Investment and Tourism Joint Stock Company Van Huong has just sent a periodic report on its financial situation for the first half of 2024 to the Hanoi Stock Exchange (HNX).

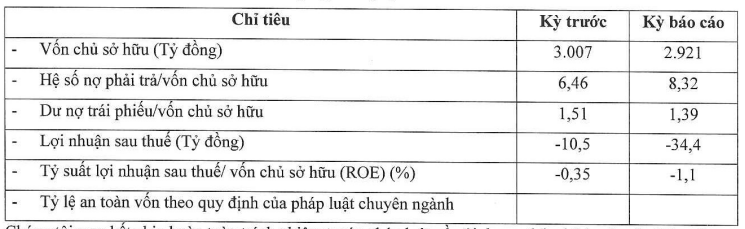

According to the report, Van Huong incurred a post-tax loss of over VND 34 billion in the first half of 2024, a deeper loss compared to the same period last year, which stood at VND 10.5 billion. Prior to this, Van Huong had consecutively incurred losses in the previous two years, amounting to VND 62 billion in 2023 and VND 5.4 billion in 2022.

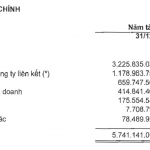

As of the end of the second quarter of 2024, the company’s equity decreased by 2.8% from the beginning of the year to VND 2,921 billion. The debt-to-equity ratio increased from 6.46 times to 8.32 times, corresponding to a total debt of over VND 24,302 billion, of which bond debt accounted for more than VND 4,000 billion.

Source: HNX

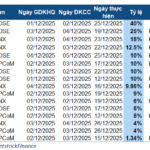

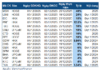

According to the report sent to HNX, Van Huong currently has six bond issues outstanding. In the first half of this year, the company paid nearly VND 284 billion in interest on these bonds.

During this period, Van Huong also repurchased four bond issues prior to their maturity. Specifically, for the bond code DRGCH2226001, the company repurchased VND 113.5 billion on February 29, 2024, and VND 113.5 billion on May 31, 2024. The remaining value of this bond issue is VND 854.5 billion.

For the bond code DRGCH2126002, Van Huong repurchased a total of VND 95 billion on February 29, 2024, and May 31, 2024. The remaining value of this bond issue is VND 375.5 billion.

As of the latest update on July 16, Van Huong successfully issued a new bond issue with the code DRGCH2427001, comprising 13,962 bonds with a face value of VND 100 million each. The total issuance value was VND 1,396.2 billion.

The issuance date was July 16, 2024, and the settlement date was August 14, 2024. The bonds have a tenor of 36 months and will mature on July 16, 2027. The interest rate at issuance was set at 10% per annum. This is the first bond issue by Van Huong in the past two years.

Investment and Tourism Joint Stock Company Van Huong is the developer of the Dragon Hill International Tourism Project in Van Huong Ward, Do Son District, Hai Phong City.

According to PV data recorded on July 22, Van Huong entered into a mortgage transaction with ABBank Hanoi Branch, using assets from the ND-LK100-01 to ND-LK100-10 plots in Zone 8 of the Dragon Hill International Tourism Project as collateral. These assets are located in Van Huong Ward, Do Son District, Hai Phong City.

On July 23, Van Huong again entered into a mortgage transaction with ABBank Hanoi Branch, this time using assets from the ND-LK101, ND-BT103 to ND-BT111, and ND-BT116 to ND-BT117 plots in Zone VIII of the Dragon Hill International Tourism Project as collateral. These assets are also located in Van Huong Ward, Do Son District, Hai Phong City.

“How does Novaland strive to make billions of profits?”

Currently, the NVL stock is experiencing margin cuts, which greatly limits its liquidity attraction. The return of positive profits is a necessary condition for the company’s stock to be granted margin again.