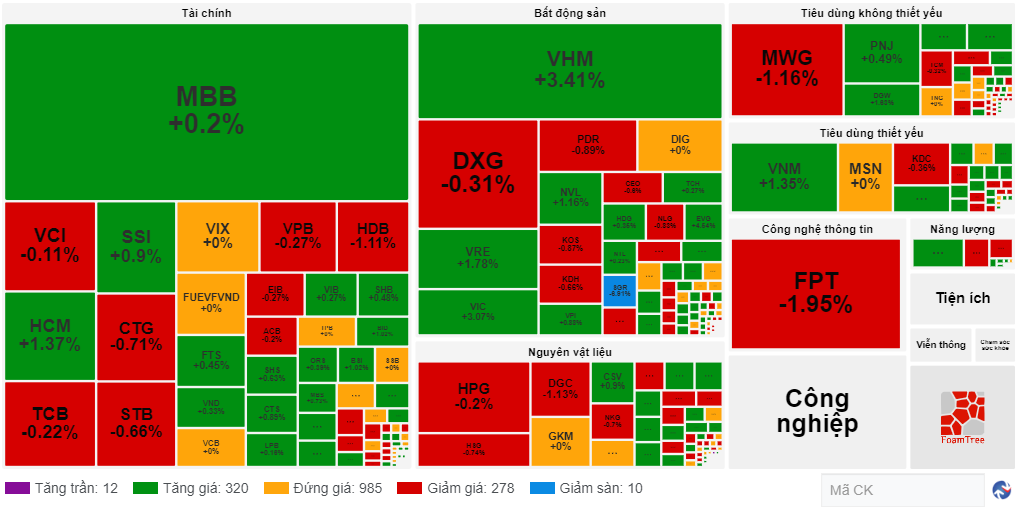

The market breadth saw 331 stocks advancing, including 12 stocks that hit the ceiling price, while there were 288 declining stocks, including 10 stocks that fell to the floor price. The remaining 985 stocks stayed unchanged. Green dominated the market.

Source: VietstockFinance

|

Investors paid great attention to pillar stocks in the banking sector such as MBB, VIB, SHB…, securities such as SSI, HCM, FTS, VND…, and real estate, especially the Vingroup trio of stocks, including VHM up 3.41%, VIC up 3.01%, and VRE up 1.78%. Stocks in these sectors also took turns influencing the market in the morning session.

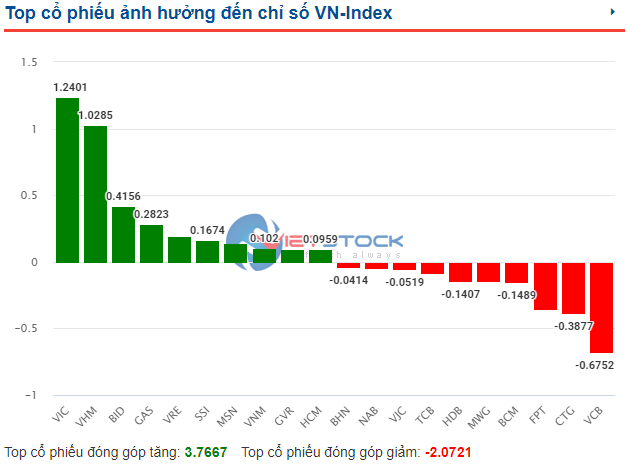

These three stocks also had a significant impact on the VN-Index, with VHM contributing 1.59 points, VIC 1.3 points, and VRE 0.2 points. All three were among the top 10 stocks with a positive impact on the VN-Index in the morning session. On the other hand, FPT was the biggest drag, taking away 0.9 points.

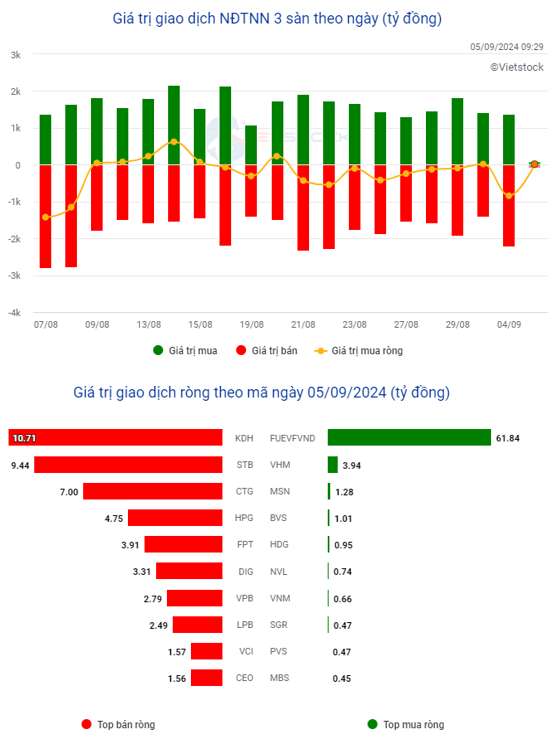

FPT was also the most net sold stock in the market, with a net sell value of more than VND234 billion, far surpassing the next stocks such as HPG with more than VND53 billion, VCI with nearly VND45 billion… In terms of net bought value, VHM attracted nearly VND78 billion, FUEVFVND more than VND65 billion, VNM more than VND34 billion, and NVL nearly VND13 billion. By the end of the morning session, foreign investors net sold more than VND525 billion.

10:45 am: Continuing to gain, momentum from finance and real estate sectors

Following the positive momentum from the beginning of the morning session, the market continued to gain, driven by the pillar sectors of finance and real estate. As of 10:30, the VN-Index increased by 5.07 points to 1,280.87, while the HNX and UPCoM also turned green.

The market map was filled with green as financial stocks such as MBB, HCM, SSI, VIX, FTS,… rose alongside real estate stocks such as DXG, PDR, DIG, NVL, and the Vingroup trio of VIC, VHM, and VRE. Although the gains were not significant, the evenly distributed increases, along with their high weightings in the market, provided a strong boost to the indices.

The total trading value of the market reached VND6,247 billion, notably higher than the previous session and slightly above the 5-session average.

The block net buying by foreign investors continued, with strong net buying in VHM of over VND55 billion and FUEVFVND of nearly VND54 billion. On the other side, FPT experienced the largest net sell-off of nearly VND71 billion, followed by CTG, STB, HPG, KDH, VPB…, which were net sold relatively evenly around VND30 billion.

Opening: Vingroup trio accelerates, the market rebounds slightly after yesterday’s decline

After falling more than 8 points in the previous session, the VN-Index rebounded by 2.88 points to 1,278.68 at the opening bell today (September 5), as of 9:30 am. Green also appeared on the HNX and UPCoM, which increased by 0.44 points to 236.58 and 0.21 points to 93.96, respectively.

Overall, there were 278 advancing stocks, including 11 stocks that hit the ceiling price, while the number of declining stocks was lower, at 157, including 2 stocks that fell to the floor price. Trading volume was higher than the previous session.

The trio of Vingroup stocks stood out in the market and the real estate sector. Specifically, VIC increased by 2.84%, VHM by 2.35%, and VRE by 1.52%. All three were also among the top 10 stocks with a positive impact on the VN-Index, contributing 1.24 points, 1.03 points, and 0.2 points, respectively, out of a total increase of 3.77 points from the top 10 stocks.

Source: VietstockFinance

|

Source: VietstockFinance

|