The VN30-Index was the only large-cap group index in the green on the HoSE this morning. The basket’s liquidity was also stable compared to yesterday morning, even as the floor dropped. The VN-Index maintained a slight increase of 2.64 points (+0.21%), thanks entirely to the blue-chips holding the pace, while the breadth tilted towards the downside.

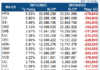

Currently, the HoSE has 11 stocks with liquidity exceeding 100 billion VND, 10 of which are in the VN30 basket, and only 2 codes are in the red: MWG down 0.75% and VNM down 0.14%. Stable cash flow in blue-chips is a positive condition as the market is moving very slowly.

The VN-Index closed the morning session with only 146 gainers and 221 losers. The differentiation is showing signs of weakening. The index peaked at 9:45 am, up more than 6 points, and the breadth had 196 gainers and 114 losers. The price slide spread quite widely towards the end of the session, even within the VN30 basket, which worsened. This basket closed the morning session with 16 gainers and 10 losers, while at the peak, only VCB was in the red.

Some sudden strong transactions also appeared only in the VN30 group, with MSN standing out. In just the morning session, liquidity increased by 40% compared to the previous day, and it is currently leading the market with 6.68 million shares, equivalent to 511.2 billion VND. MSN rose 2.54%, including net foreign buying of 128.8 billion VND. Foreign demand is also the reason for the positive price movement of MSN, as the buying volume accounts for about 37% of the total transaction.

In addition to MSN, some large VN-Index pillars also performed well: BID increased by 1.61%, GAS by 1.35%, VHM by 1.24%, and VIC by 0.74%. These are all stocks in the Top 10 market capitalization. In terms of percentage gain, the mid-cap group also includes PLX up 2.56%, VRE up 2.58%, BCM up 1.97%, and SAB up 2.03%.

There were no notable transactions in the declining stocks in the VN30 basket. VJC is currently down the most, losing 1.26%, but this stock has a small market cap (not yet in the top 20) so the impact is not clear. VCB is causing the VN-Index to lose the most points (1.09 points), but the decline is only -0.89%, with the main influence being its large market cap.

The ability of blue-chips to hold the pace is helping the VN-Index stay above the reference level, and although the breadth shows a large number of losers, the selling pressure is not strong. Midcaps are down 0.42%, small caps are down 0.16%, and among the 221 losers, only 70 stocks fell more than 1%, accounting for about 17% of the total trading value on the HoSE. Only DIG had liquidity of more than 100 billion VND, with a price drop of 1.79%. VIX, HAG, HCM, VND, and PDR are the other stocks with average liquidity. In fact, although there are 70 codes, only 20 stocks have transactions of more than 10 billion VND in liquidity.

The gainers still have a significant advantage in stocks with average to low liquidity. TDC, VTO, NAB, LSS, NAF, BFC, CSV, SAV, PVP, VHC, and HQC all rose more than 2% with transactions ranging from a few billion to a few tens of billion VND. The strong codes are still blue-chips, but they are also rare, such as MSN, VHM, GAS, VRE, and PLX, with liquidity of over 100 billion VND.

The VN-Index is approaching the 20-day moving average (MA20), which is considered a common technical resistance level, so cash flow has more reason to be cautious. The matched transaction volume of the two exchanges in the morning session decreased slightly by nearly 7% compared to the previous morning, and the breadth was quite narrow. Except for stocks that continue to attract cash flow or face mild profit-taking pressure, the others are weakening after a short-term rebound. However, as shown in the statistics above, the fact that only a small number of stocks rose/fell by more than 1% indicates that the market is still quite balanced in supply and demand.

LandX Services reports a loss of 160 billion VND in 2023, cuts over 1,000 staff

In 2023, Dat Xanh Services incurred a net loss of 160 billion VND primarily due to a shortfall in real estate service revenue. Additionally, the company downsized its workforce by over 1,000 employees in the past year.