Con Cưng: Leading the mother and baby retail market, but net profit has consecutively decreased by 84% and 87% in the past 2 years.

The mother and baby retail industry is witnessing robust growth, largely due to improving living standards and a declining birth rate, leading to increased focus on childcare and parenting. According to Vietdata, in 2023, Vietnam had approximately 20.6 million children under the age of 12 and about 50.7 million women of childbearing age (15-49), forming a promising mother and baby market.

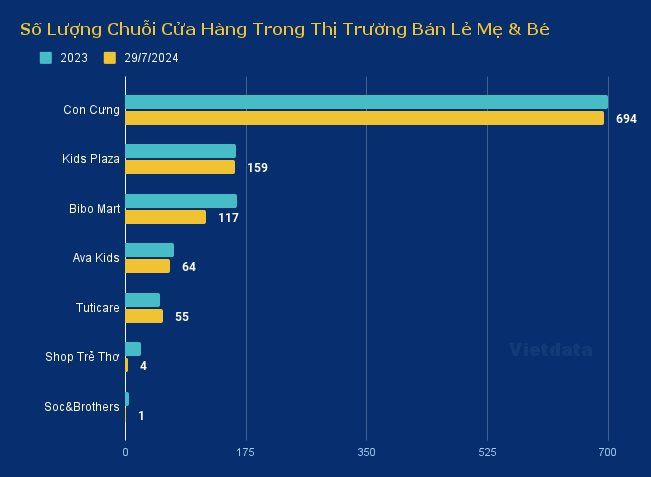

With significant growth potential, the mother and baby industry is becoming an attractive “pie” that catches the attention of many brands such as Con Cưng, Kids Plaza, Bibo Mart, and AVAKids. The competition for market share is fierce, as established brands face challenges from creative and dynamic new entrants.

Source: Vietdata

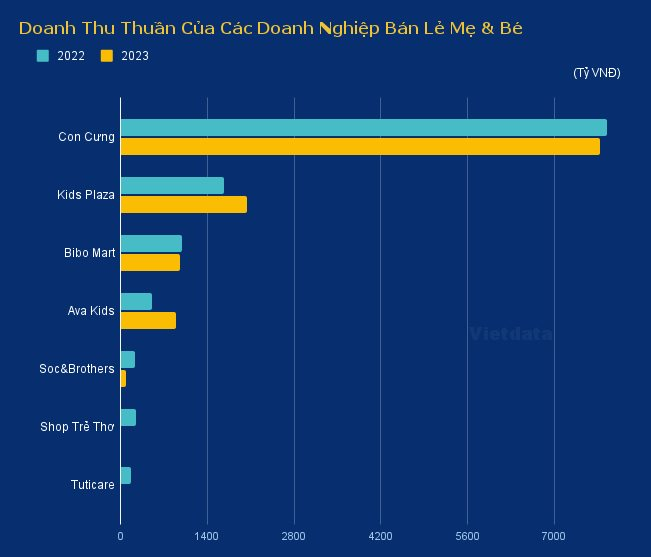

Slight revenue decrease to VND 7,700 billion, but net profit significantly dropped

As the leading brand in the mother and baby retail market, Con Cưng, the brand of Con Cung Joint Stock Company, has consecutively affirmed its leading position over the years. Established in 2011, the company is prominent in Vietnam for exclusively providing products and services for pregnant women, newborns, and young children. With a diverse product portfolio, ranging from newborn fashion, baby gear, milk, food, toys, to consulting services for pregnant women and young children, Con Cưng has earned the trust of millions of Vietnamese families and is currently leading the mother and baby market in terms of both store count and revenue.

According to Vietdata, after receiving an investment of USD 90 million from Quadria Capital in early 2022 (increasing the presence of foreign investors in Con Cưng to 49.36%), Con Cưng set an ambitious goal to expand its network to 2,000 stores and own about 200-300 Super Centers by 2025. Currently, Con Cưng focuses on optimizing its retail network, maintaining approximately 694 stores across 49 provinces and cities, and emphasizing the growth of its online sales channel.

Regarding Con Cưng’s performance, Vietdata reported that despite significant achievements in international partnerships and product portfolio expansion, the company’s 2023 business results showed concerning signals. Revenue reached VND 7,700 billion (a slight decrease from the previous year), along with a sharp decline in net profit for two consecutive years, decreasing by 84% and 87%, respectively.

Source: Vietdata

Vietdata positively assessed Con Cưng’s focus on introducing Japanese consumer goods to the Vietnamese market. In early 2024, Con Cưng collaborated with the Japan External Trade Organization (JETRO) Ho Chi Minh City Office and the electronic payment service provider MoMo to introduce Japanese products for children to the Vietnamese market.

Kids Plaza, the strong “runner-up” rising rapidly

Kids Plaza Joint Stock Company (the owner of the Kids Plaza store chain) was established in 2009 and is currently one of the prominent mother and baby store systems in Vietnam. Kids Plaza specializes in providing products for pregnant women, newborns, and young children, with a diverse product portfolio, including milk, diapers, feeding utensils, toys, strollers, baby bottles, newborn essentials, bottle warmers, and sterilization products. All products are from reputable domestic and international brands.

Currently, Kids Plaza has 159 stores nationwide and also focuses on its online sales channel, according to their 2023 report. Regarding business results, Vietdata reported that Kids Plaza achieved impressive performance in 2023, with a 21.8% revenue growth year-over-year, surpassing VND 2,000 billion, and a net profit of nearly VND 100 billion. This is the third consecutive year that Kids Plaza has recorded promising growth, solidifying its position as the strong number two in the market.

In 2024, Kids Plaza strategically partnered with Moyuum, a leading Korean manufacturer of children’s products established in 2014, to bring high-quality products to the Vietnamese market.

Bibo Mart

Established in 2006 by Bibo Mart TM Joint Stock Company, Bibo Mart continuously strives to offer high-quality, safe, and suitable products for pregnant women (during pregnancy and postpartum) and young children under 6 years old. With a diverse range of products from reputable domestic and international brands, Bibo Mart consistently affirms its position in the mother and baby retail industry.

Alongside its traditional store network of 117 stores nationwide, Bibo Mart has proactively embraced digital transformation in the context of evolving e-commerce. They have built a modern digital ecosystem to support retail stores in Vietnam, closely connecting suppliers, transport units, warehouses nationwide, and collaborations with banks and e-wallets. Through these efforts, the company has optimized its business processes, reduced costs, improved operational efficiency, and enhanced the shopping experience for its customers.

Regarding business performance, according to Vietdata, Bibo Mart’s 2023 revenue reached approximately VND 900 billion (a slight decrease of 4.3% from the previous year). The company recorded a positive net profit again after a challenging year, thanks to a successful digital transformation.

AVAKids

AVAKids, a mother and baby brand under The Gioi Di Dong Joint Stock Company, made a strong impression when it entered the market in 2022. With a diverse range of quality products, competitive prices, and the advantage of a loyal customer community from its “big brother” – The Gioi Di Dong, AVAKids quickly expanded its network to 71 stores within a year.

However, due to the economic situation at the end of 2022, AVAKids had to adjust its expansion plan. The number of stores decreased to 64 and has remained stable since then. Regarding business results, Vietdata reported that AVAKids’ revenue still grew impressively by 80% in 2023, reaching nearly VND 900 billion, quickly rising to the Top 4 companies with the highest market share in the mother and baby retail industry. AVAKids currently has the highest average revenue per store in Vietnam, at VND 1.7 billion per store. Notably, the online channel contributed 30% to AVAKids’ total revenue, demonstrating the significant potential of e-commerce.

Given these positive results, AVAKids decided to concentrate all resources on developing its online channel in 2024. The existing stores primarily serve as display spaces and trust-building points for customers. Vietdata assessed that this decision is based on the changing consumer behavior, with an increasing number of people opting for online shopping.

Mobile World has unexpectedly declared that the AVAKids chain has the highest average revenue per store in Vietnam, reaching 1.7 billion VND after more than a year without opening any new branches.

AVAKids is a leading store chain specializing in mother and baby products, and it was opened by MWG two years ago. Since reaching 64 stores by the end of November 2022, Thế giới đi động has not opened any new stores throughout 2023.