Crude oil down 1%

Oil prices closed down 1% and recorded a weekly decline as markets remained cautious about China’s demand even as OPEC+ continued to cut production.

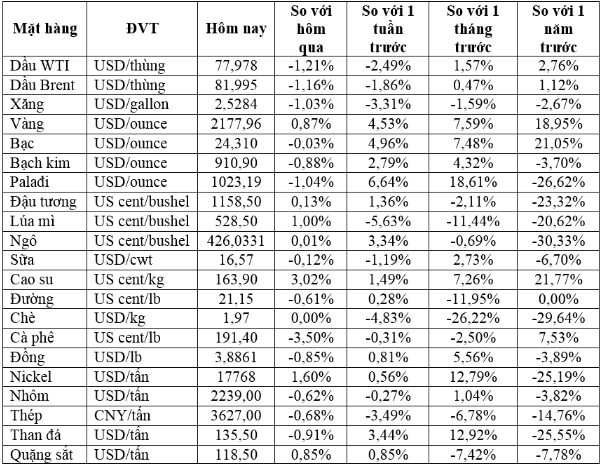

On March 8, Brent crude fell 88 US cents or 1.1% to $82.08 a barrel. WTI crude fell $0.92 or 1.2% to $78.01 a barrel. Both types of oil declined during the week, with Brent crude falling 1.8% and WTI crude falling 2.5%.

China has set a target of around 5% economic growth by 2024, which many analysts believe is ambitious unless more stimulus measures are added. China’s crude oil imports in the first two months of the year increased compared to the same period in 2023 but were still lower than previous months, indicating a downward trend in the country’s imports.

OPEC+ members have agreed to extend voluntary production cuts of 2.2 million barrels per day in the second quarter, which further supports the market amid concerns about global growth and increasing production outside the organization.

However, OPEC+ crude production increased by 212,000 barrels per day in the first two months of the year, according to Rystad Energy.

Meanwhile, US energy companies cut the number of oil rigs for the third week to 504 rigs, the lowest since February 23, according to energy services company Baker Hughes.

US nonfarm payrolls beat expectations, but the unemployment rate increased and wage growth slowed, indicating that the US economy may be slowing down, prompting the Federal Reserve to consider cutting interest rates in June.

Lower interest rates could boost oil demand by stimulating the economy. The European Central Bank may begin cutting interest rates between April and June.

Gold gains

Gold prices reached a new record high as data showed an increase in US unemployment rate, boosting expectations that the US Federal Reserve may soon begin cutting interest rates.

Spot gold rose 0.5% to $2,170.55 per ounce. COMEX gold for April delivery closed up 0.9% at $2,185.5 per ounce.

Gold has recorded its biggest percentage gain since mid-October 2023.

Gold prices reached $2,185.19 per ounce after a report showed an increase in US unemployment rate and moderate wage growth despite accelerating job growth in February.

US dollar declines

The US dollar retreated from a five-week high as speculative investors took profits after data showed a pickup in US job growth in February.

Three-month copper on the London Metal Exchange fell 0.5% to $8,595.5 per tonne after touching $8,689, the highest since January 31.

US employment data was mixed, with nonfarm payrolls in the agriculture sector increasing more than expected in February, but the highest unemployment rate in two years.

At its peak on March 8, LME copper had risen 7% since hitting a one-month low of $8,127 per tonne.

Contrary to copper, global stocks hit a record high as the Federal Reserve is expected to begin cutting interest rates later this year.

Iron ore falls due to low demand, high inventories

Iron ore prices fell as metal production was lower than expected and inventories at Chinese ports continued to rise, weighing on market sentiment.

Iron ore futures on the Dalian Commodity Exchange for May delivery closed down 1.13% at CNY 877 ($122) per tonne, down 1.6% for the week.

Iron ore for April delivery on the Singapore Exchange fell 1.56% to $114.9 per tonne, although this contract was up 1.5% for the week.

Average daily hot metal production fell for the third consecutive session, down 0.3% to 2.22 million tonnes as of March 8, compared to the previous week, while stocks at major ports surveyed increased 2% for the week to 141.51 million tonnes, the highest since February 2023, according to data from consulting firm Mysteel.

Traders expected hot metal production to increase this week, but lower-than-expected quantities disappointed them.

Concerns about a decline in iron ore demand in the coming weeks also weighed on market sentiment.

Some steel mills in southwest Vy Nam have planned to cut steel production in March to limit losses, reducing construction steel production by about 500,000 tonnes.

Steel on the Shanghai Futures Exchange declined sharply. Rebar decreased 0.62%, hot-rolled coil decreased 0.44%, and steel wire decreased 0.6%. Stainless steel increased 1.02%.

Japan rubber at 7-year high

Japanese rubber prices reached a 7-year high as concerns about prolonged weather conditions, optimism about strong Chinese car data, and rising oil prices supported a 4% increase in this contract during the week.

August rubber futures on the Osaka Exchange closed up 13 JPY or 4.33% at 313 JPY ($2.12) per kg, the highest closing price since February 17, 2017. This contract increased for the fourth consecutive session and ended the week up 4.06%.

In Shanghai, rubber for May delivery increased by 445 CNY to 14,250 CNY ($1,982.06) per tonne.

The Thai Meteorological Department issued a warning about severe weather conditions in upstream areas of Thailand from March 8 to 10, which could damage the crop season.

Coffee falls

The May robusta coffee contract closed down 2.5% at $3,297 per tonne, this market has fallen from the $3,460 level in the previous session, the highest since the contract began trading in January 2008.

Strong demand and dwindling robusta stocks in Vietnam continue to support prices.

The May arabica coffee contract fell 3.6% to $1.852 per lb, although this contract was up about 1% for the week.

Sugar declines

Raw sugar futures for May closed down 0.13 US cent or 0.6% at 21.15 US cents per lb. This contract has increased by 0.35 during the week.

Industry sources said the market was supported by the potential for a smaller harvest in Central South Brazil in the 2024/25 season.

However, improving production prospects in Thailand have limited the decline.

White sugar for May decreased by 1.1% to $597.5 per tonne.

Corn futures rise due to short covering, soybeans hit two-week high

Corn prices on the Chicago Board of Trade closed higher due to short covering after news that China canceled additional purchases of US corn pushed this contract to its lowest level in 3.5 years.

CBOT soft red winter wheat for May delivery closed up 9-1/4 US cents at $5.37-3/4 per bushel, rebounding after falling to $5.26, the lowest since August 2020.

Soybeans on the Chicago Board of Trade touched their highest level in 2.5 weeks, as traders bought to cover previous short positions before the week’s end after a monthly crop report from the US Department of Agriculture showed unstable conditions.

CBOT soybeans for May delivery closed up 17-3/4 US cents at $11.84 per bushel after rising to $11.85, the highest since February 20. This contract increased by 32-3/4 US cents or 2.8% for the week, marking its second consecutive weekly gain.