|

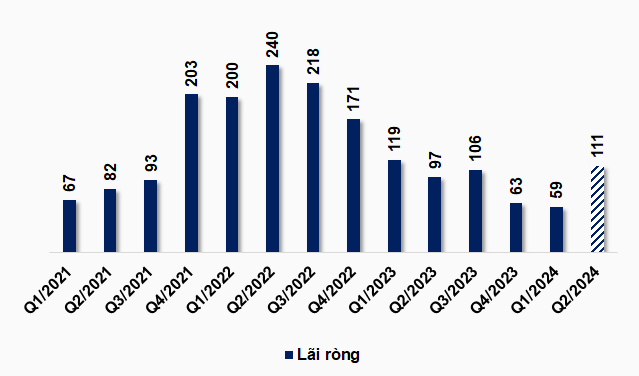

HAH’s Net Profit for the Past 5 Quarters

Unit: Billion VND

Source: VietstockFinance

|

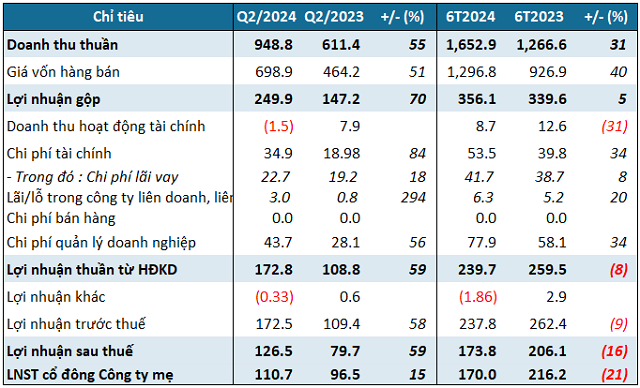

HAH announced its Q2 2024 financial statements with net revenue of nearly VND 949 billion, up 55% compared to the same period last year. This quarter saw growth in all business segments, including vessel operations, port operations, and other activities.

The company’s net profit reached nearly VND 111 billion, a 15% increase year-on-year. This is also the highest net profit HAH has achieved in the past five quarters.

According to HAH, the profit growth is attributed to an increase in the number of vessels in operation (Hai An Alfa and Hai An Beta), the addition of new routes for both domestic (Nghi Son, Chan May, Long An, etc.) and international (Singapore, Malaysia, India, etc.) destinations, and a 6.5% rise in average freight rates compared to the same period last year. Moreover, the increase in freight volume led to higher port activity and revenue.

|

HAH’s Q2 and YTD 2024 Business Results

Unit: Billion VND

Source: VietstockFinance

|

As of Q2, HAH’s total assets exceeded VND 5,925 billion, an 11% increase from the beginning of the year. Fixed assets accounted for 57% of this, totaling over VND 3,352 billion, a 17% increase, mainly comprising the value of transportation and transmission equipment.

Another significant item is short-term receivables of over VND 882 billion, accounting for 15% of the total, which decreased by 12% compared to the beginning of the year. Notably, the amount paid in advance to Huanghai Shipbuilding Co., Ltd. stood at nearly VND 256 billion, a significant reduction from the figure of nearly VND 435 billion at the beginning of the year.

This payable corresponds to the progress payments for three contracts to build three 1,800 TEU container ships. HAH took delivery of the Hai An Alfa vessel in late 2023. In May 2024, the company received the Hai An Beta vessel, and the remaining ship is expected to be delivered in July 2024.

In terms of capital structure, HAH had over VND 2,570 billion in payables, an 11% increase from the beginning of the year, including a total of nearly VND 1,718 billion in loans, a 24% increase.

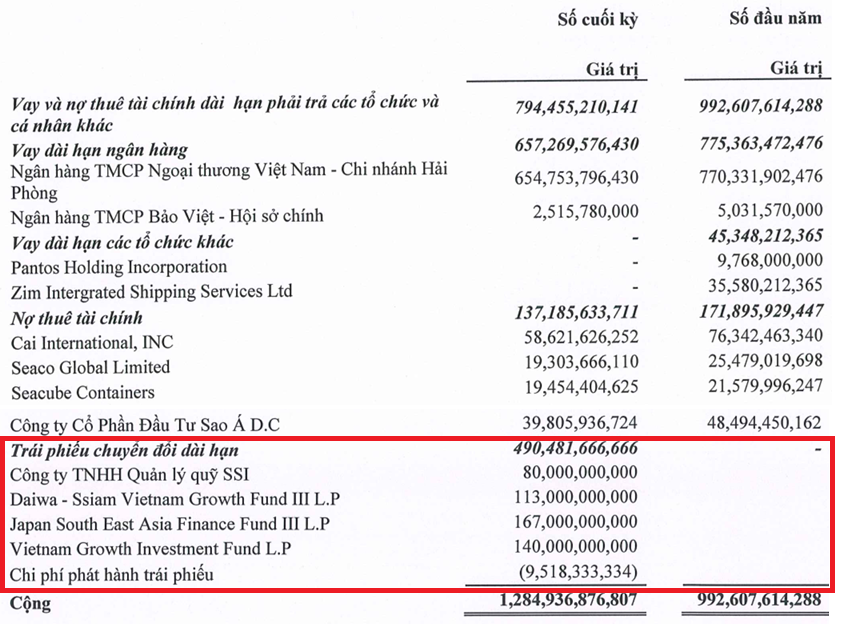

HAH’s long-term debt stood at nearly VND 1,285 billion, a 29% increase, mainly due to the issuance of convertible bonds. These bonds had a face value of VND 500 billion, and after deducting nearly VND 10 billion in issuance costs, their value as of June 30, 2024, was over VND 490 billion.

Source: HAH’s Q2 2024 Financial Statements

|

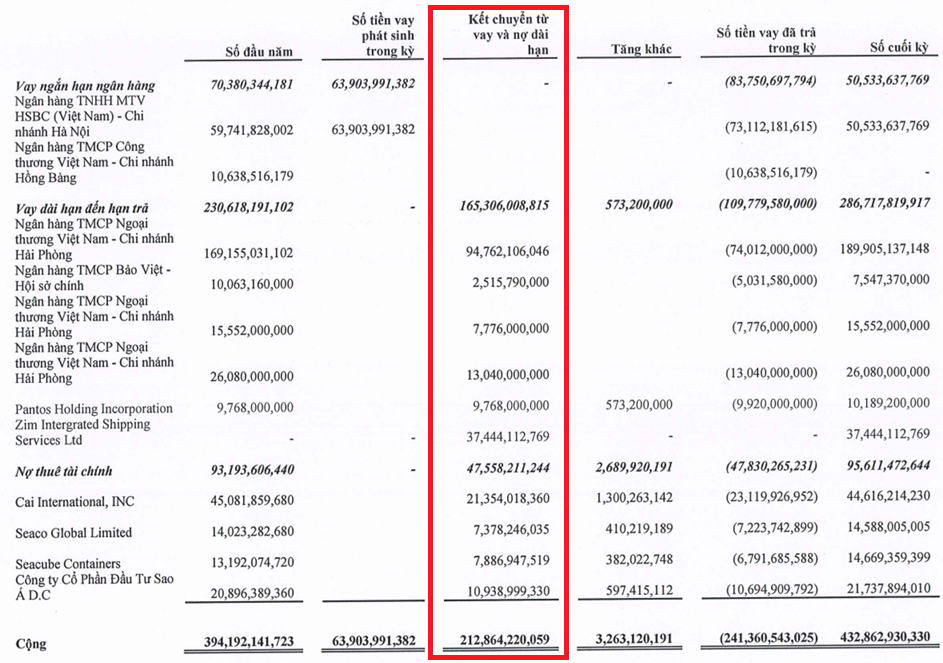

On the other hand, long-term debt decreased by 20% to over VND 794 billion, mainly due to reduced debt at Vietcombank – Hai Phong Branch, lower financial lease liabilities, and no longer recognizing long-term loans from other organizations, including Zim Integrated Shipping Services Ltd.

The decrease in long-term debt was, in fact, reclassified as short-term debt. The conversion of debt at Vietcombank – Hai Phong Branch and Zim Integrated Shipping Services Ltd. contributed to a 10% increase in short-term debt to nearly VND 433 billion, despite HAH’s active repayment of short-term loans during the period.

Source: HAH’s Q2 2024 Financial Statements

|

|

On July 8, HAH’s Board of Directors approved a loan of up to VND 414.3 billion from HSBC Bank (Vietnam) Limited – Hanoi Branch. The loan is intended to finance the company’s legitimate credit needs related to the investment in the project for building a 1,800 TEU container ship (hull number HCY-268), excluding interest expenses incurred during the investment period. The collateral for this loan includes: rights to the assets arising from the contract for building a 1,800 TEU container ship (hull number HCY-268), signed between HAH and Huanghai Shipbuilding Co., Ltd. on January 27, 2022, and the vessel Hai An Mind. |

Huy Khai

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.

Adapting to the trend, ITL is ready to take off.

Being attuned to global logistics trends is one of the secrets that helps ITL stay on track and shorten the journey towards our goals.