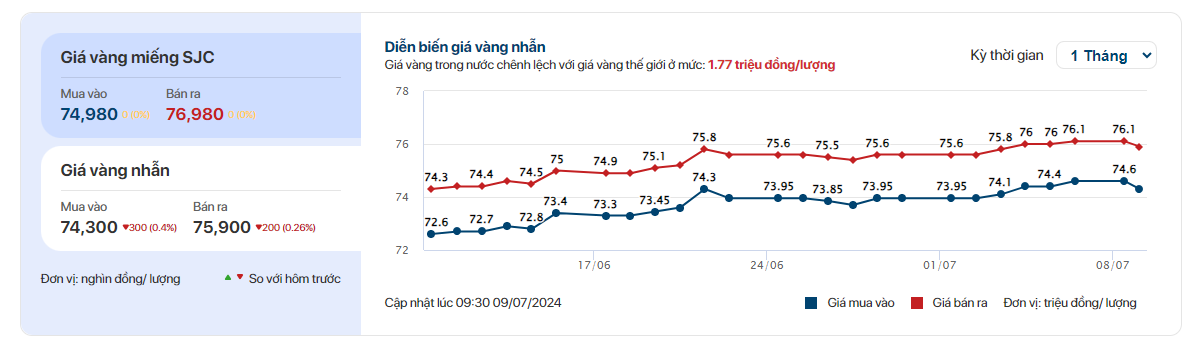

Gold prices witnessed a downward trend today, with SJC Company quoting their gold ring prices at 74.3-76.0 million VND per tael, a decrease of 200 thousand VND per tael from yesterday. Bao Tin Minh Chau also adjusted their rates downward by approximately 300 thousand VND per tael, to 75.12-76.42 million VND per tael.

Similarly, DOJI Group listed their prices at 75.15-76.4 million VND per tael, a reduction of 150 thousand VND per tael for buyers and 200 thousand VND per tael for sellers. SJC gold prices remained unchanged at the start of today, with buying and selling rates standing pat at 75 million VND per tael and 77 million VND per tael, respectively. This stagnation has persisted for 34 consecutive days since June 6.

In the international market, gold prices took a sharp downturn from USD 2,380 per ounce to USD 2,355 per ounce on the evening of July 8. However, by 9:30 am on July 9, the spot gold price rebounded to USD 2,365 per ounce. When converted according to Vietcombank’s VND/USD exchange rate, the international gold price corresponds to VND 72.5 million per tael.

The yellow metal’s retreat came as the US dollar regained its strength. The DXY index, measuring the US dollar’s performance against a basket of major currencies, climbed above 105 points. Last weekend, gold benefited from a weaker USD due to disappointing economic data, including a slowdown in the US job market, which heightened market expectations for a Federal Reserve rate cut in September. On Friday, the US Bureau of Labor Statistics reported that the economy added 206,000 jobs in June, surpassing expectations. Nonetheless, the unemployment rate ticked up to 4.1%, from 4.0% in May.

However, according to experts, the lackluster job market data is not a sustainable driver for gold prices. Meanwhile, many investors locked in profits on Monday after the People’s Bank of China (PBOC) refrained from increasing its gold reserves for the second consecutive month. Last month, when China ended its 18-month streak of continuous gold purchases, prices also dropped by over 2% overnight following this news.

Market Update on February 3rd: Crude oil, gold, copper, iron and steel, and rubber all decline together.

At the close of trading on February 2nd, the prices of oil, gold, copper, steel, rubber, and coffee all saw a simultaneous decrease, with iron ore hitting a two-week low.