The Board of Directors of FPT Online Joint Stock Company (FPT Online, code: FOC) announced that July 19 will be the record date for paying a 20% cash dividend, with shareholders receiving VND 2,000 per share. The payment is expected to be made on July 31, 2024.

With over 18.4 million shares outstanding, the company will pay nearly VND 37 billion in dividends. The parent company, FPT Telecommunications Joint Stock Company (FOX), holds over 10.4 million shares (56.51% stake) and is expected to receive approximately VND 21 billion. Following is FPT Corporation, which owns 4.4 million shares (23.86% stake) and will receive nearly VND 9 billion.

According to sources, FPT Online has a tradition of paying high dividends annually. Since listing on the UPCoM in late 2018, FPT Online shareholders have received cash dividends every year, with a peak of 200% in 2020 paid in April 2021. Subsequently, the dividend rate decreased to 80% in 2021, 50% in 2022, and 20% in 2023, meeting the target set by the General Meeting of Shareholders. For 2024, FPT Online plans to maintain a dividend rate of no less than 20%.

In reaction to the dividend news, FOC shares rose over 4% on the stock market, reaching VND 93,000 per share by 10 am on July 5. However, FOC is still 17% lower than its short-term peak reached about a month ago.

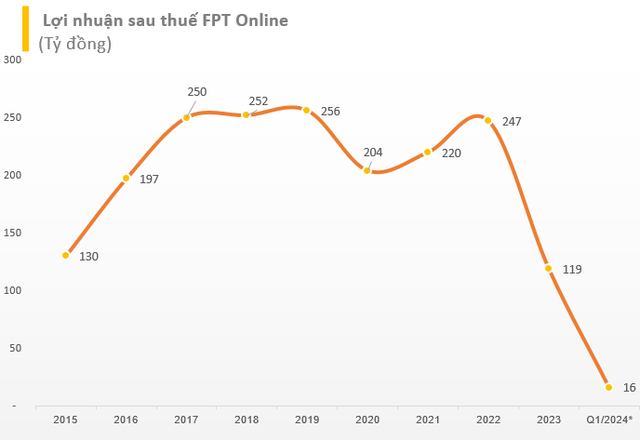

In terms of business results, in the first quarter of 2024, FOC’s revenue exceeded VND 127 billion, up 34% year-on-year. Pre-tax profit reached over VND 20 billion, 30 times higher than the same period last year. With these results, FOC has achieved 10% of its full-year profit plan (VND 210 billion).

FPT Online is a subsidiary of FPT Corporation specializing in online advertising, with its main source of revenue coming from advertising on the Vnexpress online newspaper. From 2017 to 2022, the company consistently recorded net profits of VND 200-250 billion each year before a sudden drop to VND 117 billion in 2023.

CapitaLand seals deal for over VND 18 trillion project, earns record profit of VND 2 trillion in Q4 2023, still owes Singapore giant over VND 2,700 trillion.

By the end of 2023, this real estate company achieved a total revenue of 8,204 billion VND and a net profit of 2,441 billion VND, representing a year-on-year growth of 23% and 43.6% respectively.