Navigating the Challenges

Highlighting the limitations of Vietnamese supporting industries, Dr. Tran Thi Mai Thanh, from the Faculty of Economics and International Business, Hanoi National University, shared that local Vietnamese businesses struggle to provide inputs for FDI enterprises, especially large conglomerates, failing to demonstrate their competitive advantage.

The participation of domestic supporting industries in global production and supply chains needs significant improvement.

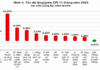

“While 90% of FDI enterprises in countries like China, Malaysia, and Thailand use domestic sources, this figure is only about 60% in Vietnam. Additionally, 30% of FDI enterprises are entirely export-oriented, not supplying the domestic market, which hinders the formation of domestic value chain linkages,” Dr. Tran Thi Mai Thanh pointed out.

According to a report by the Ministry of Industry and Trade, some domestic supporting industries have improved their production organization, increased productivity and efficiency, and reduced costs to enhance their competitiveness. They have become direct suppliers to complete product manufacturers and assemblers and multinational corporations, integrating into regional and global production networks and value chains.

The supporting industries are thriving, providing raw materials and accessories for domestic production. The localization rate has improved in various manufacturing sectors, such as the textile and garment industry, achieving 45-50%, and the mechanical engineering industry, surpassing 30%.

However, the Ministry of Industry and Trade also acknowledged that there are challenges in implementing policies and laws for the development of supporting industries, especially in serving the processing of agricultural, forestry, and aquatic products and the development of agriculture and rural areas.

Specifically, there are limitations in the effectiveness of preferential policy implementation, and there is a lack of regular and widespread promotion and dissemination of these policies to the business community. A portion of businesses also have a limited understanding of the government’s policy regulations.

These challenges arise due to the specific nature of supporting industry production and a low starting point, as the production capacity of Vietnamese enterprises does not yet meet the conditions to benefit from preferential policies. Some conditions for enjoying these privileges are quite stringent and may not be entirely practical during policy implementation.

A section of supporting industry enterprises has not shown interest or taken the initiative to learn about and understand the preferential and supportive policies. Due to limited resources, they often lack a dedicated department to research and explore these preferential policies…

According to the Vietnam Electronics Enterprise Association (VEIA), Vietnam has continuously welcomed FDI enterprises seeking support for connectivity and supply chain development, including leading companies from Europe, America, and a series of Apple’s first-tier suppliers. Notably, these “big players” are not just looking for one or two suppliers but aim to approach the entire chain and build a product support ecosystem in Vietnam. This clearly presents an opportunity for Vietnamese businesses to develop and occupy a more critical position in the global value chain with high-tech, high-value-added products.

However, Mr. Pham Tuan Anh, Deputy Director of the Industry Department (Ministry of Industry and Trade), pointed out the existing concerns. The connection between FDI and domestic enterprises remains loose, limiting the spillover effects between the FDI sector and the domestic economy. Additionally, the competitiveness, management skills, and technological level of most Vietnamese enterprises are still low, failing to meet the stringent requirements and standards of multinational corporations or leading companies in the supply chain.

Linking Up: The Shortest Path

According to economic experts, there is a reality that global production supply chains are led by multinational corporations, and latecomers must join these chains to participate. Therefore, the shortest path for Vietnamese enterprises to join the global supply chain is to link up with these multinational companies. Connecting with multinational corporations is considered the shortest route for domestic supporting industry enterprises to join the global supply chain.

From a policy-making perspective, Mr. Pham Tuan Anh acknowledged that Vietnamese supporting industry enterprises still face challenges in entering the global supply chain. To enable Vietnam’s supporting industries to engage more deeply and extensively in the global supply chain, it is necessary to promote stronger linkages and enhance solidity within the supply chains of Vietnam’s key industries, such as textiles, footwear, and electronics. Along with this, there is a need to improve the system of institutions, policies, and legal documents to create a foundation and drive industrial development.

The Ministry of Industry and Trade also noted that the level of linkage and business cooperation between enterprises within the same industry and between industries remains limited. The connection between FDI and domestic enterprises is slow, hindering the development of management skills, technology transfer, and the formation of supply chains for materials and components and industry linkage clusters. The strong participation of domestic enterprises in global production and supply chains needs significant improvement.

Moreover, it is essential to continue collaborating with FDI enterprises, large industrial production enterprises at home and abroad, and international organizations to promote linkages with domestic enterprises and enhance the capabilities of local suppliers, enabling Vietnamese supporting industries to join the global value chain.

Regarding this matter, Dr. Truong Thi Chi Binh, Chairman of the Vietnam Supporting Industries Association, stated that this is the time to invest more in domestic supporting industries. When working with major foreign partners, they set very high requirements for production lines. Even if we act as ODM (Original Design Manufacturer), we still need to provide complete products or components, which demands substantial new investments. Meanwhile, investing in small and medium-sized enterprises is extremely challenging, and they desperately need support with interest rates, which is the issue that businesses are most concerned about.

On the other hand, according to Dr. Binh, local governments can also provide investment support and interest rate assistance to enterprises producing supporting industry products instead of solely relying on government policies.

Furthermore, the Chairman of the Vietnam Supporting Industries Association suggested that if we wait for FDI enterprises to favor Vietnamese businesses, we will only be able to produce miscellaneous spare parts. Therefore, if possible, Vietnamese enterprises should negotiate with them. Or, for new investors in Vietnam, it is crucial to anticipate their needs in advance to be well-prepared, or else we will fall behind. This proactive approach will help prevent situations where FDI enterprises already have their supply chain established when they enter Vietnam.

With the above solutions, the business community expects that the new preferential policies will create a driving force for enterprises to innovate, access capital, and enhance their competitiveness… At the same time, with the mechanisms opened up by the government, enterprises also need to change their mindset and approach to industrialization and modernization, shifting from a dependent, assembly-based industry to a proactive, creative one. They should also promote the application of digital technology in production to improve productivity and competitiveness. Strengthening linkages between domestic enterprises and the FDI sector and the global market will enable Vietnamese supporting industries to participate more deeply in the global value chain, leveraging the opportunities presented by free trade agreements.

Prime Minister discusses investment, production, and business with 19 corporations and conglomerates

On the morning of February 5th, Prime Minister Pham Minh Chinh chaired a working conference with the State Capital Management Committee in Enterprises and 19 groups and corporations to discuss the implementation of production and business activities in 2024, as well as promoting investment for economic and social development.

Ensuring a Stable Fuel Supply for the Lunar New Year 2024

The Ministry of Industry and Trade has recently issued a letter to key petroleum producers, petroleum trading companies, and petroleum distribution businesses, requesting them to ensure a stable supply of petroleum for production, business, and consumption during the Lunar New Year holiday in 2024, which falls on the Year of the Wood Dragon.