Executive salaries soar as VFG shares skyrocket

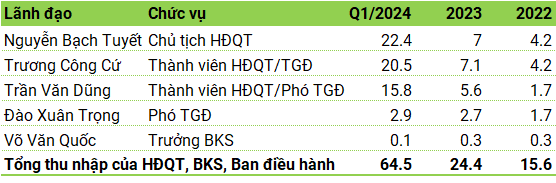

Ms. Tuyet’s total income for Q1, according to the published financial statements, was nearly VND 22.4 billion, compared to nearly VND 5 billion in the same period last year.

Not only Ms. Tuyet but also other members of the Board of Directors and Supervisors of Vietnam Fumigation Joint Stock Company (HOSE: VFG) experienced significant increases in their incomes.

VFG explained that the high income in the past quarter included performance-based bonuses that were approved but not fully distributed in 2023 and were fully distributed before March 31 as per regulations. In addition, there was a bonus fund paid in lieu of ESOP shares. VFG leaders affirmed that this was done in accordance with the regulations decided by the Board of Directors.

|

Income of some VFG leaders in the period of 2022-Q1/2024

(Unit: billion VND)

Source: Author’s compilation

|

In addition to the leadership’s income, VFG shares have also impressed investors since the beginning of 2024, soaring to an all-time high (adjusted price) and showing no signs of stopping.

|

VFG share price movement since its listing on the HOSE (December 17, 2009) up to now (adjusted price)

Source: VietstockFinance.

|

In its more than 15 years of listing, VFG shares have experienced about four waves of price increases. Three of them were long waves lasting a whole year with an increase of about 65-85%, while the fourth wave is currently ongoing and extremely strong. In just over six months, VFG’s price has increased from VND 35,000/share to nearly VND 84,000/share (as of July 5, 2024), an increase of approximately 140%.

Currently, PAN Farm Joint Stock Company, a subsidiary of PAN Group Joint Stock Company (HOSE: PAN), is the largest shareholder and parent company, holding 51.25% of VFG’s charter capital, according to the 2023 annual report. It is known that at the end of 2020, PAN divested nearly 15.4 million VFG shares to PAN Farm, taking its place as the largest shareholder.

VFG shares are thriving amid a 40% year-on-year increase in Q1 revenue and after-tax profit. VFG attributed this result to the increase in the prices of some agricultural products such as rice, coffee, and durian, which contributed to higher revenue, while the cost of goods sold increased at a lower rate thanks to discounts from suppliers. In addition, financial expenses decreased by more than 10%, and short-term financial investments helped increase financial revenue by nearly 12%.

Regarding the high remuneration in the first quarter, it was partly due to the 2023 results exceeding the profit plan by more than 18%, reaching VND 296 billion. As a result, 1.5% of after-tax profit was allocated to pay remuneration to the Board of Directors (equivalent to VND 4.4 billion), 10% to establish a reward and welfare fund (nearly VND 30 billion), 8% of the surplus profit to bonus the Board of Directors (VND 3.6 billion), 15% of the surplus profit to bonus the management board (VND 6.7 billion), VND 5 billion for charity, and three advance dividend payments totaling 30% (over VND 125 billion)…

|

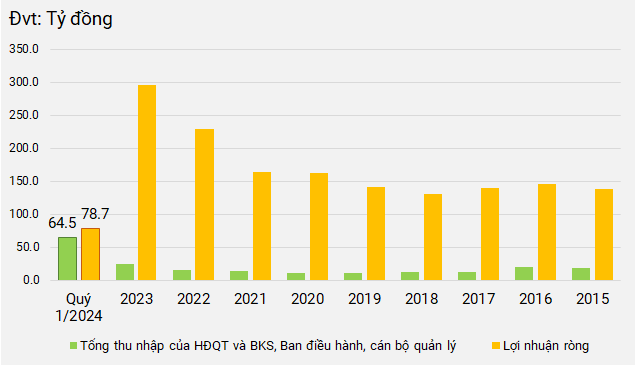

Income of VFG leaders and after-tax profit over the years

Source: Author’s compilation

|

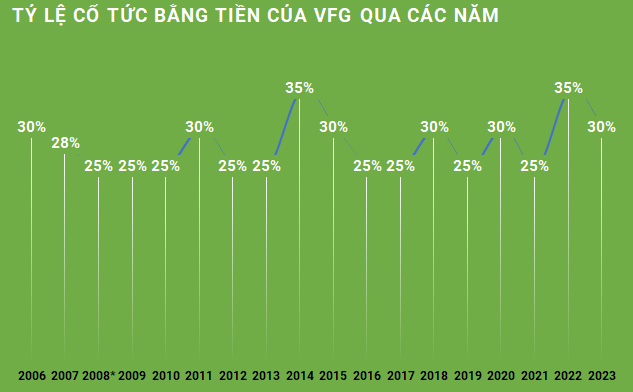

Historically, VFG has also been a business that favors paying regular cash dividends to shareholders with a rate of 25% to 35%.

Source: Author’s compilation. 2008* includes 10% in shares and 15% in cash

|

In 2024, the company set its highest-ever targets with total revenue and after-tax profit of VND 3,690 billion and VND 300 billion, up 4% and over 1% year-on-year, respectively. The dividend rate was set at 20%, and the investment budget for this year is expected to be VND 45 billion.

In addition, the Board of Directors’ remuneration for 2024 is set at 1.5% of after-tax profit. If the after-tax profit exceeds the target, the Board of Directors will receive a bonus of 5% of the surplus, and the management board will receive a bonus of 10%.

Financial statements over the years are embedded from VietstockFinance

| VFG’s net revenue and after-tax profit over the years |

| Some of VFG’s profitability ratios over the years |

| VFG’s total assets, liabilities, and charter capital over the years |

Despite COVID-19, VFG has maintained stable growth in its business results. The company’s main products include agricultural chemicals, crop seeds, crop technical services, fumigation services, and pest control. In 2023, Vietnam’s rice export value reached US$ 4.7 billion (up 36%) with a volume of 8.2 million tons (up 15%). The high rice prices have encouraged farmers to increase the consumption of agricultural chemicals, thereby creating more opportunities for companies providing input products for the agricultural sector, including VFG.

Dispute over a 16-year investment in Novotel Nha Trang Hotel

At the 2024 General Meeting of Shareholders, a representative from the Securities Company of the Mekong Housing Bank questioned the amount of money that VFG lent to PAN Group, which was larger than its charter capital, and the amount that VFG invested in Hai Yen Company, which has been disputed with its joint venture partner for a long time.

| It is known that VFG provided a zero-interest loan of VND 450 billion to PAN Group, with a repayment date of September 6, 2024. In 2023, the interest rate paid by PAN Group to VFG was VND 9.8 billion. |

The Chairman of the Meeting stated that PAN Group is a strong company that invests in leading companies in the agricultural sector in Vietnam, which has created many good business opportunities for VFG. The loan to PAN Group was disbursed in June 2023, before VFG borrowed from HSBC Bank to make an early payment to its partner (Syngenta) to receive a higher discount rate than the loan interest rate.

Mr.

Another issue of concern is the investment in Hai Yen Company to build Novotel Nha Trang Hotel. VFG stated that this investment was made a long time ago and there are still unresolved disputes over capital with its joint venture partner. This issue is facing certain difficulties, but the VFG leadership has made efforts to manage and operate the hotel effectively. The unit in charge of operating the hotel is Accor Group, a reputable company that has performed well in its mission, even during the COVID-19 pandemic.

|

Novotel Nha Trang Hotel is a 4-star hotel with 18 floors and a total investment of VND 200 billion. It has been in operation since 2008. Fococev Vietnam has a charter capital of over VND 100.7 billion, and Mr. Dao Quy Chung is the Chairman of the Board of Directors and General Director, as well as the legal representative.

|

The origin of this cooperation dates back to July 2004, when VFG signed a joint venture contract with Centrimex to establish Hai Yen Company, located at 50 Tran Phu, Nha Trang city. On October 9, 2007, Centrimex merged with Fococev, and Fococev disagreed with the profit-sharing ratio of the joint venture partners in Hai Yen. As a result, VFG filed a lawsuit against Fococev at the People’s Court of Khanh Hoa province to resolve the dispute. As of the end of Q1/2024, after 16 years of dispute, the case is still being processed, and the Court has not issued a final decision.

Ms.

As of Q1/2024, VFG had a loan of VND 116.5 billion from Hai Yen Company. In contrast, this unit was accounted for by VFG as an associated company with an investment cost of over VND 179.5 billion, equivalent to nearly 300% of its charter capital.

|

One of the oldest chairpersons on the stock exchange Ms.

|

Thu Minh