May Song Hong: Poised for Leadership in Vietnam’s Textile Industry

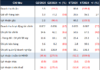

In a recent report, VNDirect Securities assessed that Song Hong Garment JSC (stock code: MSH) – the second-largest listed company in the textile industry in terms of market capitalization – is well-positioned to become a leading player in the sector.

MSH’s production facilities in Nam Dinh, the cradle of Vietnam’s textile industry

LOCATED IN THE HEART OF VIETNAM’S TEXTILE INDUSTRY

According to VNDirect, all of May Song Hong’s production facilities are strategically located in Nam Dinh, often referred to as the cradle of Vietnam’s textile industry. The province boasts a well-developed supporting industry for textile manufacturing, including the production of raw materials (such as cotton, yarn, fabric, and dyes), auxiliary materials (like threads, buttons, zippers, and lace), accessories (keys, pins, beads, and sequins), and machinery (embroidery machines, overlock machines, hole-punching machines, and button machines).

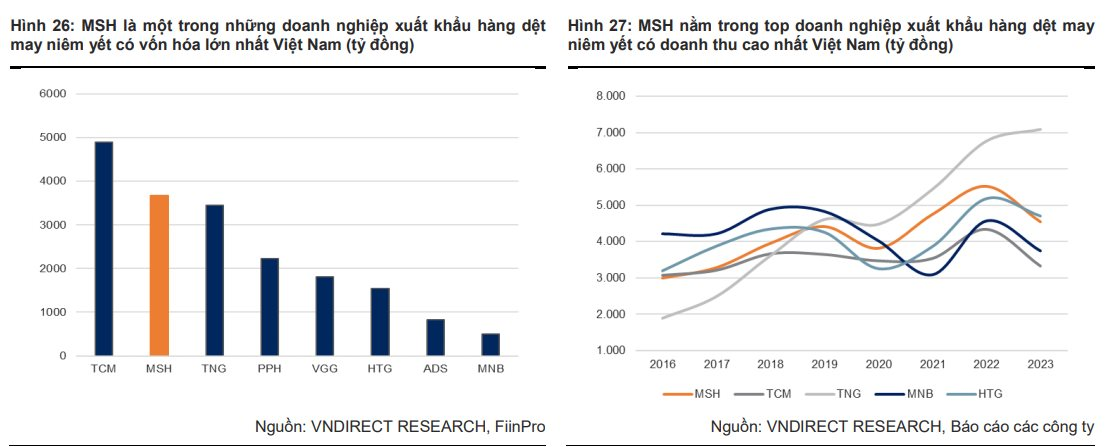

Nam Dinh is poised to become a northern hub for the textile industry. The province is actively attracting investors to the textile sector, particularly in supporting industries such as fabric production. Recently, two companies from Hong Kong and mainland China received investment registration certificates for dyeing and weaving projects from the Nam Dinh Industrial Zone Management Board.

Additionally, several Taiwanese and Singaporean investors are expected to commence production in 2024 at the Aurora Industrial Park in Nghia Hung, Nam Dinh, further bolstering the province’s textile capabilities.

This development aligns with the Vietnamese government’s strategy to enhance self-sufficiency in the textile industry. As per the “Strategy for Developing Vietnam’s Textile and Footwear Industries by 2030, with a Vision to 2035,” approved by the government in December 2022, the localization ratio in the textile industry is targeted to reach 51-55% in the period of 2021-2025. This ratio is expected to increase to 56-60% in the period of 2026-2030, up from the current level of 47-50%.

VNDirect expects local fabric production to ease supply bottlenecks

VNDirect anticipates that promoting investment in fabric production in Nam Dinh will help address fabric supply constraints.

Moreover, the formation of large-scale textile industrial parks will spur comprehensive and centralized investment in wastewater treatment systems, incorporating advanced and environmentally friendly technologies.

This development will benefit textile companies operating in Nam Dinh, including May Song Hong.

ENHANCING FOB PRODUCTION CAPABILITIES TO CATER TO NEW ORDERS

May Song Hong is committed to establishing a factory that meets high standards and embraces environmental friendliness. The new Xuan Truong factory is the company’s most significant investment in technology, energy efficiency, and emission reduction, aiming to become a high-tech green factory.

Their initiatives include utilizing natural light, LED lighting, and planting trees around the production area. Furthermore, May Song Hong is transitioning from coal-fired boilers to electric boilers at the Song Hong 7 and Song Hong 9 factories, with plans to continue these improvements in other production areas.

VNDirect believes that May Song Hong will be a pioneer in sustainable production thanks to its solid financial foundation and leadership aspirations. The securities firm also expects May Song Hong to secure more FOB orders from its existing clients.

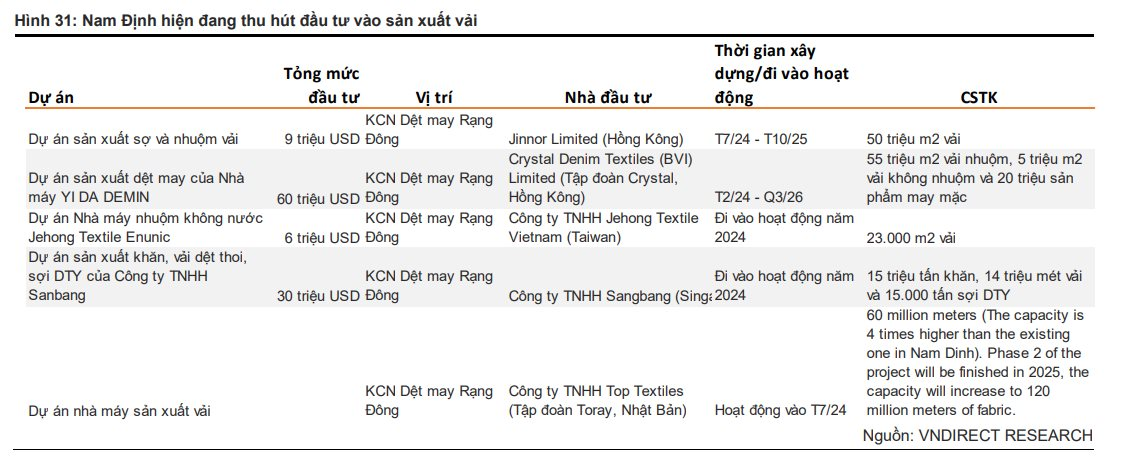

May Song Hong’s partners forecast revenue growth in the 2024-2025 period. G-III and Columbia Sportswear anticipate revenue improvements of 3-5% year-over-year in 2024-2025, following a decline in 2023.

Revenue growth expectations from key partners

Additionally, VNDirect believes that MSH is well-positioned to benefit from its current clients’ efforts to reduce their reliance on Chinese suppliers. G-III, one of May Song Hong’s major customers, has expressed a preference for Vietnamese partners over Chinese ones.

In 2023, products sourced from Vietnam accounted for 31.4% of G-III’s total inventory, up from 24.6% in 2020. In contrast, products sourced from China made up 37.6% of G-III’s total inventory in 2023, down from 49.5% in 2020.

XUAN TRUONG FACTORY: A NEW ACE IN THE HOLE

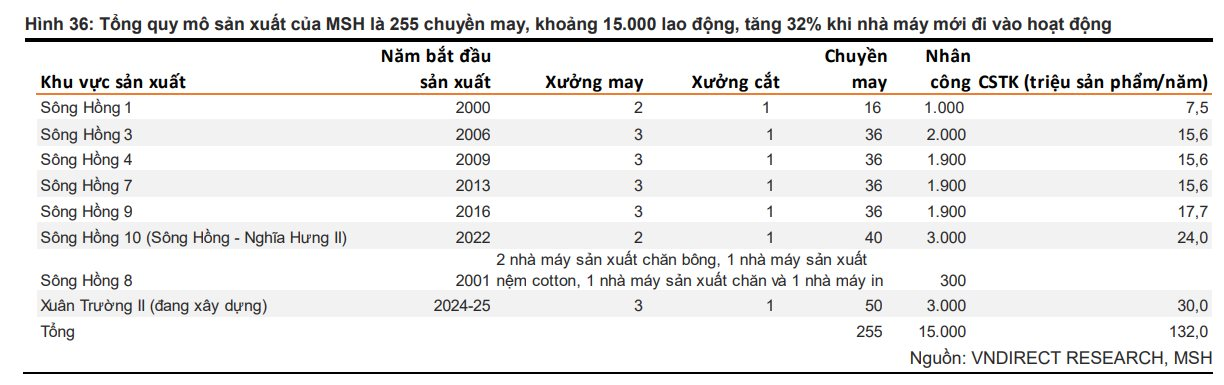

According to VNDirect, the construction of the Xuan Truong II factory commenced in Q4 2023, with operations expected to begin in late 2024 or early 2025. The factory entails a total investment of VND 700 billion, spanning an area of 9.6 hectares, and comprising 3 factories, 1 warehouse, and 1 cutting facility.

With 50 production lines, the factory is designed to produce 30 million units annually. The Board of Directors expects the factory to operate at 50% capacity in 2025, contributing VND 700 billion to total revenue, and projects full capacity utilization from 2027 onwards, generating VND 1,500 billion, equivalent to 25% of current revenue.

Once the new factory reaches full capacity, May Song Hong’s production scale will encompass 255 production lines, approximately 15,000 employees, and a 32% increase in designed capacity compared to the present.

Xuan Truong factory: May Song Hong’s new growth engine

However, as of Q2 2024, VNDirect estimates that May Song Hong has disbursed only VND 50 billion of the total investment of VND 700 billion for the factory. The securities firm believes that the implementation progress will be slower than the company’s plan, and the factory is expected to become operational in Q3 2025.

VNDirect estimates that the new factory will contribute approximately VND 250 billion, equivalent to 5% of total revenue, in 2025. They anticipate the Xuan Truong factory to operate at full capacity in 2028, generating revenue of VND 1,500 billion, or 19% of total revenue in 2028.

PRICE INCREASES IN 2024-2025 AS INFLATION COOLS, BOOSTING PROFIT MARGINS

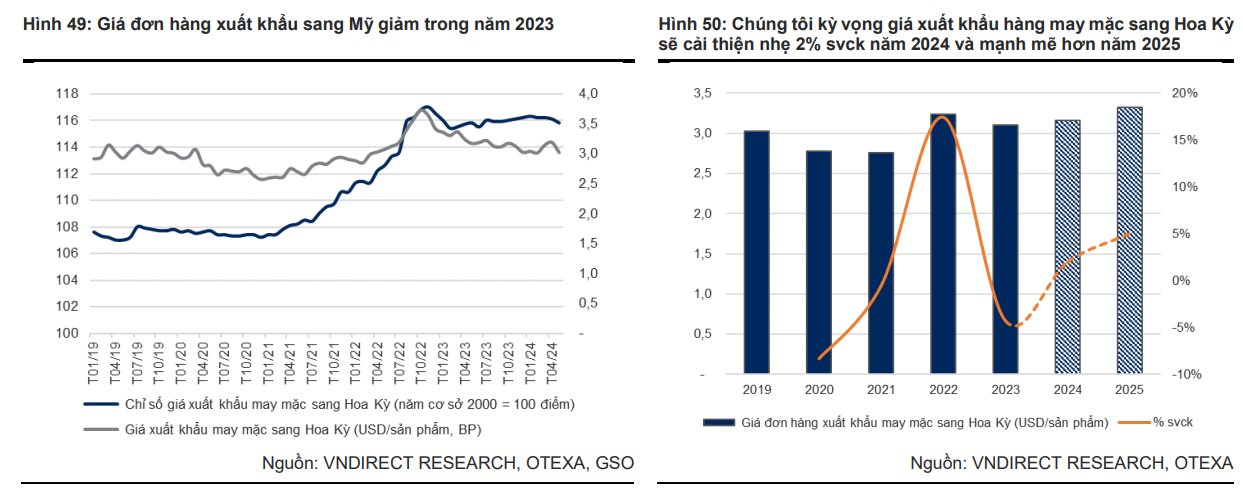

VNDirect expects a slight improvement of 2% in export prices for garments to the US in 2024, followed by a more robust recovery in 2025 as inflation eases. MSH’s management shares a similar outlook, anticipating a mild increase in export order prices in 2024 and a rebound in 2025.

Expected improvement in export prices to the US

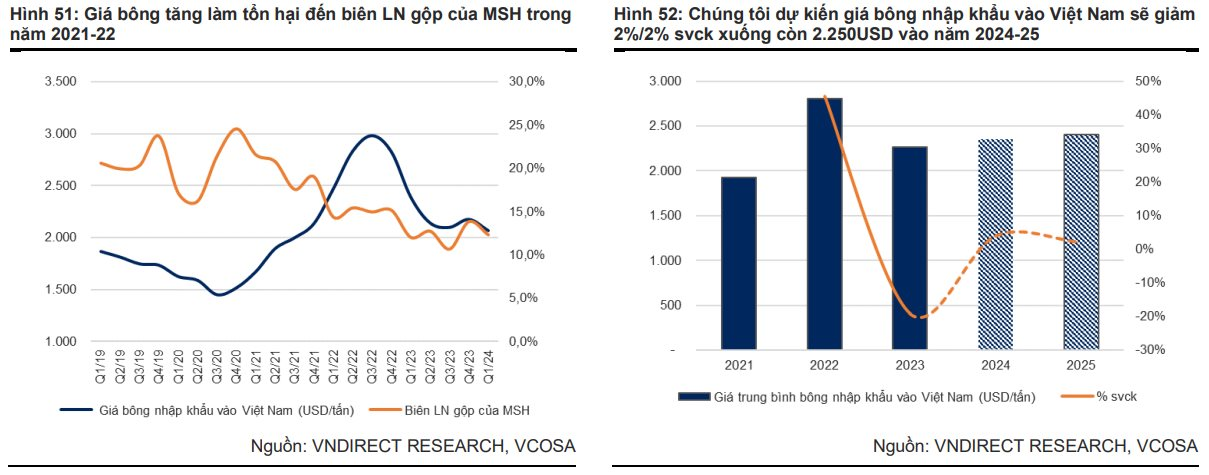

Additionally, VNDirect believes that stable raw material costs will support gross profit margins. According to the US Department of Agriculture (USDA), cotton prices are projected to remain stable at $2,200-2,300 per ton in 2024, as global cotton production and consumption are expected to increase by 3% each in the 2024-25 season.

VNDirect forecasts that the import price of cotton into Vietnam will stabilize at around $2,250 per ton in 2024-25. The securities firm expects May Song Hong’s gross profit margin to improve by 1.1/1.6 percentage points in 2024-2025.

VNDirect’s projection for stable cotton prices and improved profit margins

Exporting Made Easy: Navigating Orders and Pricing

Many enterprises have secured export orders through to the end of this year and even into the first quarter of 2025. However, they are facing the challenge of decreasing order values amidst rising costs.