The Line Between Corrections and “Escapes”

Up until the end of April 2024, the Vietnamese stock market continued a period of upward movement that began in 2023. The index has grown by 7.04% after an increase of 12.2% in 2023.

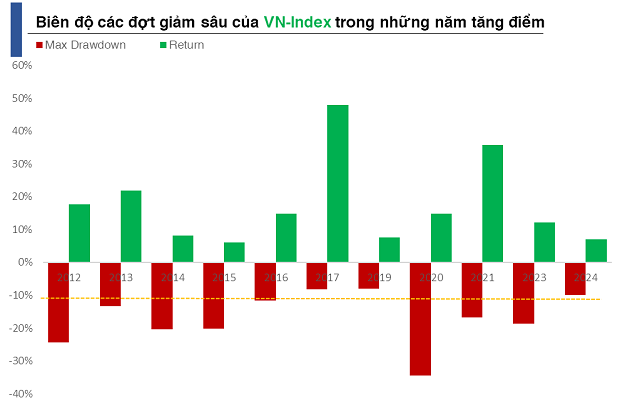

However, even during years in which the market was rising, periods of correction could still appear, or sometimes there were years in which there were drops of more than 20%. According to statistics, from 2012 to the present, the market has grown 11 times, but corrections (drops of between 10% to 20%) or bear markets (drops of more than 20%) have occurred a total of 8 times.

In April 2024, a downturn brought the market close to the threshold of correction, as evidenced by the maximum drawdown (MDD) from the year’s peak measured as 9.89%.

With a few recovery sessions immediately before the holiday break, the VN-Index was able to regain the 1200 point mark, and also avoid a correction point.

Of course, investors’ apprehension has not entirely subsided, which means that the possibility of a correction has not been eliminated entirely. Nonetheless, there’s still the possibility that the market might establish a short-term low and potentially avoid falling by more than 10% from its zenith for the third time.

Most recently, the market witnessed a Maximum Drawdown (MDD) under 10% in 2017 and 2019, with declines of 8.11% and 7.99%, respectively. 2017 was a year of exceptional growth for the VN-Index, reaching 48%.

As of the end of April 2024, the performance of the VN-Index was not only nowhere near as good as 2017, but it had also failed to surpass the results achieved in 2019.

In order to avoid a correction, the index will need to bolster its gains from the past four months, which will require the major stocks in sectors such as banking to perform.

Banking remains the backbone of the market

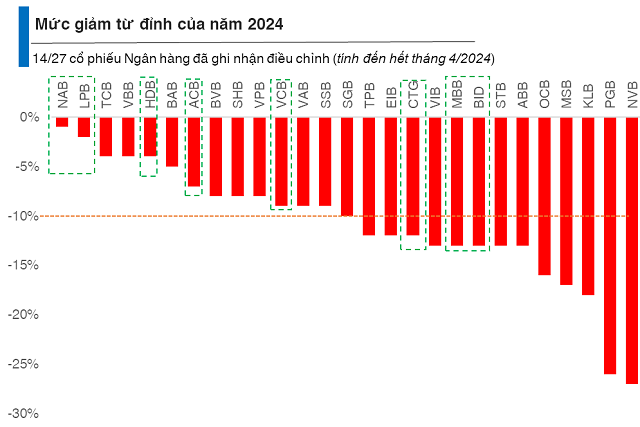

According to statistics from all three exchanges, 14 out of 27 bank stocks have experienced a drop of more than 10% compared to their peak in 2024. Despite this, there are still 13 stocks that have declined by less than 10%.

When we look at the top 10 stocks with the highest liquidity (based on the average of the last 20 sessions), the ratio of stocks that haven’t been adjusted to those that have been remains balanced, with 5 out of 5.

Moving on to an in-depth analysis of bank stocks, it’s also worth taking a closer look at the “strongest” performers – those that had set price records in early 2024. Specifically, there were 7 stocks that set all-time highs, and one stock, CTG, came close to doing the same.

The price of CTG shares reached a high of 37,150 VND per share in 2024, just 10 VND short of its all-time high. (CTG weekly chart)

|

Out of the 8 strongest stocks in the banking sector, only 3 have suffered a correction: CTG (-12%), MBB (-13%), and BID (-13%).

Conversely, there are 5 stocks that haven’t yet experienced a correction: NAB (-1%), LPB (-2%), HDB (-4%), ACB (-7%), and VCB (-9%) – with LPB having set a new all-time high in the trading session on April 25 (the trading session just before the holiday break).

For the market to regain some confidence during the holiday break, the best performers in the banking sector will need to stay resilient, while those that have already corrected will need to quickly reduce their MDDs.

According to Nguyen The Minh, Director of Personal Customer Analysis at Yuanta Vietnam Securities Company, the market has shown signs of improvement as the VN-Index returned to the 1170 point area, where the medium-term MA200 trendline sits.

Although he didn’t make any predictions about how low the index might go, Minh is hopeful that the market may have bottomed out in the last weeks of April. “When everyone’s aware of the bad news, it’s no longer as bad,” said Minh.

In addition, the market has become more appealing because of the fact that banking stocks have already fallen before the market and are now at a relatively balanced PB valuation. According to Minh, the banking and securities sectors will be essential participants in the market’s recuperação. Additionally, investors might consider the oil, technology, and real estate sectors.