|

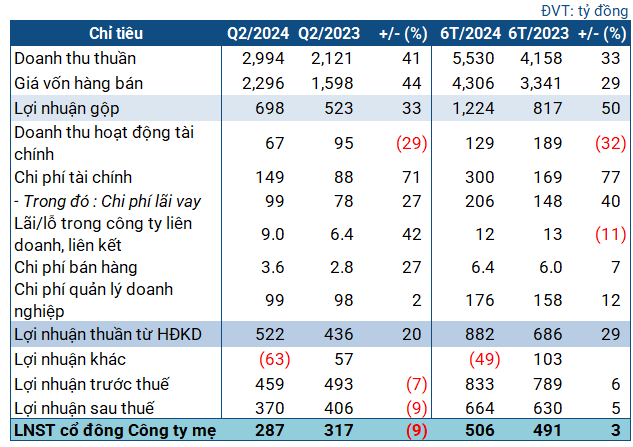

PVT’s Business Targets in Q2 2024

Source: VietstockFinance

|

In Q2, PVT achieved impressive results with nearly VND 3,000 billion in net revenue, a 41% increase compared to the same period last year. The majority of this revenue came from the transportation services segment, amounting to approximately VND 2,300 billion, a 28% increase. Additionally, the company’s trade revenue reached VND 454 billion, more than triple the amount from the previous year. After deducting the cost of goods sold, PVT’s gross profit stood at nearly VND 700 billion, a 33% increase year-over-year.

However, the company’s financial income decreased by 29% to VND 67 billion due to higher loan interest and exchange rate differences, along with lower interest rates on deposits and unreceived dividends from associated companies. Meanwhile, expenses increased across the board, with financial expenses surging by 71% to VND 149 billion. Despite these challenges, PVT’s strong gross profit led to a net profit of over VND 522 billion, a 20% increase compared to the same period last year.

Unfortunately, the company incurred an “other loss” of VND 63 billion (compared to a profit of VND 57 billion in the same period last year), which PVT did not elaborate on. This loss reversed the company’s fortunes, resulting in a net profit of only VND 287 billion, a 9% decrease year-over-year. Nonetheless, this outcome is still commendable, outperforming most recent quarters.

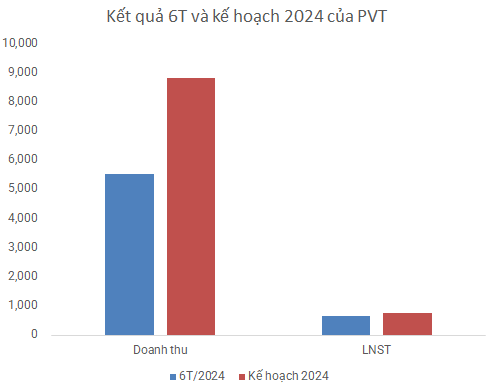

For the first half of the year, PVT’s cumulative results showed a 33% increase in revenue to over VND 5,500 billion and a slight 3% increase in net profit to over VND 506 billion, compared to the same period in 2023. These figures represent 63% of the company’s annual revenue plan and over 87% of its after-tax profit goal, as approved by the 2024 Annual General Meeting of Shareholders.

Source: VietstockFinance

|

As of the end of Q2, PVT’s total assets remained unchanged from the beginning of the year, standing at nearly VND 17,600 billion. Short-term assets increased by almost 10% to nearly VND 6,900 billion. The company held nearly VND 4,900 billion in cash and cash equivalents, a 10% increase.

Accounts receivable from customers increased by approximately 9% to over VND 1,000 billion, while inventory levels rose by 17% to VND 272 billion. On the capital side, short-term debt remained stable at VND 3,400 billion. The company’s substantial cash position ensures its ability to meet all short-term debt obligations as they become due.

In terms of borrowings, PVT had short-term borrowings of over VND 1,100 billion as of the end of June, a 20% decrease from the beginning of the year, and long-term borrowings of nearly VND 4,200 billion, an 8% decrease. All of these borrowings are from banks.

Bamboo Capital (BCG) surpasses 4,000 billion VND in revenue, reduces debt by 5,500 billion VND by 2023

The amount of debt to be paid has been reduced by more than 5,498 billion VND as the Group has actively settled all borrowings in order to lessen the cost of interest and ensure financial stability for the business.

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.