Not only did the Oracle of Omaha share the fundamentals behind the companies in Berkshire Hathaway’s portfolio this year, but he also shared how to live a happy life.

CNBC found two pieces of his investment and life advice particularly compelling on May 4.

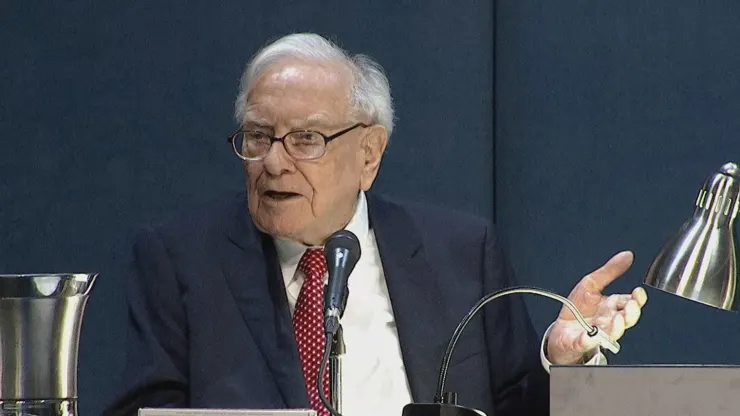

Warren Buffett

|

“We’ve never worried about missing anything we didn’t understand.”

During this year’s annual meeting, a shareholder asked Buffett about one of the most fundamental decisions for any investor: When to buy/sell an investment.

In response, Buffett revealed the decision-making process he and his right-hand man, Charlie Munger, go through for every investment.

“Charlie and I can make decisions very quickly, but they’re the result of years of thinking about the parameters that will enable you to make a quick decision when the opportunities arise,” he said.

He wouldn’t buy heavily into Apple until he felt he had a solid understanding of consumer behavior. This is a lesson he learned from investing in a number of other consumer businesses.

Importantly, Buffett doesn’t buy into any investment based on a feeling or instinct. Only after determining that the iPhone was “probably the best consumer product ever,” did he buy Apple stock.

Meanwhile, he never worries about missing out on an investment if it’s outside his circle of competence. “Charlie and I have missed plenty… but we have never worried about missing anything that we didn’t understand,” the investing legend shared.

Write your own eulogy

A common question shareholders ask Buffett is about his thoughts on living a good life, and one shareholder posed a simple, yet profound question: “If you could share one piece of advice that you think everybody needs to hear, what would it be?”

Buffett repeated advice from Charlie Munger: Think about what you want your eulogy to say, and start living your life to earn it.

He notes that people living in modern America have it as good as anyone in the history of the world. “You are living in the best of all possible worlds. And you want to figure out the people you want to share it with, and the activities that work for you,” he said. “And if you’re as lucky as Charlie and I have been, you’ll find that you were interested in it at an early age. But if you don’t find it right away, you’ve got to keep looking for it.”

Buffett acknowledges that finding your passion may take some trial and error. “I’ve always said to college students, find something you love to do and then figure out how to get paid for it. You may find it early, and sometimes you find it through different experiences,” he said. “But don’t give up on it.”

No matter what setbacks you face, keep in mind how you want to be remembered, Buffett says. “There’s going to be some rough stuff along the way, but if you think about it that way, you’re more likely to get there,” he shared.