Prior to June 20, Phuoc Huu – Duen Hai 1 had 14 outstanding bond lots with a total value of VND 955 billion. All bonds were issued in 2021, including PHDCH2124003 (VND 15 billion), PHDCH2125004 (VND 40 billion), PHDCH2126005 (VND 50 billion), PHDCH2127006 (VND 60 billion), PHDCH2128007 (VND 60 billion), PHDCH2129008 (VND 60 billion), PHDCH2130009 (VND 70 billion), PHDCH2131010 (VND 70 billion), PHDCH2132011 (VND 70 billion), PHDCH2133012 (VND 80 billion), PHDCH2134013 (VND 80 billion), PHDCH2135014 (VND 100 billion), PHDCH2136015 (VND 100 billion), and PHDCH2137016 (VND 100 billion)

Only one lot of bonds is maturing in August 2024 (lot PHDCH2124003), valued at VND 15 billion. This lot was also repurchased by the company in mid-February 2024 for VND 15 billion. The other lots have a much longer maturity, with some maturing as far as 2036 (lot 6015) or 2033 (lot 3012). With this significant repayment of nearly VND 1 trillion, the company has officially cleared its bond debt.

Consecutive losses: Where did the money come from to repay the debt?

The company is the investor of the Phuoc Huu – Duen Hai 1 wind power plant project in Binh Thuan province. The project has a total investment of nearly VND 1.3 trillion and a capacity of 30 MW.

Phuoc Huu – Duen Hai 1 Wind Power Project

|

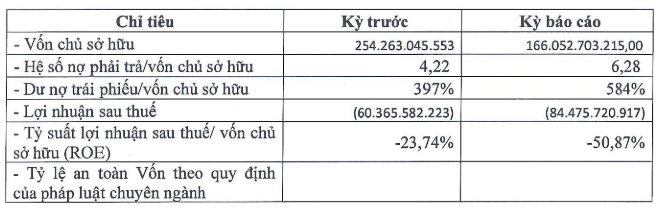

In terms of business performance, this wind power company has experienced consecutive losses for two years. According to periodic financial statements published on the Hanoi Stock Exchange, Phuoc Huu – Duen Hai 1 Wind Power ended 2023 with a loss of over VND 60 billion, compared to a loss of over VND 84 billion in the previous year.

|

Business Performance of Phuoc Huu – Duen Hai 1 in 2023

Source: HNX

|

Owner’s equity at the end of 2023 was recorded at VND 254 billion, an increase of 53% from the beginning of the year. The debt-to-equity ratio decreased from 6.28 times to 4.22 times, corresponding to a total debt of nearly VND 1.1 trillion at this time. Of this, bond debt at this time was VND 975 billion, equivalent to a bond debt-to-equity ratio of 3.97 times.

The question arises: With such business performance, where did the company get the money to repay its bond debt so aggressively?

It is known that Phuoc Huu – Duen Hai 1 Wind Power Company was initially established as a joint-stock company with a charter capital of VND 20 billion. The founding shareholders included Hung Tin Company Limited (Gia Lai) holding 95%; Mr. Le Trung Tin (residing in Hai Ba Trung District, Hanoi) holding 4%; and Nguyen Thai Ha (Ba Dinh, Hanoi) holding 1%. The legal representative was Mr. Le Trung Tin, who also served as the company’s CEO.

In October 2020, the company transitioned into a limited liability company. The shareholders became capital contributors. In December 2020, the charter capital increased to over VND 71 billion. The capital contribution ratio of the members remained unchanged.

In early 2021, the legal representative was changed to Mr. Tran Duc Viet, who also served as the CEO, and this role has been maintained until now. In September 2021, Hung Tin Company withdrew from the list of members. Hung Tin’s capital contribution was transferred to Mr. Trinh Van Quang (Thanh Hoa). In addition, a new member, Nguyen Thi Kieu Trang (Hoang Mai, Hanoi), holding 1% capital contribution, was added. Soon after, the company proceeded to increase its charter capital to VND 260 billion. Of this, Mr. Quang and Mr. Viet each held 45%, while Ms. Trang contributed 10%.

At the end of 2021, Ms. Kieu Trang left the list, and her capital contribution was transferred to Ms. Nguyen Phong Mai (Son Tay, Hanoi). The company further increased its charter capital to VND 310 billion, with the ratio of Mr. Quang and Mr. Viet decreasing to nearly 38% each, while Ms. Mai’s contribution increased to 24.5%.

In mid-2023, the company’s membership structure underwent a notable change with the participation of BVIM Growth Investment Fund, holding over 16.4% capital. Ms. Mai’s contribution decreased to 8%, while Mr. Quang and Mr. Viet maintained their 38% holdings.

In the latest development, in January 2024, Phuoc Huu – Duen Hai 1 had only two members, including BVIM (16.4%) and new member Thai Son – Long An JSC (83.6%). Ms. Phong Mai and Mr. Tran Duc Viet became the authorized representatives for Thai Son – Long An’s capital contribution.

Thus, it can be said that this wind power company has “changed owners” and come under the control of Thai Son – Long An JSC, a member of T&T Group, since the beginning of January 2024, not long before the company repurchased a portion of the PHDCH2124003 bond lot (with a repurchase value of VND 15 billion on February 15, 2024).

Thai Son – Long An is a well-known company in the real estate sector, established in 2009, and currently represented by Mr. Do Hoang Viet as its legal representative and CEO. The company is the investor of the T&T Millenial City project in Long An.

T&T Millenial City Project in Long An

|

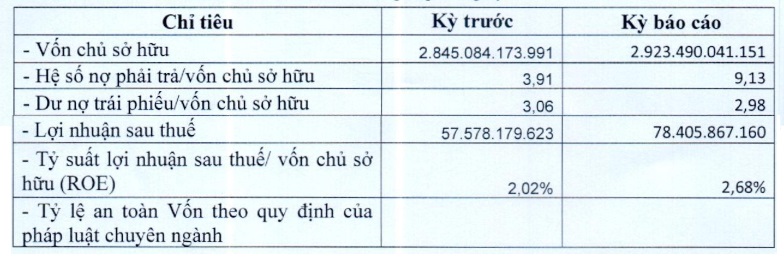

According to periodic financial reports on HNX, Thai Son – Long An recorded a profit of nearly VND 58 billion in 2023, a decrease of 27% compared to the previous year. Owner’s equity was reported at over VND 2.8 trillion, a decrease of 3% from the beginning of the year. ROE decreased from 2.68% to 2.02%.

|

Financial Indicators of Thai Son – Long An in 2023

Source: HNX

|

The debt-to-equity ratio in 2023 decreased significantly from 9.13 times to 3.91 times, corresponding to a total debt of over VND 11 trillion. Most of this was bond debt (approximately VND 8.7 trillion, or 78%.

Currently, Thai Son – Long An has two outstanding bond lots issued in 2021, namely TSLCH2129001 (VND 4.6 trillion) and TSLCH2129002 (VND 4.1 trillion). These are non-convertible bonds without warrants and are asset-backed. The purpose of the issuance is to invest in the project of a commercial, villa, and high-rise apartment complex in Long Hau, Can Giuoc, Long An province, with a scale of 267 hectares – the T&T Millenial City project.

The assets securing these two bond lots are the entire land use rights of the project land and the assets formed on the land in the future, excluding 877 houses in phase 1 with a total land area of over 11.3 hectares. The project, located in Long Hau, Can Giuoc, is valued at over VND 41 trillion, according to Appraisal Certificate No. 984/2021/CTTĐG-VFA VIETNAM dated November 5, 2021, issued by Vietnam Finance and Valuation Consulting Company Limited.

Chau An

Mango and Xemesis Sell 40% Stake in Beef Selling Avocado, Xemesis’s Brother Inherits as New Owner

The reason for the couple’s retreat to Bơ Bán Bò is revealed by Xoài Non, due to the unresolved issues of the shareholders.