Illustration

According to the latest survey, Sacombank’s savings interest rates in August 2024 range from 0.5 – 5.7%/year for term deposits with interest paid at maturity. The interest rates for online deposits are significantly higher than those for over-the-counter deposits.

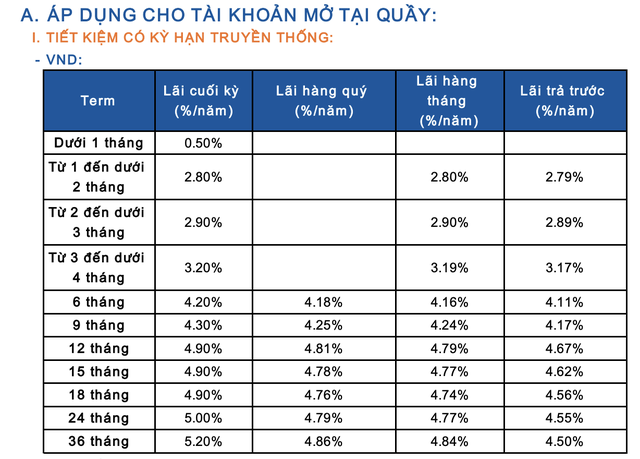

Sacombank’s Over-the-Counter Deposit Interest Rates for August 2024

At the beginning of August, Sacombank’s interest rates for over-the-counter deposits with interest paid at maturity range from 0.5% to 5.2% per year.

Specifically, the interest rate for a period of less than 1 month is 0.5%/year; the interest rate for a period of 1 to less than 2 months is 2.8%/year; the interest rate for a period of 2 to less than 3 months is 2.9%/year; the interest rate for a period of 3 to less than 4 months is 3.2%/year; the interest rate for a period of 6 months is 4.2%/year; and the interest rate for a period of 9 months is 4.3%/year.

Sacombank offers an interest rate of 4.9%/year for a period of 12-18 months and 5.0%/year for a period of 24 months.

Currently, the highest interest rate offered by Sacombank for over-the-counter deposits is 5.2%/year for a period of 36 months.

In addition to interest paid at maturity, Sacombank also offers flexible interest payment options, including quarterly interest payments (4.18%/year – 4.86%/year), monthly interest payments (2.8%/year – 4.84%/year), and advance interest payments (2.79%/year – 4.67%/year).

Sacombank’s Over-the-Counter Deposit Interest Rates for August 2024

Source: Sacombank

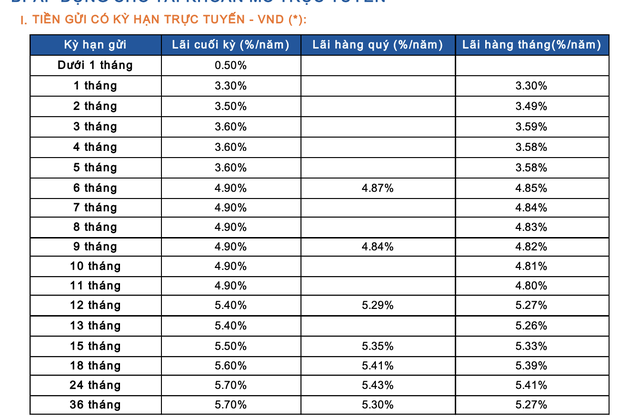

Sacombank’s Online Savings Interest Rates for August 2024

For online deposits with interest paid at maturity, Sacombank offers interest rates ranging from 0.5% to 5.7% per year. The interest rates for online deposits with terms of 1 month or more will be 0.4% to 0.7% higher than those for over-the-counter deposits.

Specifically, the interest rate for online deposits with a period of less than 1 month is 0.5%/year; the interest rate for a period of 1 month is 3.3%/year; the interest rate for a period of 2 months is 3.5%/year; and the interest rate for a period of 3 to 5 months is 3.6%/year;

The interest rate for online deposits with a period of 6 to 11 months is 4.9%/year; the interest rate for a period of 12 to 13 months is 5.4%/year; the interest rate for a period of 15 months is 5.5%/year, and the interest rate for a period of 18 months is 5.6%/year;

Sacombank offers the highest interest rate of 5.7%/year for online deposits with a period of 24-36 months.

Sacombank’s Online Deposit Interest Rates for August 2024

Source: Sacombank

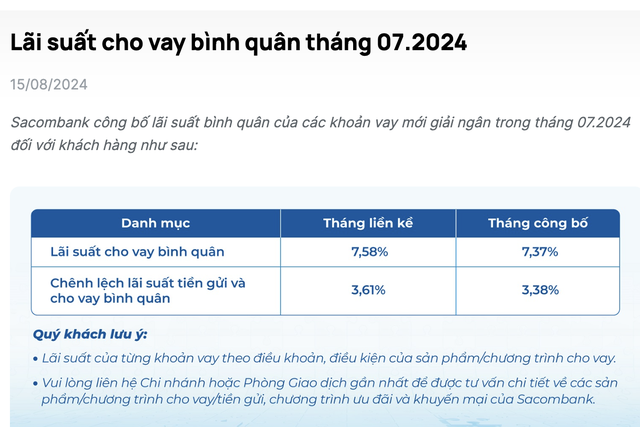

Sacombank’s Latest Lending Interest Rates

Sacombank announced an average lending rate of 7.58%/year for new loans disbursed in July 2024, with an average interest rate spread of 3.61%/year. Previously, the average lending rate at Sacombank in June 2024 was 7.37%/year, and the average interest rate spread was 3.38%/year.

Note that this is the average lending rate of the bank and may not be the actual rate applied to specific loans. Customers can contact their nearest Sacombank branch or transaction office for advice and more information about Sacombank’s credit programs and promotions.

Latest Interest Rates at Agribank in February 2023: Highest Rate for 24-month Term

Interest rates for deposits at Agribank have further decreased in early February 2024 compared to January. Specifically, individual customers’ deposits are subjected to interest rates ranging from 1.7% to 4.9% per annum, while business customers’ deposits are subjected to interest rates ranging from 1.7% to 4.2% per annum.

International visitors “invade” New Year’s celebration; nearly 3,000 employees of The Gioi Di Dong quit their jobs

Móng Cái border gate welcomes nearly 1,000 entrants on the first day of the year; Feng Shui experts predict the economy in the Year of the Wooden Horse; Over 10,000 tons of rice distributed to residents in 17 provinces for Tet; Approximately 3,000 employees of Thế giới Di động resign… are notable news from the past week.