Illustration photo

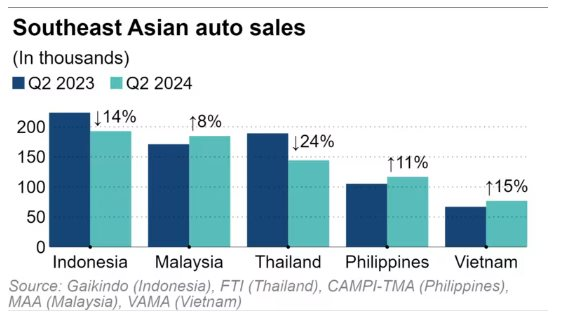

According to Nikkei Asia, Malaysia has witnessed a surge in car sales since the beginning of the year and is now just 8,000 units behind the largest market, Indonesia, in the second quarter.

Specifically, Malaysia surpassed Thailand to claim the second spot with a rapid growth rate. Sales data for the second quarter from Nikkei across five countries, including Indonesia, Malaysia, Thailand, the Philippines, and Vietnam, revealed that Malaysia’s sales volume trailed Indonesia’s by only 8,134 units, a significant reduction from the 89,474-unit gap in the first quarter of 2023.

Per the Malaysia Automotive Association, car sales climbed 8% year-on-year to 184,702 units in the second quarter, led by national auto brands Perodua and Proton.

Malaysia emerged as the second-largest auto market in the region, surpassing Thailand. Source: Nikkei

Malaysia’s economic growth reached 5.9% year-on-year. With inflation hovering between 1.7% and 2.0% and the strengthening of the ringgit, consumers felt more comfortable considering big-ticket items like automobiles.

Proton and Perodua are popular for their competitive pricing. Government policies support national brands through high import duties, excise duties, and sales taxes on foreign vehicles. Perodua benefits from its partnership with Daihatsu and Toyota, offering diverse models, good after-sales service, and fuel efficiency.

Electric and hybrid vehicles are driving overall sales growth. In the first half, Malaysia’s electric vehicle sales totaled 10,663 units, a 2.4-fold increase year-on-year. Hybrid vehicle sales reached 11,722 units, up 21.8%.

Rasman Abdullah, head of the Honda car dealership in Glenmarie, noted a surge in demand for hybrid vehicles, with sales rising about 30% in the first half of the year.

He stated, “There is a backlog of orders for Honda’s hybrid models, including the HR-V, CR-V, and City. The demand has been particularly high since the beginning of 2024.” He also observed an increase in order volume in both the second and third quarters, with expectations that demand will continue to rise towards the year’s end.

The Toyota Corolla Cross hybrid remained the most popular model, selling 3,869 units, followed by the Honda HR-V hybrid with 2,750 units. As the dealer remarked, Honda dominates the hybrid segment with its City, CR-V, and Civic models.

Malaysia’s ascent in the Southeast Asian auto market coincides with a slowdown in Indonesian car sales.

According to the Indonesia Automotive Industry Association, car sales in the second quarter fell 14% year-on-year. While this decline is less steep than the 24% drop in the first quarter, monthly sales have been lower year-on-year for 13 consecutive months since July 2023.

This downturn is attributed to customer concerns about rising gasoline and maintenance costs, increasing interest rates, and the weakening of the rupiah against the US dollar, which has reduced consumers’ purchasing power.

The Thai market is also experiencing a downturn. According to the Federation of Thai Industries, car sales in the second quarter dropped 24% year-on-year, following a 25% decline in the first quarter.

One factor hindering consumption is the tightening of auto loan lending by Thai banks due to high household debt, which stood at 91% of GDP in the middle of this year.

Source: Nikkei Asia

Territory-based credit policy in Ho Chi Minh City shows nearly 39% growth

Credit programs, not only support and assist the poor and vulnerable, who are the main subjects of policies in Ho Chi Minh City, with capital for production and business to create livelihoods and employment opportunities, but also play a significant role in the direction of sustainable economic development, economic growth, and social security ensured by the Government.

Will Vietnamese fruit and vegetable exports set a new record?

From the beginning of 2024, the export field of vegetables and fruits in Vietnam has received positive signals, with the estimated export turnover of over 500 million USD. With the current market trends, the vegetable and fruit industry is forecasted to set a new record and contribute 6-6.5 billion USD to the agricultural sector in 2024.