Vietnam Dabaco Group Joint Stock Company (code: DBC-HOSE) announces the Board of Directors’ resolution on the handling of the remaining unallocated shares.

Accordingly, at the end of the offering period to existing shareholders on August 15, Dabaco Vietnam had offered 77.88 million shares out of a registered offering of 80.67 million shares, equivalent to 96.5% of the total registered offering, with 2,792,078 shares remaining unoffered.

Notably, the unoffered shares will be subject to a one-year restriction on transfer from the date of the offering completion.

It is known that the offering price of Dabaco Vietnam’s shares is 46.5% lower than the closing price on August 23, which was 28,050 VND/share, and the share price closed at 27,550 VND/share on August 26.

In addition, Dabaco Vietnam also reported the offering of 11,730,000 shares under the Employee Stock Ownership Plan (ESOP) out of a total offering of 12 million shares, with 270,000 shares remaining unallocated.

The company will offer ESOP shares to other employees at a price of 10,000 VND/share, with a registration and payment period from August 26 to 11:00 am on August 29. Mr. Nguyen Danh Quyet, Director of the Project Management Board, is eligible to purchase 100,000 shares; Mr. Tran Cong Nam, Director of Technical Quality Management, is eligible to purchase 90,000 shares; and Ms. Nguyen Thi Kim Oanh, in charge of shareholder relations, is eligible to purchase 80,000 ESOP shares.

Previously, on June 5, Dabaco Vietnam approved two plans to increase its charter capital by offering shares to existing shareholders and issuing shares under the ESOP program.

Firstly, the company planned to offer 12 million shares under the ESOP program, equivalent to 4.96% of the total outstanding shares, at an issuance price of 10,000 VND/share.

In addition, Dabaco Vietnam approved the plan to offer shares to existing shareholders at a ratio of 33.33%, meaning that for every 100 shares owned, shareholders would have the right to buy more than 33 new shares at a price of 15,000 VND/share, with the offering expected to be implemented in 2024.

Based on the number of shares outstanding, Dabaco Vietnam is expected to offer an additional 80,667,286 shares to existing shareholders to raise over VND 1,210 billion.

Thus, if both offerings are completed, Dabaco Vietnam’s charter capital will increase from VND 2,420 billion to VND 3,346.7 billion. The total amount of VND 1,330 billion raised will be used by the company to invest in Dabaco Vegetable Oil Company to implement the “Project for the Construction of a Soybean Oil Pressing and Refining Plant.”

Prior to this, Pyn Elite Fund reported the purchase of 1.63 million DBC shares through matching orders, increasing its ownership to 22.8 million shares, or 9.45% of DBC’s capital. Since May, the foreign fund has continuously bought 6.63 million DBC shares, with a total value of approximately VND 192 billion.

As of the closing price on August 1, at VND 26,250/share, Pyn Elite Fund has spent about VND 42.7 billion on this transaction.

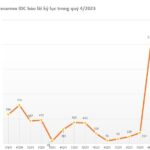

In terms of business results, DBC published its second-quarter 2024 financial statements, reporting revenue of VND 3,185 billion, an 8% decrease compared to the same period last year (VND 3,473 billion); gross profit decreased by 35% to nearly VND 431 billion; financial revenue decreased by 60% to nearly VND 5 billion, while financial expenses increased by 13% to VND 80 billion. After deducting expenses, Dabaco’s after-tax profit decreased by 55%, from VND 327 billion to VND 145 billion.

For the first half of 2024, DBC recorded revenue of VND 6,437 billion, up 11% over the same period last year (VND 5,787 billion); and after-tax profit of over VND 218 billion, 36 times higher than the figure in the first half of 2023 (VND 6,091 billion).

According to Dabaco’s explanation, in the second quarter of 2024, the prices of raw materials for animal feed production, both domestic and imported, continued to fluctuate; diseases in livestock and poultry, especially the African Swine Fever, remained complex and widespread, leading to a significant reduction in the national pig herd, which also affected the company.

Although the domestic live hog prices increased, the production and business results of the livestock units in the Group did not improve significantly. Meanwhile, in the same period last year, the parent company recorded profits from real estate business activities.

In 2024, DBC approved a business plan with a revenue target of VND 25,380 billion, up 14% over the previous year, and an after-tax profit target of VND 729.8 billion, 29 times higher than the result in 2023.

Thus, after six months, DBC has achieved 25% of its revenue target and 30% of its profit target for the year.

A “squad” carrying mattresses back home for Tet holidays

In 2023, May Sông Hồng achieved a net revenue of 4,542 billion VND, a decrease of 18% compared to the previous year, and a post-tax profit of over 245 billion VND, experiencing a decline of nearly 28%.