The Ho Chi Minh City Party Committee has recently approved a proposal on remittance policies for the 2024-2030 period. The proposal was crafted with a hands-off approach, refraining from administrative intervention in remittance sending and receiving processes, and instead aiming to channel these resources into productive sectors. The proposal is now being refined before its official issuance by the Ho Chi Minh City People’s Committee.

Boosting Foreign Currency Supply

Mr. Tran Minh Khoa, Chairman and CEO of Sacombank-SBR, the bank’s remittance arm, reported a nearly 19% year-on-year increase in remittances to Vietnam through their system in the first seven months of this year. These funds, sent by overseas Vietnamese and Vietnamese expatriates, are primarily used to support their families or for savings. “What’s unique is that this inflow of foreign currency is one-directional and stable, indirectly boosting consumption and economic growth, increasing savings, and reducing capital mobilization risks and reliance on external foreign currency sources,” said Mr. Khoa. Remittances also help meet the economy’s foreign currency needs, thereby easing pressure on exchange rates.”

Remittances, along with other capital sources, have become a crucial resource for the economic growth and development of both Vietnam and Ho Chi Minh City specifically.

At the recently held “4th Global Conference of Vietnamese Diaspora,” the Ministry of Foreign Affairs shared that over the years, overseas Vietnamese have become an essential resource in the country’s construction and development journey. Statistics show that in over 30 years, total remittances to Vietnam have reached approximately $230 billion, equivalent to foreign direct investment disbursements in the same period.

Experts believe that Vietnam’s potential for attracting remittances remains significant.

In Ho Chi Minh City alone, data from the State Bank of Vietnam’s Ho Chi Minh City branch revealed that remittances reached $5.17 billion in the first half of 2024, a 19.5% increase compared to the same period in 2023. Against this backdrop, the city has developed a proposal on remittances, focusing on harnessing the role of remittances, attracting more remittances, and utilizing these resources effectively.

Preparing for the Influx: Technological Enhancements

In anticipation of the proposal’s implementation and the subsequent surge in remittances, Sacombank-SBR has been strengthening its technological infrastructure. They have invested in establishing a system that meets safety and security standards, connecting with most partners to provide the best money transfer services. Within just a few seconds, recipients in Vietnam can receive money in their accounts from overseas Vietnamese or Vietnamese expatriates sending remittances.

Exploring Bond Issuance for Overseas Vietnamese

Mr. Vo Hoang Hai, Deputy General Director of Nam A Bank, shared that the bank is researching and developing mechanisms and policies related to financial programs for overseas Vietnamese. This includes a focus on digital transformation to reduce costs and ensure safety. The bank is also working on business plans involving the development and integration of applications, providing payment solutions, connecting remittance channels, managing cash flow and investment capital, and connecting with foreign investors and overseas Vietnamese. “The bank is actively creating preferential policies to support overseas Vietnamese businesses investing in Vietnam, particularly in green and digital fields like high technology, clean agriculture, and carbon credits. We also support investments in vacation real estate and repatriation,” said Mr. Vo Hoang Hai.

Economic expert Dr. Nguyen Tri Hieu analyzed that remittances flowing into Vietnam are primarily used for domestic consumption and investment in real estate, industrial, and agricultural sectors. However, remittances have not been utilized for infrastructure development in Vietnam, while the country’s transportation systems, aviation, railways, and other infrastructure are in need of modernization and substantial investment.

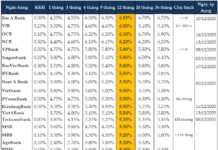

According to Dr. Hieu, with approximately 5.5 million overseas Vietnamese worldwide and a total annual income of over $100 billion (equivalent to a quarter of Vietnam’s GDP), remittances to Vietnam in 2023 amounted to only about $16 billion. This indicates a significant potential for attracting more remittances. “Currently, banks offer a 0% interest rate on USD deposits, making it less appealing for overseas Vietnamese to save in this currency. Therefore, I suggest exploring a plan to issue bonds for overseas Vietnamese in high-income countries to contribute to the development of Ho Chi Minh City,” Dr. Hieu proposed.

Should We Track Remittance Flows for Better Policy-Making?

In the past, Vietnam used to track the amount and proportion of remittances flowing into different sectors, including production and business, real estate, and consumption. However, in recent years, the data only shows the total remittances entering Vietnam without specifying their allocation. So, should we consider researching and tracking remittance flows to develop more effective policies?

Sacombank-SBR, as a service provider, fulfills customers’ requests for sending and receiving remittances. Once the money reaches the recipient, it can be used for various purposes, including consumption, investment in production and business, savings, and more, making it challenging to track.

Mr. Tran Minh Khoa suggested that if tracking remittance flows, it should be done through voluntary surveys of recipients conducted by independent and professional statistical organizations. This would provide insights into how remittances are utilized, helping authorities develop appropriate policies and mechanisms to attract and channel remittances into specific areas, voluntarily and beneficially.

With concrete statistics, service providers and authorities can formulate policies to better serve and attract more remittance resources in the future.

(To be continued)

2023 Remittances Surpass Half of Ho Chi Minh City’s Budget Revenue

As part of the Homeland Spring 2024 program in Ho Chi Minh City, this morning (2/2), the overseas Vietnamese delegation had a tour of the City Hall and met with city leaders.