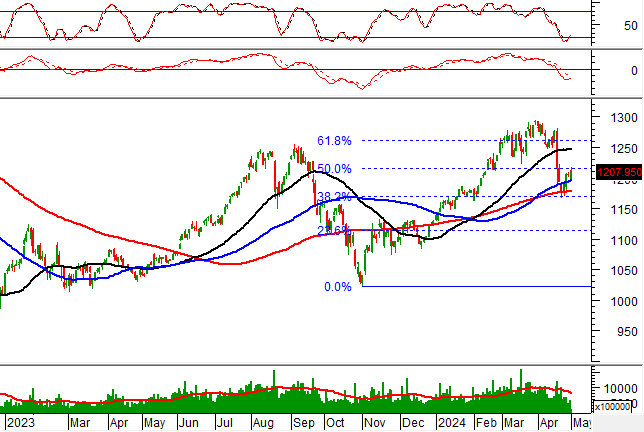

Technical Signals of VN-Index

During the morning trading session of May 2, 2024, the VN-Index slipped marginally, accompanied by a modest increase in liquidity, indicating ongoing uncertainty among investors.

Meanwhile, the index is testing the 50% Fibonacci Projection level (corresponding to the 1,200-1,220 point range) as the MACD indicator narrows its distance from the Signal line. A buy signal from the indicator, combined with the VN-Index breaking above this level in upcoming sessions, would paint a more optimistic outlook.

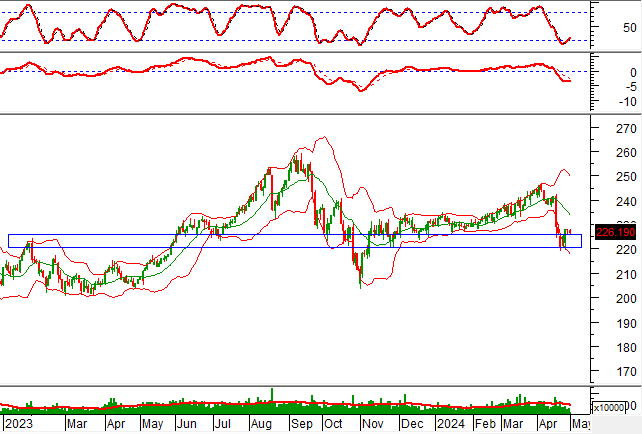

Technical Signals of HNX-Index

During the trading session on May 2, 2024, the HNX-Index continued to decline and remained below the Middle line of Bollinger Bands. Volume has consistently stayed below the 20-session average in recent trading sessions, signaling investor caution.

However, the MACD indicator is narrowing its gap with the Signal line. A renewed buy signal in upcoming sessions would brighten the short-term outlook.

ACV – Airports Corporation of Vietnam JSC

During the morning session of May 2, 2024, ACV surged, forming a long-bodied candlestick pattern with significant volume exceeding the 20-session average, reflecting positive sentiment among investors.

Moreover, the Stochastic Oscillator has triggered a buy signal after displaying bullish divergence in oversold territory, further strengthening the case for a short-term recovery.

SAB – Saigon Beer – Alcohol – Beverage Corporation

During the morning session of May 2, 2024, SAB rallied, forming a White Marubozu candlestick pattern with noticeably increased liquidity that surpassed the 20-session average, indicating upbeat investor sentiment.

Both the MACD and Stochastic Oscillator indicators continue their upward trajectory after presenting buy signals. This bullish technical setup comes as SAB share prices rebounded after testing previous lows in March 2020 and November 2023 (corresponding to the 50,300-54,700 range), suggesting a high probability that the short-term recovery will persist in upcoming sessions.

Technical Analysis Department, Vietstock Consulting