When it comes to Vietnam, it’s often recognized as an attractive investment destination, a crucial production hub in the region, and a rising star in global supply chains. But the story of Vietnam goes beyond “FDI attraction and exports.” It’s also a promising tale of consumption.

The irresistible potential of the consumer market

We remain optimistic about the potential of Vietnam’s consumer market – one of the fastest-growing economies in Southeast Asia. With a population of over 100 million and a GDP per capita forecasted by S&P to reach $4,500 by the end of 2024, Vietnam showcases its long-term potential to become a shining star in consumption.

The ever-growing middle class puts Vietnam on track to enter the top 10 largest consumer markets globally by 2030, surpassing Germany and the UK, according to HSBC Global Research. This study also places Vietnam among the top 5 fastest-growing consumer markets in Asia during this decade (2021-2030). The high middle class (with personal income between $50 and $110 per day) is expected to expand at an average rate of 17% per year until 2030.

Amid global import-export disruptions, consumption remains a vital pillar contributing to Vietnam’s economic growth. Notably, consumption, coupled with digitalization, propelled Vietnamese e-commerce to a market size of $20.5 billion in 2023, a 25% increase from the previous year, according to the Ministry of Industry and Trade. Vietnam is recognized as the fastest-growing digital economy in ASEAN, with an impressive growth rate of 20%, as per the e-Conomy SEA 2023 report. In terms of gross merchandise value (GMV), Vietnam has the potential to become the second-largest digital market in the region by 2030, second only to Indonesia.

Mr. Pramoth Rajendran, National Head of Wealth Management and Personal Banking, HSBC Vietnam (author of the article)

Consumer payments are changing rapidly

The evolution of consumption, particularly e-commerce, has triggered an explosion of payment methods to meet the needs of convenient and secure transactions for the people. Vietnam, once a predominantly cash-based society, has witnessed a shift towards cashless transactions in urban areas, where individuals can go through a day without using physical currency as most payments can be made through cards, instant transfers, or QR code scans.

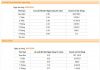

Cashless payments have permeated all aspects of consumption, from booking flights and hotels to purchasing goods in traditional markets, from automatic bill payments to buying street food. According to the State Bank of Vietnam, as of 2023, there were over 147 million bank cards in circulation and 32.77 million active e-wallets in the country. The average growth rate of internet and mobile payment channels during 2021-2023 reached 52% and 103.2%, respectively. QR code payments increased by over 170%.

While not growing at the same rapid pace, card payments are also gaining traction as consumers increasingly adopt this payment method. Global Data figures show that card payments in Vietnam expanded during 2019-2023, with a compound annual growth rate of 27.2%.

Among the various types of cards, credit cards, though not yet widely used, are gradually becoming more common. As of 2023, the credit card penetration rate in Vietnam stood at 27 cards per 100 people, indicating significant untapped potential. Credit cards are a crucial component in banks’ unsecured lending strategies as they generate higher transaction volumes and values than debit cards.

With their diverse features and options for physical or virtual cards, credit cards essentially offer a “buy now, pay later” proposition. Currently, the concept of “buy now, pay later” is not limited to credit card payments. Other forms, such as installment plans or “buy now, pay later” options through e-wallets, have emerged, contributing to a significant shift in consumer behavior, especially among Millennials and Gen Z. The younger generation readily embraces this trend as they favor financial solutions that are transparent about fees, flexible, and convenient, enabling them to manage their spending effectively.

Evidently, with the rapid advancement of technology, cashless payments are becoming increasingly diverse and prevalent, benefiting the economy, businesses, and consumers alike. It’s essential for the government and enterprises to promote this trend by upgrading the payment infrastructure, expanding the cashless payment ecosystem, and enhancing security to protect users from financial crimes. Consumers also need to be financially and technologically literate to leverage the advantages of new payment methods and become savvy, intelligent spenders.

Author: Pramoth Rajendran, National Head of Wealth Management and Personal Banking, HSBC Vietnam

Overloaded Lunar New Year Orders

This year, the situation of overloaded delivery during the Lunar New Year holiday is happening earlier than usual.

Lucky Shipper Wins Big During Lunar New Year

In the days leading up to Tet holiday, the amount of online shopping has significantly increased, with delivery personnel being busy on every route in Hanoi. According to an e-commerce expert, online shopping during this Tet holiday has seen a remarkable surge and is expected to continue rising in the coming period.

A multi-billion dollar industry set to enter the top 5 largest export markets in Vietnam: USA and Japan could be major clients.

The industry has the potential to reach $12 billion by 2027, making it the fifth largest export industry in Vietnam.