**Vietnam Airlines and Other Companies Delay Annual General Meetings**

By regulation, April 30, 2024, is the deadline for holding this year’s Annual General Meeting of Shareholders (AGM). However, for various reasons, several companies have announced extensions to the AGM schedule, despite the risk of penalties from the stock exchange.

Specifically, Vietnam Airlines Corporation – Joint Stock Company (Vietnam Airlines, code HVN, HoSE floor) has published a resolution regarding the schedule for holding the 2024 Annual General Meeting of Shareholders.

Accordingly, the last day to register for the meeting is May 23rd, and the tentative date for the meeting is June 21st. The airline has not yet released specific documents in preparation for the meeting.

In 2023, Vietnam Airlines postponed the date for the Annual General Meeting of Shareholders four times. After multiple changes, the meeting was held in December 2023, just before the end of the financial year.

Recently, the national airline of Vietnam also submitted a document explaining measures to address the issue of controlled stocks. Vietnam Airlines stated that it had submitted a restructuring plan for the 2024-2025 period, which had been approved by shareholders and competent authorities.

In the plan, the corporation will implement synchronous solutions to rectify the situation of consolidated losses and negative consolidated equity, such as implementing comprehensive measures to increase adaptability, improve business operations, restructure assets and the financial investment portfolio to increase revenue and cash flow.

In the 2023 audited consolidated financial statements, Vietnam Airlines recorded a loss after tax of VND 5,631 billion, a 50% decrease compared to the loss in 2022, mainly due to a decrease in the loss after tax of the parent company and Pacific Airlines.

Next, PetroVietnam Ca Mau Fertilizer Joint Stock Company (DCM – HoSE floor) has just announced the document for the 2024 Annual General Meeting of Shareholders, scheduled to be held on June 11th.

According to the published document, in 2024, Ca Mau Fertilizer sets a target of VND 11,878.2 billion in consolidated total revenue, and profit before and after tax of VND 841.4 billion and VND 794.8 billion, respectively. Regarding the financial targets of the parent company, the plan for total revenue is VND 11,080.8 billion, and profit before and after tax is VND 839.3 billion and VND 793.6 billion, respectively.

DCM’s business plan for 2024 represents a 9.82% decrease in revenue and a 28.4% decrease in profit compared to the results achieved in 2023.

At the AGM this year, DCM will also present a plan for profit distribution, fund allocation, and dividend payment. Accordingly, with the retained earnings after tax as of the end of 2023 amounting to more than VND 2,044 billion, DCM plans to pay a dividend of 20%, equivalent to a total payout of VND 1,058.8 billion.

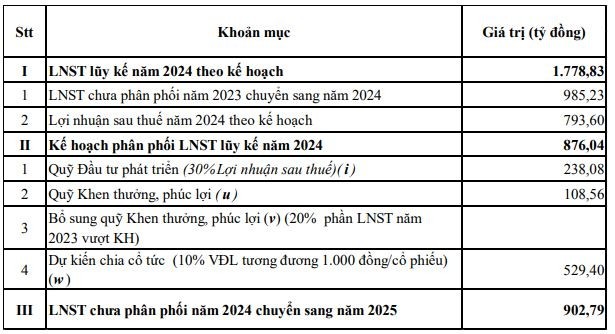

DCM’s profit distribution plan for 2024

Meanwhile, Ca Mau Fertilizer plans to distribute after-tax profit in 2024 with an expected dividend yield of 10%. The specific implementation will depend on the company’s business performance and will be approved at the 2025 Annual General Meeting of Shareholders.

At the end of April, Sao Thai Duong Investment Joint Stock Company (code SJF, HoSE floor) announced a resolution to extend the schedule for organizing the 2024 Annual General Meeting of Shareholders to no later than June 30, 2024. This is because the preparation of documents for the shareholders’ meeting has not been completed. The meeting is scheduled to take place at: Floor 8, Simco Song Da Building, New Van Phuc Urban Township, Van Phuc Ward, Ha Dong, Hanoi.

SJF shares have been suspended from trading since November 13, 2023. The reason is that the company continued to violate regulations on information disclosure after being put on the restricted trading list.

Previously, SJF was put on the restricted trading list from October 16th due to a delay in submitting its 2023 half-year reviewed financial statements for more than 45 days beyond the prescribed deadline.

Similarly, Thu Duc House Development Joint Stock Company (Thuduc House, code TDH, HoSE floor) has also approved a policy to extend the schedule for organizing the 2024 Annual General Meeting of Shareholders to no later than June 30, 2024. The reason is to allow sufficient time to prepare for the meeting.

Recently, Thuduc House announced that it had received Notice No. 7035/TB-CTTPHCM dated April 22, 2024, from the Ho Chi Minh City Tax Department regarding the suspension of invoice use. The reason for the suspension is that Thuduc House has tax arrears for more than 90 days from the prescribed payment deadline. The amount forcibly collected is VND 91.77 billion.