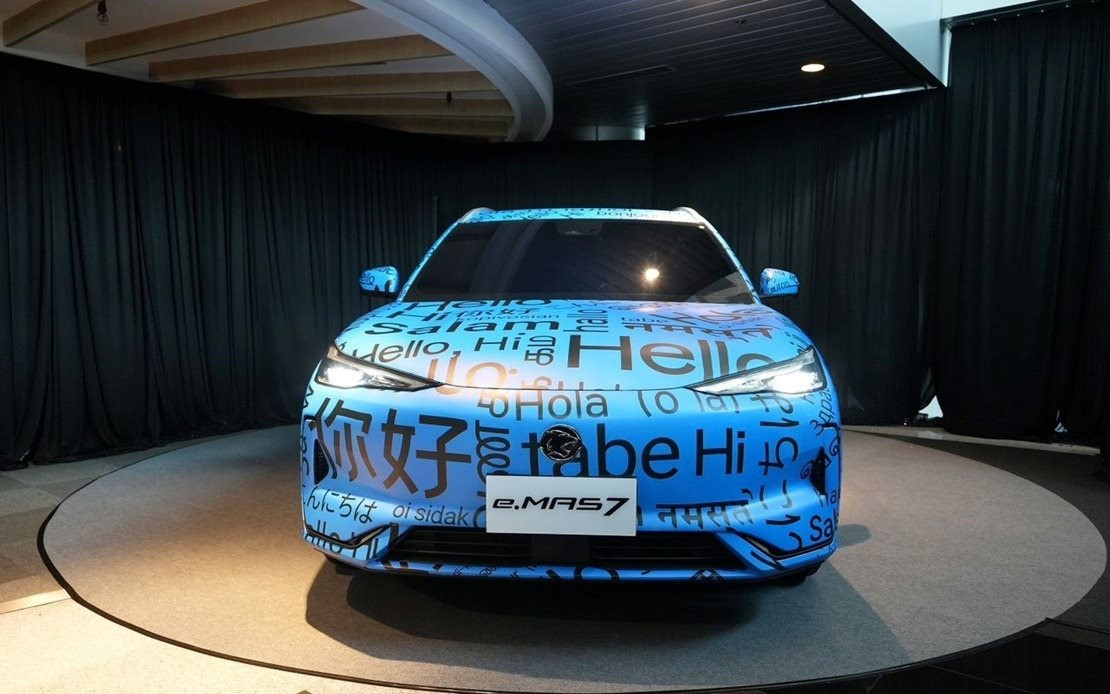

The upcoming e.Mas 7 from Proton.

Like many other Malaysians, Adit Rahim grew up with – and has owned – Protons and Peroduas – Malaysia’s homegrown automotive brands. He has considered switching to electric vehicles but decided against buying a BYD or a Tesla – the most popular EV brands on the market. He wants to wait for Proton’s first electric car, due out later this year.

“My first and second cars were both Protons, both second-hand,” said the 47-year-old media professional to Rest of World. “I seriously considered buying a Tesla, but it was out of my budget, and BYD didn’t have a suitable model for me.”

With their affordable pricing, models from the two domestic brands, Proton and Perodua, have become the first cars for many generations of Malaysians. They account for almost two-thirds of car sales in Malaysia, in contrast to many other Southeast Asian countries – where Japanese and Korean brands dominate.

As EV sales soar, BYD is taking the lead, but Malaysians are looking to Proton and Perodua to drive the EV transition.

In June, Proton – backed by its Chinese partner, Geely Holding – unveiled its own electric vehicle brand, e.Mas, with plans to launch its first model by the year’s end. These vehicles will be produced at Proton’s plant in Perak state. Geely is also considering establishing a Proton factory in neighboring Thailand, targeting the Southeast Asian market.

“Our goal with Proton e.Mas is to fulfill the promise of delivering Malaysia’s first pure electric car,” said Li Chunrong, Proton’s CEO, at the brand launch. He stated that access to Geely’s technology enables Proton to offer new features. “We believe it will not only impress with its innovative breakthroughs but also create a profound resonance with users on an emotional level.”

Connecting with Malaysians on an emotional level is what sets Proton and Perodua apart in the increasingly crowded Malaysian market. Founded in 1983, Proton initially produced affordable Mitsubishi models under an agreement with the Japanese company.

Proton manufactured its first domestically designed car in 2000 and established plants in countries including Pakistan, Nepal, and Sri Lanka. They export cars to several Asian and African nations.

Geely – which now owns brands such as Volvo and Zeekr – acquired a 49.9% stake in the company in 2017. According to Paultan, Proton’s first electric car is being developed based on the Geely Galaxy E5 – Geely’s first all-electric SUV.

Perodua, on the other hand, was established in 1993 with Japan’s Daihatsu holding a minority stake. It is Malaysia’s largest car manufacturer, surpassing Proton. Perodua unveiled its first electric car prototype in May, developed through partnerships with three local universities, slated for launch in 2025.

“We want the car to be as Malaysian as possible,” said CEO Zainal Abidin Ahmad of Perodua.

Pricing will be a key factor. Abhik Mukherjee, an automotive analyst at Counterpoint Research, said Perodua and Proton are expected to price their electric vehicles below $25,000, significantly lower than BYD and Tesla’s offerings, which start at over $30,000. BYD and Tesla currently account for nearly 80% of electric vehicle sales in Malaysia.

“To boost the industry, Malaysia needs homegrown brands. Proton and Perodua can create competition by offering more affordable models,” said the analyst. “With their current market share, Perodua and Proton will easily sell their electric vehicles as both have established a strong and trusted presence.”

Malaysia also has measures in place to promote domestic electric vehicles. From late 2025, the government will stop exempting imported electric vehicles from taxes. They are also encouraging BYD and Tesla to set up local factories.

Last year, Malaysia’s passenger car sales reached 720,000 units. The country plans for electric vehicles to make up 15% of total car sales by 2030, up from about 3% currently. Shahrol Halmi – President of the Electric Vehicle Association of Malaysia – stated that electric vehicle sales would increase once Proton and Perodua launch their electric models. “They have the significant advantage of being local businesses with better connections and networks.”

However, a significant challenge is ensuring charging infrastructure, especially in high-rise buildings in Kuala Lumpur, Halmi said. Malaysia currently has over 2,000 electric charging stations, aiming for 10,000 by 2025.

In addition to domestic production advantages and government support, Proton and Perodua have another significant edge: loyal customers like Adit – who most recently purchased a Proton X90 SUV.

“No car on the market met my criteria within my acceptable price range. I will definitely wait for Proton’s e.Mas. It’s a good investment for my family,” he said.

Source: Rest of World

“Tasco Auto: Now Official Distributors of Premium Electric Car Brand, Zeekr, in Vietnam.”

Zeekr, the premium electric vehicle brand under the Geely Holding Group, has entered into an official distribution agreement with Tasco Auto, Vietnam’s leading automobile distributor. This strategic move signifies Zeekr’s expansion plans in the Southeast Asian market and underscores Tasco Auto’s commitment to bringing premium electric vehicles with advanced technology and internationally-accredited service standards to Vietnamese consumers.

Car Rental – The Flexible “Ownership” Trend in the US and Europe

In recent years, leasing has become a popular trend in developed countries such as the US and Europe, especially when it comes to electric vehicles. With the convenience and benefits that electric vehicles offer, this trend is expected to quickly gain traction in Vietnam as well, providing significant financial advantages to those who embrace it.

The Future of Transportation in Ho Chi Minh City: Introducing Mini Buses and Electric Shuttles to Connect Passengers to Saigon Station

Mini-buses and electric trams will be the two public transport modes connecting passengers to Saigon station in the future.