especially the ring road system) starts to enter the peak construction phase and secondary prices recover more clearly.

Meanwhile, according to KBSV’s assessment, the recovery rate of the real estate group will be relatively slow due to difficulties that have not really been resolved: Investors are also facing more difficulties in accessing capital sources when credit to the real estate sector is restricted by banks and bond issuance activities are closely monitored, and legal bottlenecks affect the progress of enterprises’ project implementation.

Many real estate stocks are currently trading at 2024fw P/B lower than the average P/B over the past 5 years, so KBSV believes that investors can consider real estate industry stocks when share prices are adjusted and choose businesses with good prospects with large clean land funds with full legal documents, projects that are being implemented and sold, and safe financial structures. The notable investment opportunities are VHM, KDH, NLG, DXG stocks.