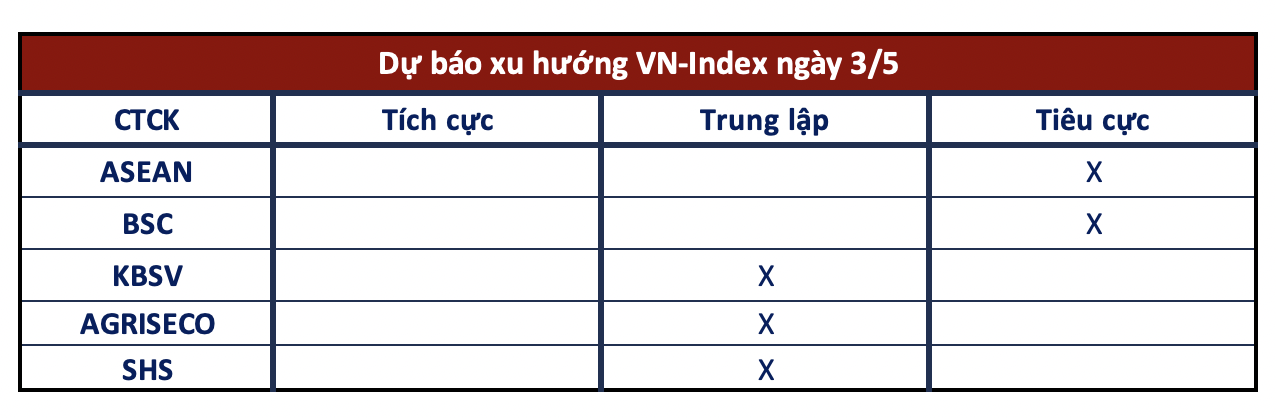

VN-Index swung wildly in the morning session and gradually recovered in the afternoon with small-amplitude incremental gains. The index closed on May 2 with a slight gain of 6.84 points at 1,216 points. The money flow remained cautious after the long holiday as the matched order value on HOSE only reached over VND 12,500 billion.

On market outlook in the coming sessions, brokerage firms believe that the selling pressure is lurking in the 1,220 resistance zone, so the risk of a market reversal remains imminent. Therefore, investors need to be cautious in the coming sessions.

Selling pressure is present

ASEAN Securities

VN-Index recorded a modest gain but the overall fluctuation was insignificant. The momentum indicators such as MFI and RSI are gradually approaching the neutral level of 50 points, which is often a signal that recovery phases are ending. Coupled with the fact that liquidity is lower than the 20-session average, it shows that the selling pressure in the 1,220-1,230 resistance zone is relatively strong. Therefore, the market is likely to continue fluctuating within the 1,170-1,220 point range in the coming trading sessions. Investors should avoid chasing stocks during this period and wait for the selling momentum to return to the 1,170-1,180 support zones to buy in line with the T+ trading strategy.

BSC Securities

At present, VN-Index’s recovery momentum is still fragile as liquidity is very low and the index is facing the resistance level of 1,220 – where there was once a significant sell-off. Investors should trade with caution.

Investors should be cautious

KBSV Securities

The index showed a relatively strong recovery during the session, forming a candlestick with a long lower shadow and closing at the previous session’s high, indicating the dominance of demand and the stronger sentiment of the holders. Although there is an opportunity for an extended recovery, approaching the resistance zone leaves VN-Index exposed, and the risk of a reversal around 1,220 (+-5) should still be noted. Investors are advised to place sell orders to reduce the weight of their portfolio when the index rises to the aforementioned resistance zone.

Agiseco Securities

Agriseco Research believes that the market will continue to move sideways up with alternating rising and falling sessions around the 1,180-1,230 point range. Investors should buy more stocks during corrections to the lower boundary and vice versa, reduce weight during strong recoveries to near the upper boundary. Prioritize trading with stocks already in the portfolio and stocks in the VN30 group.

SHS Securities

In the short term, the market is developing positively, having completed a small w pattern at the 1,170-point level and recovering after a significant decline. The index’s immediate resistance is the 1,225-point zone and further up at 1,250 points, corresponding to the upper edge of the medium-term accumulation zone.