On August 27, 2024, the Government Inspectorate published its findings on the “Compliance with laws on equitization and state capital divestment at the Investment and Development Construction Corporation (now DIC Corp., stock code: DIG).”

Following this announcement, DIG’s stock price dropped significantly during the trading session on August 28, even approaching the floor price at one point.

According to the Government Inspectorate, the equitization and state capital divestment process at this company has revealed limitations, shortcomings, and violations. These include non-compliance with regulations regarding the equitization procedure and inaccurate asset valuation, particularly regarding capital investment in land, which resulted in a discrepancy in the assessed value of assets compared to the prescribed value.

For instance, there were violations in determining the value of land-use rights. The appraisal unit failed to reassess the value of land-use rights for 25 villas in the Phuong Nam Villa complex and the Dai Phuoc Eco-Tourism Urban Area project. Instead, they used the accumulated investment costs and the value of the project’s development rights to calculate the value of the equitized enterprise, which is contrary to the government’s regulations.

The Government Inspectorate also pointed out that during the settlement of state capital value, the Investment and Development Construction Corporation incorrectly recorded the losses of its three subsidiaries into the state capital value to be transferred to the joint-stock company. This action is inconsistent with the government’s regulations. Other violations were also identified concerning the issuance of private placement shares, procedures for divestment, and determination of the price of state capital shares.

RECOMMENDATIONS BY THE GOVERNMENT INSPECTORATE

Based on the inspection results, the Inspectorate General has recommended that the Prime Minister direct the Ministry of Construction to:

+ Organize a review and take disciplinary action according to regulations against the collective leadership of the Ministry during the 2007-2008 and 2016-2017 periods, as well as related organizations and individuals, for their involvement in the aforementioned limitations, violations, and shortcomings identified in the inspection findings.

+ Urge relevant organizations and individuals to rectify the amount of money involved in the violation regarding the determination of asset values on land as detailed in Appendix 03 attached to the inspection conclusions. Identify the causes of the losses at DIC No. 1 JSC, DIC Construction Materials JSC, and DIC Tourism JSC, and implement appropriate measures in accordance with the government’s regulations mentioned in Clause 4, Article 21 of Decree No. 109/2007/ND-CP. Clarify the instructions on the offering price of private placement shares in 2009, and review and clarify the failure to re-evaluate the land-use rights of three land plots during the appraisal of shares for state capital divestment at the Corporation.

+ Coordinate with the People’s Committee of Dong Nai province to review the determination of the value of land-use rights at the Dai Phuoc Eco-Tourism Urban Area project. If the reassessed value of the land-use rights is lower than the accumulated investment costs and the value of the project’s development rights that have been included in the enterprise’s value, then the original value will be retained. However, if it is higher, then the difference should be paid as a supplement to the state budget.

POSITIVE OUTCOMES FROM THE EQUITIZATION OF DIC CORP.

“The process of equitizing the Investment and Development Construction Corporation and divesting state capital from DIC Corp. has received attention and proactive implementation by the Ministry of Construction, achieving positive results. It has successfully mobilized resources from various economic sectors to enhance the company’s financial capacity and efficiency.”

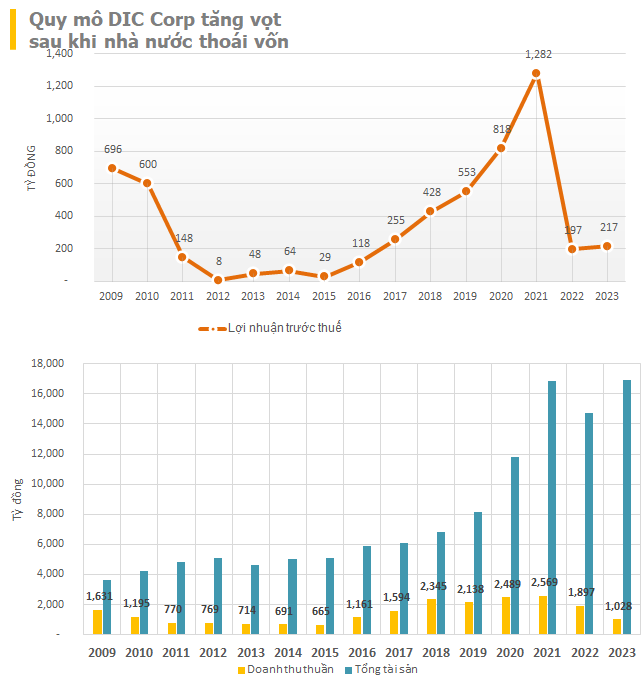

From the time of its transformation into a joint-stock company until the complete divestment of state capital, DIC Corp.’s charter capital increased from VND 370 billion to VND 2,382 billion. Its total assets also grew from VND 2,319 billion at the time of the transition to a joint-stock company to VND 6,133 billion as of September 30, 2017, before the complete divestment of state capital. The company has distributed dividends of over VND 400 billion for the state capital portion. The value of state capital has increased from VND 240 billion at the time of equitization to VND 1,182 billion after divestment. An amount of over VND 2,274 billion has been contributed to the Enterprise Arrangement and Development Support Fund, with a surplus capital of VND 1,092 billion. The equitization and divestment processes ensured timely progress in line with the government’s and Prime Minister’s directions…” as stated in the inspection document.

Established in 1990, DIC Corp. originated as a small company under the Ministry of Construction in Vung Tau city. By the first quarter of 2008, the company had completed its equitization process. On August 19, 2009, it officially listed its shares on the Ho Chi Minh City Stock Exchange under the stock code DIG.

From 2018 onwards, DIG underwent a significant transformation, focusing on restructuring and investing in real estate development in two main areas: urban areas and resort tourism. Currently, the company owns several large-scale projects under the DIC Star brand in Vung Tau, Hau Giang, and Quang Binh provinces within the resort tourism sector. It also has large-scale urban area projects such as DIC Chi Linh City (99.7 ha), DIC Solar City Vung Tau (90.5 ha), and DIC Phu My Ba Ria (35 ha), with a total land fund of over 800 ha.

On the stock market, DIG is one of the prominent real estate businesses, with a charter capital of VND 18,444.5 billion and owner’s equity of over VND 7,889 billion. The company generates thousands of billions of dong in revenue and hundreds of billions in profit annually. In 2023, despite market challenges, DIG still achieved VND 1,039 billion in revenue and nearly VND 118 billion in net profit.

For 2024, DIG has set ambitious plans, targeting VND 2,300 billion in revenue, a 72% increase, and VND 1,010 billion in expected pre-tax profit, representing a significant 509% increase compared to the previous year’s performance. According to the company, the projected profit for 2024 is based on its business plan and expected revenue from the transfer of products at various projects: the Dai Phuoc Eco-Tourism Urban Area (Dong Nai), Lam Ha Center Point Urban Area (Ha Nam), DIC Nam Vinh Yen City (Vinh Phuc), DIC Victory City (Hau Giang), Hiep Phuoc Residential Area, Vung Tau Gateway Apartment Building, and the CSJ Phase 1 project, all of which are highly feasible.

In the first half of 2024, the company’s consolidated revenue reached approximately VND 875 billion, and its pre-tax profit was VND 40 billion, equivalent to 38% of the revenue plan and about 4% of the profit plan. The company has resolved legal procedures in the second quarter of 2024, providing a basis for accounting for these indicators in the last six months to ensure a consolidated pre-tax profit of VND 1,010 billion. This year also marks the 35th anniversary of DIG’s establishment.

Revealing a Series of Businesses with Irregularities in Quang Nam

Through the inspection of mining operations at 9 enterprises, the Provincial Inspection agency of Quang Nam has identified violations at 8 units.

Auction Over 15 Thousand Vehicle License Plates, with a Total Value of Over 2 Trillion VND

Over the course of three months, more than 15,000 license plates for automobiles have been successfully auctioned off, bringing in a total of over 2,000 billion Vietnamese Dong, according to Nguyen Van Trung, the Director of the Traffic Police Department.