As of today, Yuanta Securities statistics indicate that 800 out of 1,649 businesses have announced their Q1 business results, with 645 reporting profits and 155 reporting losses.

The industrial goods and services group recorded the highest number of profitable businesses at 100; followed by the construction materials group with 85 profitable businesses; the third group was electricity, water, gasoline, oil, and gas with 81 profitable businesses; followed by the food and beverage group with 52 profitable businesses; real estate with 47 profitable businesses; and basic resources with 49 profitable businesses.

The group with the most losses was the construction materials group, with 45 businesses reporting losses in Q1; followed by food and beverage with 22 businesses reporting losses; and real estate with 17 businesses reporting losses.

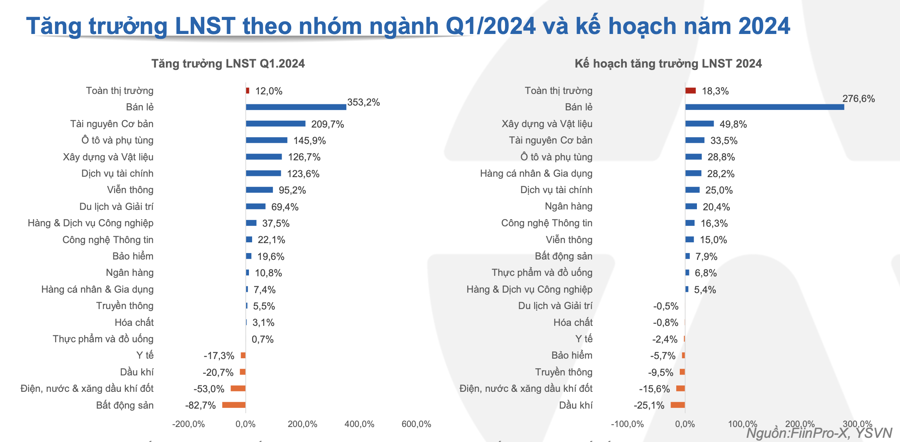

Overall market profit growth increased by 12% compared to the same period last year, with the financial group increasing by 13.7% and the non-financial group increasing by 9.5%. This figure is based on 800 businesses accounting for 87% of the market capitalization that have announced their Q1/2024 business results and 621 businesses accounting for 37% of the market capitalization that have announced their 2024 business plans.

According to the plan for the year 2024, overall market profit growth is estimated to be 18% compared to the same period last year; with the financial group increasing by 20% and the non-financial group increasing by 17%.

Overall market revenue increased by 3.4% in the first quarter. Tourism and entertainment grew the strongest at 35.2%; financial services came in second at 22.2%; personal and household goods came in third at 19.7%; information technology at 17.3%; retail at 16.4%; banking at 8.4%; construction and materials at 5.2%…

On the other hand, real estate was the group that declined the most at 49.3%; followed by oil and gas at 6.9%; electricity, water, gasoline, oil, and gas at 6.5%; and chemicals at 2.3%.

In terms of profit, retail was the group with the strongest growth at 353%; basic resources increased by 209%; automobiles and spare parts increased by 145.9%; construction and materials increased by 126.7%; financial services increased by 123.6%; telecommunications increased by 95%; tourism and entertainment increased by 69.4%; while insurance increased by 19.6%; banking increased by 10.8%. On the other hand, real estate decreased by 82.7% while its profit target for the year increased by nearly 8%; electricity, water, gasoline, oil, and gas decreased by 53%; oil and gas decreased by 20.7%; healthcare decreased by 17.3%.

According to Yuanta’s assessment, Q1/2024 profits have slowed down but there is still hope for a recovery in the whole of 2024.

Previously, FiinTrade’s statistics also showed that the two “pillar” industries of the market, Banking and Real Estate, had poor business results: With Banking, the after-tax profit of 27/27 banks increased by 9.6%, far below the expected growth rate for the whole of 2024 (+19%) and the expectations of analysts for the first quarter of 12-15%.

With Real Estate, the after-tax profit of 60/130 businesses representing 74.4% of the industry’s total market capitalization) decreased by 82% because Vinhomes (VHM) no longer recorded income from project wholesaling as in the same period last year. Excluding VHM, the profit of the remaining 59 real estate businesses decreased by 15.1% due to the impact of the residential real estate group (NVL, KDH, DIG, NLG). Meanwhile, industrial real estate maintained a growth of 26.5% over the same period thanks to BCM, SZC, and SZB.