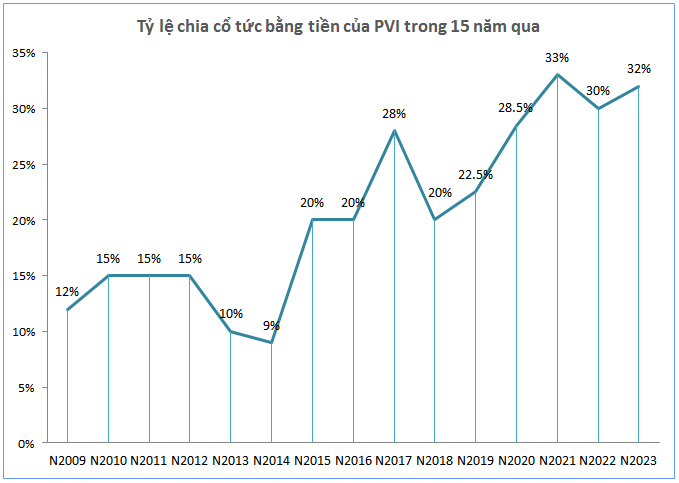

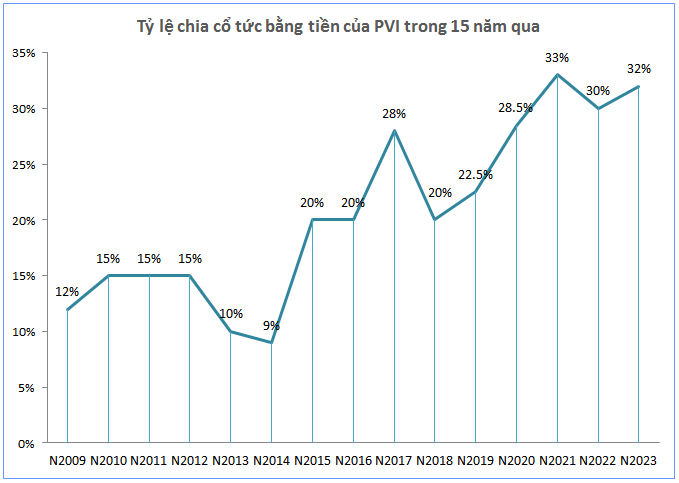

With a payout ratio of 32% of par value (1 share receives 3,200 VND) and more than 234 million shares in circulation, PVI is estimated to distribute nearly VND 750 billion in dividends to shareholders. The expected payment date is September 20, 2024.

Source: VietstockFinance

|

PVI has maintained a tradition of paying cash dividends to shareholders for the past 15 years. Except for 2014, when the dividend payout ratio was below 10%, PVI has consistently paid double-digit dividends, ranging from 12% to 33%.

Recently, PVI‘s shareholder structure underwent changes as the IFC group exited its position as a major shareholder after selling nearly 8 million shares out of the registered 9 million, reducing its ownership to 2.63%.

Source: VietstockFinance

|

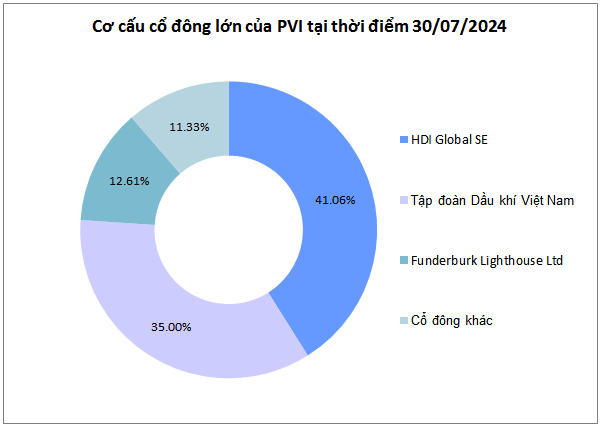

While IFC was exiting, HDI Global SE moved in the opposite direction by acquiring an additional 4.98 million PVI shares, increasing its ownership to 41.06% (96.2 million shares). As a result, HDI Global SE remains PVI‘s largest shareholder and is expected to receive approximately VND 308 billion in dividends this time. Furthermore, HDI Global SE has registered to purchase an additional 3.12 million PVI shares between August 8 and September 5, 2024, intending to increase its ownership above the 42% threshold, nearing 100 million PVI shares.

Vietnam Oil and Gas Group (PVN) is PVI‘s second-largest shareholder, with a 35% stake, and is expected to receive over VND 262 billion in dividends.

Amidst the changes in major shareholders, PVI also witnessed a shift in its top management. On August 16, 2024, the first extraordinary general meeting of PVI shareholders in 2024 approved the dismissal of Mr. Nguyen Xuan Hoa from his position as Vice Chairman and CEO of PVI to assume another role assigned by the Vietnam Oil and Gas Group (PVN).

Mr. Nguyen Tuan Tu, new CEO of PVI

|

Mr. Nguyen Tuan Tu (born in 1972) was appointed as Vice Chairman and CEO of PVI. Mr. Tu represents PVN’s invested capital in PVI. Prior to his appointment as CEO of PVI, Mr. Nguyen Tuan Tu served as Deputy General Director of Vietnam Oil Corporation – JSC (PVOIL).

Simultaneously, the PVI General Meeting of Shareholders dismissed Ms. Pecastaing Pierre Tatiana from her position as Independent Member of the Board of Directors and appointed Ms. Christine Nagel to this role.

On the same day, Mr. Duong Thanh Danh Francois was appointed by the PVI Board of Directors as Permanent Vice Chairman of the Board of Directors.

| PVI’s Business Results for the First Half of 2024 |

According to the reviewed semi-annual financial report for 2024, PVI recorded a consolidated net profit of over VND 636 billion, a 12% increase compared to the same period last year. This growth was attributed to a 25% increase in profits from insurance business activities, totaling more than VND 649 billion.

In the first half of 2024, PVI achieved 73% of its full-year profit before tax target of VND 1,080 billion.

As of June 30, 2024, PVI‘s total assets exceeded VND 31,236 billion, a 16% increase from the beginning of the year. The Company held over VND 10,800 billion in bank deposits, reflecting an increase of nearly VND 1,400 billion, or 15%, compared to the beginning of the year.

A “squad” carrying mattresses back home for Tet holidays

In 2023, May Sông Hồng achieved a net revenue of 4,542 billion VND, a decrease of 18% compared to the previous year, and a post-tax profit of over 245 billion VND, experiencing a decline of nearly 28%.