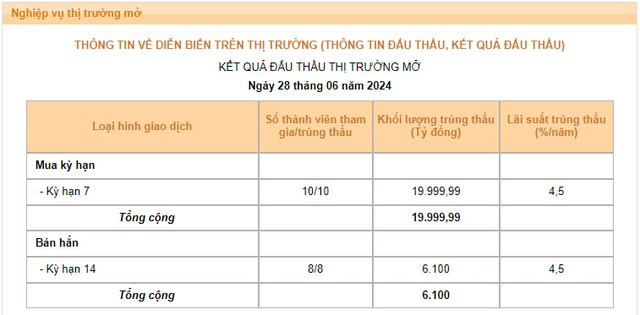

The State Bank of Vietnam (SBV) recorded an unusual spike in lending activities during the June 28 trading session, specifically in the lending of securities against collateral (OMO). Ten market members borrowed nearly VND 20,000 billion from the central bank for a term of 7 days at an interest rate of 4.5%/year.

In the bill market, the SBV continued to auction 14-day bills, with all 8 participating members winning the bid. The total volume amounted to VND 6,100 billion at an interest rate of 4.5%/year. Conversely, VND 16,250 billion in old bills matured.

Overall, the SBV injected a net amount of VND 30,150 billion into the banking system during last week’s trading session—the highest injection in over a month.

The surge in liquidity demand from the system occurred during the peak payment and balancing period at the end of the second quarter. Additionally, the acceleration in credit growth at the end of June may have also influenced the system’s liquidity.

While the SBV remains accommodative of the system’s needs, it has maintained the OMO rate at 4.5%/year, indicating its intention to keep interbank rates high.

Furthermore, the consistent auctioning of new bills with gradually increasing interest rates, now reaching 4.5%/year, showcases the SBV’s determination to narrow the USD-VND interest rate spread in the interbank market.

Source: SBV

Analysts suggest that the SBV’s move to increase OMO and bill interest rates aims to establish a higher interbank rate, thereby alleviating pressure on exchange rates and foreign reserves.

In reality, despite the SBV’s intervention through foreign currency sales over the past two months, USD exchange rates at banks have consistently inched closer to the permitted ceiling, even surpassing the intervention sale rate. This has exerted significant pressure on foreign reserves, which barely meet the safety threshold (3 months of imports) recommended by international organizations.

However, with bill interest rates now almost reaching the “ceiling,” matching OMO rates, there is little room for further increases. Therefore, experts predict that the SBV is likely to raise the OMO rate if exchange rates face additional pressure in the future.

Previously, the SBV had increased the OMO rate twice within two months. The first hike occurred on April 23, raising the rate from 4.0% to 4.25%, and the second on May 22, pushing the rate further up to 4.5%.

Bank stocks plummet after overnight financial report release on January 31st.

The banking stock group, which has been leading the market in the first weeks of the year, experienced a collective downturn today.