In its recent Catching the Money Flow Program organized by FiinGroup in collaboration with FIDT, Ms. Do Hong Van, Head of FiinGroup’s Analysis Team, stated that market valuations are nearing their historical peak.

An update on FiinGroup’s Q1 business results and 2024 business plan revealed that, while quarterly profits continue to grow year-over-year, the growth rate shows signs of slowing down. Market-wide profits based on 541/1641 corporates that have released their financial statements show a 23% growth, with the non-financial group growing by 22.3% and the financial group by 23.3%.

Meanwhile, industries with exceptional profit growth and a positive outlook for 2024 include Steel, up 666.1%; Oil & Gas Extraction, up 320.2%; Textiles, up 218%; Securities, up 156%; Fertilizer, up 55.5%; Rubber, up 50%; Water Transport, up 31%; and Insurance, up 27%. In contrast, Seafood has declined by 57.6%; Electricity, by 36.1%; Pharmaceuticals, by 22.2%; Chemicals, by 14.7%; and Water, by 3.1%.

FiinTrade’s latest figures as of April 28 show that the aggregate net income of 787 listed companies grew by 14.8% year-over-year, primarily driven by the non-financial group’s 19.3% growth, while the financial group grew at a lower rate of 12.4%. Overall profit growth slowed significantly compared to the growth rate in Q4 2023 (+48.6%).

According to FiinGroup’s analysts, market valuations are approaching their historical peak, with P/E at 14.1; the non-financial group’s valuation at 22.9, exceeding its historical peak; and the banking group’s P/E still at a low level of 9.8; while in the non-financial group, real estate has a P/E of 20.1.

Industries currently trading at low valuations include Banking with a P/E of 9.8; Real Estate, 14.6; Beer, 16.9; and Oil & Gas Extraction, 20.6. Conversely, groups with high valuations are Steel, 38.2; Rubber, 35.7; and Construction, 45.4.

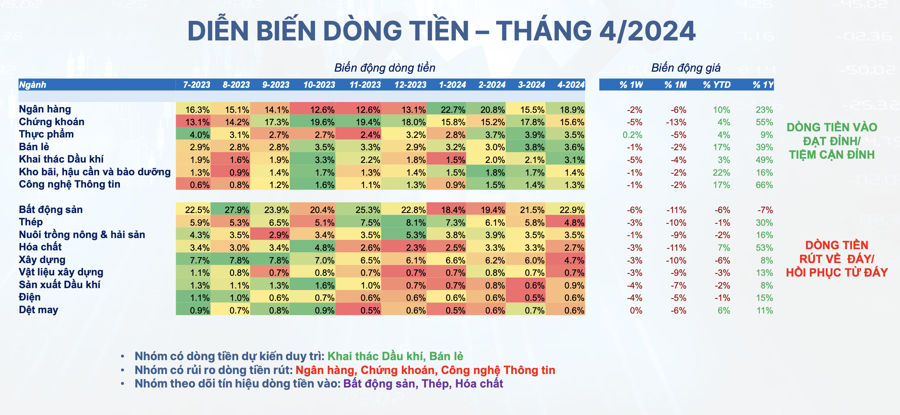

Regarding cash flow trends, Ms. Do Hong Van predicts that groups with expected stable cash flow include Oil & Gas Extraction and Retail; groups with cash flow withdrawal risks include Banking, Securities, and Information Technology; and groups to watch for cash flow inflows include Real Estate, Steel, and Chemicals.

Meanwhile, commenting on market valuations, Mr. Huynh Hoang Phuong, Director of Research and Investment Analysis at FIDT JSC, believes that market valuations based on P/E and P/B in the VN-Index range of 1,160-1,180 are relatively attractive for this year. With the expectation of approximately 18% growth in profits for listed companies in 2024, a forward P/E of 11.8 presents an attractive entry point for new positions throughout the year.

The key fundamental factors impacting the market in the medium to long term are economic growth, profit growth of listed companies, interest rates, and the potential upgrade in market status, which continue to provide positive support for the market. Short-term risks from early April will gradually ease in May, but factors such as exchange rates require attention.

After the panic subsides, the market will likely experience certain recoveries, and fundamentally sound stocks with strong growth in 2024 or with unique stories will continue to recover and grow, with less dependence on the overall index.

For the Oil & Gas group, the outlook for Lot B remains positive and unchanged. The general market correction has brought stock prices in this sector to attractive levels, such as PVS, PVD, and PVD.